Challenges Mounting for Old Dominion Freight Line: A Cautious Investment Outlook

Introduction: Old Dominion Freight Line, Inc. (ODFL) is navigating through several obstacles that make it a less favorable investment choice.

Declining Earnings Estimates: The Zacks Consensus Estimate for ODFL’s earnings in the fourth quarter of 2024 has dropped by 15.6% in the past 90 days. Additionally, the earnings forecast for the entire year has seen a decline of 4.4%. This downward trend indicates a significant decrease in analysts’ confidence regarding the stock.

Low Zacks Rank and Style Score: Currently, ODFL holds a Zacks Rank of #4 (Sell). Its Value Score stands at F, reflecting its limited appeal to investors.

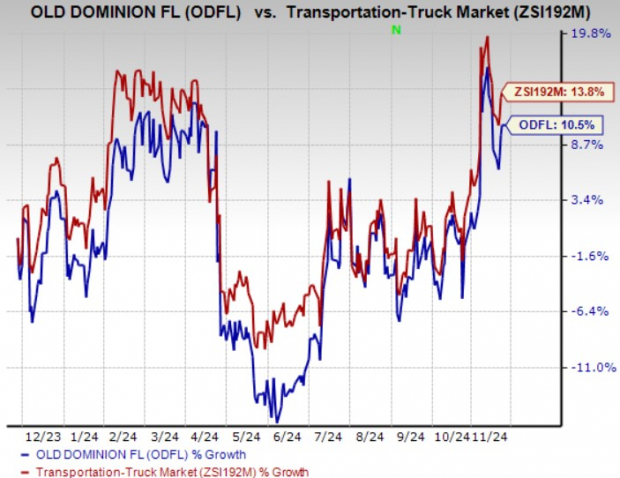

Subpar Price Performance: In the last year, ODFL has achieved a gain of just 10.5%, falling short of its industry, which experienced a growth of 13.8% during the same period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Dim Earnings Predictions: The outlook for earnings is concerning, with a predicted decrease of 19.73% year-over-year in the fourth quarter of 2024. Overall, forecasts indicate a year-on-year earnings drop of 3.55% for ODFL in 2024.

Additional Challenges: ODFL is grappling with revenue declines, largely due to ongoing geopolitical tensions and persistent high inflation, which are negatively impacting consumer confidence and growth projections. The surprising CPI figure for September adds to these inflation concerns, suggesting that the economic landscape remains challenging.

Despite its cost-cutting measures, ODFL’s operating ratio remains above 70, implicating ongoing top-line weaknesses and rising costs. Furthermore, underwhelming fuel surcharge revenues are affecting the company’s profitability. Given this mix of economic instability, decreased demand, and escalating costs, ODFL’s investment appeal appears diminished. As such, potential investors might want to reconsider purchasing shares at this time.

Alternative Stocks to Watch

Investors looking for better prospects may consider stocks like C.H. Robinson Worldwide (CHRW) and Wabtec Corporation WAB. Both companies currently boast a Zacks Rank #2 (Buy).

C.H. Robinson has shown a solid earnings surprise history, exceeding the Zacks Consensus Estimate in three of its last four quarters, reflecting an average surprise of 10.29%. The expected growth rate for CHRW in 2024 is impressive, estimated at 32.42%, with earnings estimates revised upward by 7.3% in the past 90 days. Notably, CHRW shares have risen by 26.2% this year.

Similarly, WAB has consistently outperformed earnings expectations, also exceeding the Zacks Consensus Estimate in three of the past four quarters, yielding an average surprise of 9.46%. The 2024 earnings growth forecast for WAB is 28.55%, with a recent upward revision of 2.5% in its earnings estimates, and shares have surged by 58.5% year-to-date.

Zacks’ Expert Selection: Stocks with High Potential

Zacks’ research team has identified five stocks that have a high probability of doubling in value in the coming months. Among these, the Director of Research, Sheraz Mian, has named one standout stock with remarkable potential for growth.

This top pick belongs to a pioneering financial firm with a rapidly expanding customer base of over 50 million and a diverse range of innovative solutions, positioning it well for substantial gains. Although not every stock in this selection achieves success, this one could significantly outperform past picks like Nano-X Imaging, which saw a rise of +129.6% within just over nine months.

Discover Our Top Stock and Four Additional Recommendations

Stay updated with Zacks Investment Research: Download today’s 5 Stocks Set to Double.

C.H. Robinson Worldwide, Inc. (CHRW): Free Stock Analysis Report

Old Dominion Freight Line, Inc. (ODFL): Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB): Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.