Werner Enterprises (WERN) faces significant challenges, making it a less appealing investment choice at this time.

Let’s take a closer look.

WERN: Major Challenges Ahead

Declining Earnings Estimates: The Zacks Consensus Estimate for earnings in the current quarter has decreased by 31.8% over the last 60 days. Similarly, the expectations for full-year earnings have been trimmed down by 22.2% in the same period. These revisions suggest that analysts are losing faith in the stock’s potential.

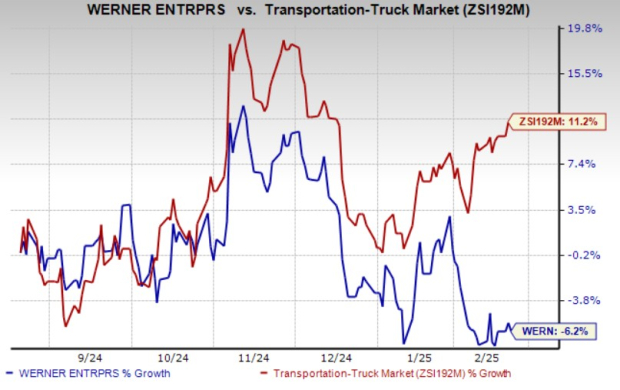

Weak Share Performance: Over the past six months, shares of WERN have dropped by 6.2%, while the industry has increased by 11.2%.

Image Source: Zacks Investment Research

Inconsistent Earnings Surprises: WERN has consistently missed the Zacks Consensus Estimate for the last four quarters, with an average shortfall of 42.45%.

Poor Zacks Rank: Currently, WERN holds a Zacks Rank of #5 (Strong Sell).

Weak Industry Position: The transportation industry, where WERN operates, has a Zacks Industry Rank of 195 out of 250, placing it in the bottom 22%. Historical data shows that half of a stock’s price movement is directly linked to the performance of its industry.

In a strong industry, even a mediocre stock can outperform a solid stock in a weak sector. Therefore, understanding the industry’s overall performance is crucial.

Ongoing Challenges: Werner’s revenue continues to struggle in both segments of its business. The company reported fourth-quarter 2024 revenues of $754.7 million, falling short of the Zacks Consensus Estimate of $772 million. This represents an 8.2% decrease year-over-year, primarily due to a 9% drop in Truckload Transportation Services revenue, equating to $52.8 million, and a 6% decline in Logistics revenue, amounting to $13.8 million.

The trucking industry, crucial to Werner’s operations, has faced a protracted driver shortage. As veteran drivers retire, companies struggle to attract younger replacements, as the job often lacks appeal for the new workforce.

Investment Alternatives

For investors interested in the Zacks Transportation sector, consider United Airlines (UAL) and SkyWest (SKYW). Both currently boast a Zacks Rank of #1 (Strong Buy). A full list of today’s Zacks #1 Rank stocks is available here.

United Airlines anticipates an earnings growth rate of 21.11% for the current year. Over the past 60 days, the consensus estimate for UAL’s earnings per share in 2025 has been increased by 10.6%.

United Airlines has shown a strong performance, surpassing the Zacks Consensus Estimate in each of its last four quarters with an average surprise of 22.93%. Over the past year, UAL shares have appreciated by 161.2%.

SkyWest, established in 1972 and located in St. George, operates regional jets for leading U.S. airlines. The company’s strong adherence to meeting the needs of its airline partners supports impressive revenue from flying agreements. As demand for air travel continues to rise, expecting growth in passenger volumes should benefit SKYW’s financials.

SkyWest has also performed well, with earnings exceeding the Zacks Consensus Estimate in each of the past four quarters, yielding an average surprise of 16.71%. The 2025 earnings estimate for SKYW has been raised by 7.9% over the past two months.

Zacks’ Top Stock to Watch

Zacks experts have recently identified five stocks that have high potential for gaining over 100% in value in the upcoming months. Among these, Research Director Sheraz Mian emphasizes one stock that stands out.

This leading choice is from an innovative financial firm with a rapidly growing customer base of over 50 million. The company offers a diverse array of cutting-edge solutions, positioning it well for significant growth. While not all selections may succeed, this particular stock could greatly outperform previous Zacks winners like Nano-X Imaging, which climbed 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Alternatives

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

Werner Enterprises, Inc. (WERN): Free Stock Analysis Report

Read more about why investors might want to avoid Werner Enterprises stock here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.