EPAM Systems: A Strong Player in AI with Promising Growth

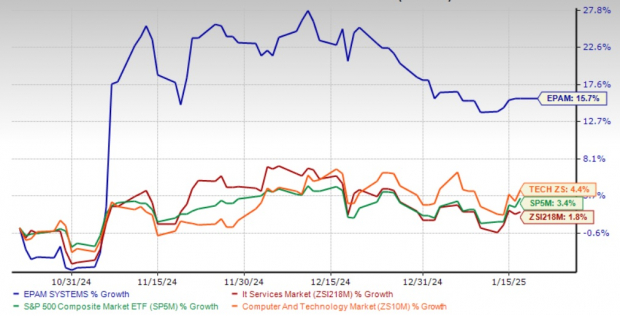

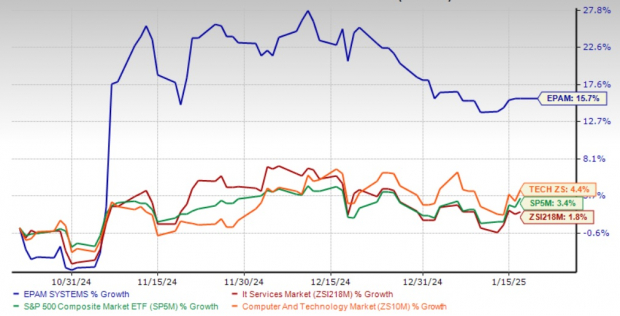

EPAM Systems has seen its shares climb 15.7% over the last three months, notably outpacing the Zacks Computers – IT Services industry, the Zacks Computer and Technology sector, and the S&P 500, which rose by 1.8%, 4.4%, and 3.4%, respectively. Thanks to EPAM’s solid fundamentals, focus on growth through acquisitions, and advancements in artificial intelligence (AI), analysts expect this upward trend to persist, making the stock a compelling choice for investors.

EPAM Enhances Its AI Offerings

To broaden its influence in the AI sector, EPAM Systems is collaborating with industry leaders. Recently, it expanded its partnership with Alphabet‘s GOOGL Google Cloud to provide scalable AI solutions. Additionally, EPAM has formed alliances with Microsoft MSFT and Salesforce CRM to implement AI-driven projects.

The collaboration with Alphabet allows EPAM to leverage Google Cloud’s Vertex AI platform, which helps clients modernize their IT frameworks through generative AI solutions. Furthermore, the promotion to Microsoft’s Globally Managed Enterprise Systems Integrator partner status permits EPAM to create cloud-based applications using Azure OpenAI Service. The partnership with Salesforce resulted in the development of the Salesforce Service Agent AI Coach, a tool designed to analyze interactions between customer service agents and clients.

Performance Over the Last Three Months

Image Source: Zacks Investment Research

Growth Through Strategic Acquisitions

To solidify its market position and enhance product expertise, EPAM Systems is focusing on strategic acquisitions. For example, the company acquired Vates in 2024 to boost its market share in Latin America. Over the past year, EPAM also brought Odysseus, NEORIS, and First Derivative into its portfolio.

The acquisition of First Derivative introduced generative AI-enabled financial and business solutions, expanding EPAM’s client base in capital markets, banking, and asset servicing across North America, Europe, and the APAC region. Acquiring Odysseus furthered EPAM’s capabilities in the life sciences domain by adding advanced data analytics and AI technologies. Similarly, the merger with NEORIS enriched EPAM’s expertise in digital experience and data analytics, applicable across various sectors such as manufacturing and retail.

These strategic moves have prompted analysts to adopt a positive outlook for EPAM Systems. The Zacks Consensus Estimate for EPAM’s revenues in 2025 is set at $5.25 billion, reflecting a 12% increase year-over-year. Additionally, projections indicate a modest 5% growth in earnings for that year.

EPAM has consistently exceeded the Zacks Consensus Estimate in the last four quarters, achieving an average surprise of 9.9%.

Discover current EPS estimates and surprises using Zacks Earnings Calendar.

Conclusion: Consider Adding EPAM to Your Portfolio

With rapid expansion efforts in the AI sector through collaborations and acquisitions, EPAM Systems demonstrates strong potential for growth in 2025 and beyond. Given these developments, investing in this Zacks Rank #2 (Buy) stock may be wise at this time. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Top Stock Picks for the Coming Month

Recently released: Experts have identified 7 exceptional stocks from a list of 220 Zacks Rank #1 Strong Buys, highlighting them as “Most Likely for Early Price Pops.”

Since 1988, this group has outperformed the market by more than a factor of two, achieving an average gain of +24.1% annually. Make sure to consider these carefully selected stocks.

See them now >>

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce Inc. (CRM): Free Stock Analysis Report

EPAM Systems, Inc. (EPAM): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.