Should You Hold or Sell Your Apple Stock? A Closer Look

There are many investors still holding Apple(NASDAQ: AAPL) stock, but it may be time to reconsider. The past decade has seen exceptional performance, yet much of the recent success appears to stem from investor enthusiasm rather than actual business achievements.

In the last three years, Apple has reported several disappointing quarters without any clear growth prospects. A market correction seems inevitable, leading Apple stock to a more realistic price point.

iPhone Sales Stagnation Over the Last Five Years

Apple is a well-known tech giant, especially popular in the United States. Its product ecosystem is unmatched and has attracted a loyal customer base.

However, the company is falling behind in the crucial race for artificial intelligence. A substantial portion of Apple’s revenue comes from iPhones, and its AI features, dubbed Apple Intelligence, do not measure up against Android competitors. This became apparent during the first fiscal quarter of 2025, which ended on December 28, 2024. The crucial holiday season is when most iPhones are sold. If iPhone sales surged during this period, it would indicate a successful launch. But if sales remained unchanged, it would suggest that the new model didn’t offer significant innovations.

Using this metric, it’s evident that Apple has not made any notable progress.

| Year | iPhone Revenue |

|---|---|

| 2024 | $69.1 billion |

| 2023 | $69.7 billion |

| 2022 | $65.8 billion |

| 2021 | $71.6 billion |

| 2020 | $65.6 billion |

Data source: Apple.

Over the past five years, Apple’s iPhone revenue has stagnated. This situation is exacerbated by inflation—the $65.6 billion in iPhone sales from the 2020 holiday quarter would equal approximately $79.5 billion today.

Consequently, when adjusted for inflation, iPhone sales have actually declined over the past five years. Given that iPhones account for 56% of Apple’s revenue, this trend is troubling for the company’s future.

While Apple’s overall revenue grew by 4% year-over-year, its earnings per share (EPS) increased by 10%, thanks to operational efficiencies. Despite this, the growth rate is comparable to the market average, suggesting that the stock should reflect a value similar to broader market benchmarks.

Apple’s Stock Valuation: A Look at Premium Prices

Despite its average financial performance, Apple’s stock price reflects a valuation typical of high-growth companies.

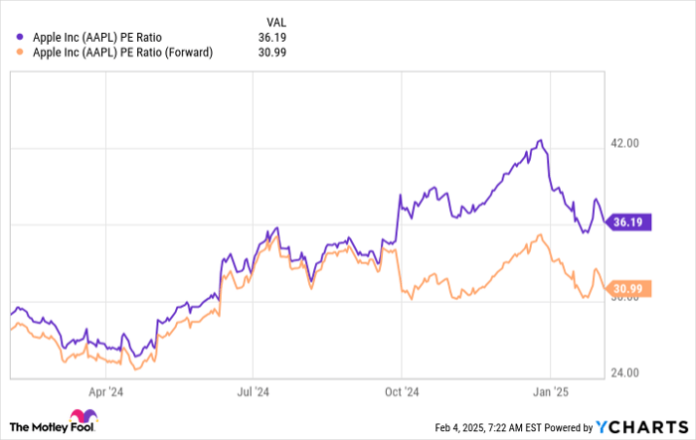

The stock now trades at an impressive 36 times trailing earnings and 31 times forward earnings.

AAPL PE Ratio data by YCharts. PE = price-to-earnings.

In comparison, the S&P 500 trades at 25.5 times trailing earnings and 22.3 times forward earnings. This puts Apple’s stock at about a 40% premium over the market average.

Though Apple deserves some premium due to its strong brand, a 40% mark-up is excessive, especially when several companies offer better growth prospects at lower valuations. Here are examples of more attractive investments:

| Company | Forward P/E | Last Quarter Diluted EPS Growth |

|---|---|---|

| Nvidia | 26.2 | 111% |

| Taiwan Semiconductor | 22.2 | 54% |

| Meta Platforms | 27.6 | 52% |

| Salesforce | 30.2 | 35% |

| Alphabet | 22.4 | 21% |

| ASML | 29.4 | 30% |

Data source: YCharts.

These alternatives provide superior growth potential at reasonable prices compared to Apple. Finally, if you own an S&P 500 index fund, you already possess nearly 7% of your funds in Apple stock, highlighting that further investment in a company showing unremarkable performance may not be prudent.

With numerous promising companies to consider, it may be wise to divest from Apple stock and seek more compelling investment opportunities.

Explore New Investment Opportunities

Have you ever felt like you missed the chance to invest in successful stocks? Here’s your opportunity to catch up.

Occasionally, our expert team recommends a “Double Down” stock—a company they believe is poised for significant growth. If you think you missed your chance to invest, now may be the ideal time before prices rise. Consider these impressive returns:

- Nvidia: An investment of $1,000 back in 2009 would now be worth $323,686!

- Apple: A similar investment in 2008 would have grown to $44,026!

- Netflix: Investing $1,000 in 2004 would yield $545,283!

Currently, we are issuing “Double Down” alerts for three remarkable companies—another chance may not come around soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook as well as sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also on the board. Keithen Drury holds positions in ASML, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has investments in and recommends ASML, Alphabet, Apple, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. A disclosure policy is in place.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.