IBM’s Surge: Is the Stock Still a Bargain?

Shares of International Business Machines (NYSE: IBM) are trading at a record high, having rallied an impressive 68% over the past year. As IBM’s stock price climbs, some investors may worry it has become overvalued.

However, this perspective might ignore an important shift happening within IBM. The company is transitioning from traditional hardware to focus on software and hybrid cloud services. This year, demand for its artificial intelligence (AI) capabilities has surged, leading to increased earnings and free cash flow, all while improving its long-term outlook.

Given these strong fundamentals, IBM stock may still offer a compelling investment opportunity.

Valuation: IBM Remains Competitive

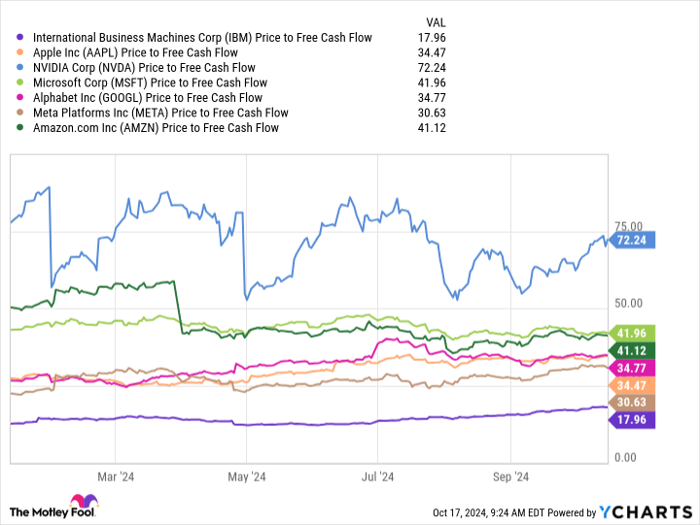

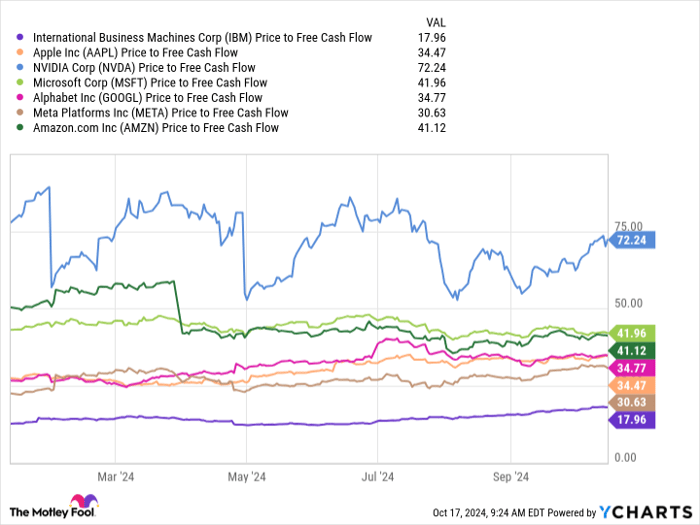

One key metric to consider for IBM stock is its price-to-free-cash-flow ratio, which stands at 18. This measure highlights a $215.2 billion market capitalization against the $12.3 billion in cash generated over the last year.

In comparison to the so-called “Magnificent Seven” stocks, such as Amazon and Microsoft with average multiples above 40, IBM appears to be attractively priced. Along with this, the company offers a notable dividend yield of 2.9%, further enhancing its value proposition.

Data by YCharts.

Future Outlook for IBM

Determining whether a stock is considered cheap or expensive involves much more than one metric. The company’s execution of its strategy and ability to drive profitable growth are often more crucial indicators of future performance.

The encouraging news is that IBM appears to be on a path to maintain its operational and financial momentum. Despite the occasional volatility in the stock market, IBM has reaffirmed its standing as a high-quality tech leader poised to reward shareholders in the long term.

This Might Be Your Second Chance

Have you ever felt like you missed out on investing in successful stocks? If so, this might catch your interest.

Our analysts sometimes issue a “Double Down” stock recommendation for companies they believe are about to see significant growth. If you think you’ll miss your chance to invest again, now might be the right time to act. Here are some past results:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $21,285!

- Apple: A $1,000 investment from 2008 would have grown to $44,456!

- Netflix: A $1,000 investment when we doubled down in 2004 would now stand at $411,959!

Currently, we are issuing “Double Down” alerts for three exciting companies, and this opportunity might not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is part of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also serves on the board. Randi Zuckerberg, sister of Meta Platforms CEO Mark Zuckerberg, is a member of the board as well. Dan Victor holds no positions in any stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends International Business Machines and suggests long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.