A Rising North Star

The enchanting constellation of RENOVA (TSE:9519) has recently experienced a celestial shift, with its one-year price target ascending by 19.98% to a stellar 1,625.20 per share. This metamorphosis echoes across the financial universe, leaving stargazers in awe of its newfound luminosity compared to the previously estimated 1,354.56 on January 16, 2024.

Analyst Constellations Align

Like seasoned astronomers collaborating to map the night sky, financial analysts have lent their expertise to this cosmic appraisal. The confluence of their projections crafts an average price target of 1,625.20, painting a vivid image of growth that represents a 36.23% uptick from RENOVA’s latest closing price of 1,193.00 per share.

Surveying the Investment Landscape

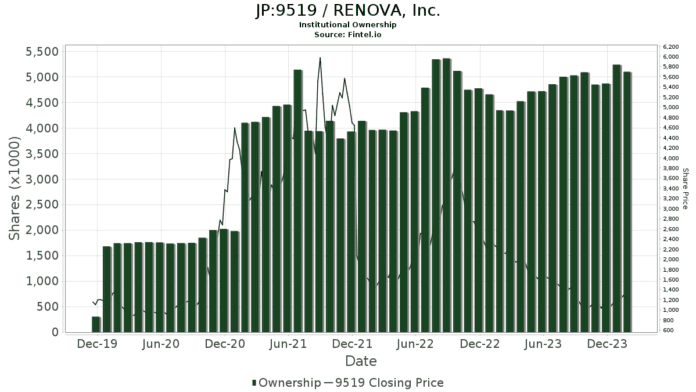

The saga of RENOVA’s trajectory extends beyond the celestial realm to the earthly domain of funds and institutions. Presently, there are 51 entities boasting stakes in RENOVA, marking a decrease of 1.92% or one fewer cosmic voyager in the last quarter. The average portfolio weight dedicated to 9519 stands at 0.11%, exhibiting a moderate descent of 1.70% from prior levels.

The total shares embraced by institutions have seen a palpable surge of 5.57% over the past three months, elevating the count to an impressive 5,100,000 shares. This surge mirrors the gravitational pull of RENOVA on investors, drawing them closer to its orbit.

Shifting Investment Tides

In this cosmic ballet of investments, various entities have pirouetted to new positions in RENOVA. ICLN – iShares Global Clean Energy ETF has increased its celestial hold on the company, now cradling 881,000 shares, a 3.89% expansion from its prior stake of 846,000 shares.

On the other hand, ECOAX – Ecofin Global Renewables Infrastructure Fund A Class has seen a cosmic realignment, with its stake decreasing to 691,000 shares, a dip of 1.29% from 700,000 shares. The universe of TAN – Invesco Solar ETF has also witnessed a celestial dance, with its RENOVA stake dwindling to 691,000 shares, an 8.21% decrease from 748,000 shares.

Meanwhile, VGTSX – Vanguard Total International Stock Index Fund Investor Shares has augmented its embrace, cradling 630,000 shares, an increase of 5.02% from 598,000 shares. Each entity’s movements contribute to the intricate cosmic dance of RENOVA’s investment landscape.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares stands steadfast with its 366,000 shares, embodying a beacon of stability amidst the celestial transitions.

Fintel shines as a beacon of wisdom and insight across the vast expanse of investment research. Its comprehensive data, ranging from fundamentals to options sentiment, serves as a guiding star for individual investors, traders, and financial advisors as they navigate the cosmic seas of finance.

The wonders of the investment universe continue to unfold, each movement adding a new layer of intrigue and possibility to the cosmic tapestry that is RENOVA.

Take a deeper dive into the cosmic dance of RENOVA and other celestial entities at Fintel, where knowledge and opportunity converge.

As we gaze upon the financial constellations, let us remember that the views expressed herein belong to the author and do not necessarily mirror those of Nasdaq, Inc.