Repligen Corporation Surpasses Earnings Expectations in Q3 2024

Repligen Corporation (RGEN) announced adjusted earnings per share of 43 cents for the third quarter of 2024, exceeding the Zacks Consensus Estimate of 34 cents. This is a significant increase from the adjusted earnings of 23 cents per share reported during the same period last year.

Total revenues reached $154.9 million, marking a 10% increase compared to the previous year. When accounting for acquisition revenues and currency fluctuations, organic revenue growth was 7%. This figure also surpassed the Zacks Consensus Estimate of $153.1 million.

The revenue growth can be largely attributed to the strong demand for new modalities, as well as increases in CDMO and equipment sales over the quarter.

Highlights from Repligen’s Q3 Performance

Product revenues, which include base business sales, totaled $154.8 million—an increase of 10% year over year. Royalty and other revenues were relatively stable at $0.04 million compared to the prior year.

Repligen’s core business consists of four major franchises: filtration, chromatography, protein, and process analytics. This base business saw revenues rise 7% year over year to $150.8 million, driven by strong performance in the Filtration segment and a recovery in the chromatography sector.

The new modalities business, which encompasses cell and gene therapies and mRNA, experienced a notable 20% year-over-year revenue increase.

CDMO sales also rose approximately 20% from the previous year, while equipment revenues grew about 6%. Management indicated that these lines also saw improvements compared to the previous quarter.

Analyzing Repligen’s Expenses and Financial Health

The company reported an adjusted gross margin of 50.7%, an improvement from 42% in the same quarter last year.

Adjusted research and development expenses were around $9.6 million, reflecting a 9% decrease from the prior year’s level. However, adjusted selling, general, and administrative expenses rose by 5% to $45.8 million.

Adjusted operating income totaled $23.1 million, compared to $5.2 million the previous year, resulting in an adjusted operating margin of 14.9% for the quarter.

As of September 30, 2024, Repligen had cash and cash equivalents of $784 million, slightly down from $809 million on June 30, 2024.

Repligen’s 2024 Revenue Forecast

Repligen has adjusted its revenue guidance for 2024, now projecting total revenues in the range of $630-$639 million, compared to the previous forecast of $627-$642 million.

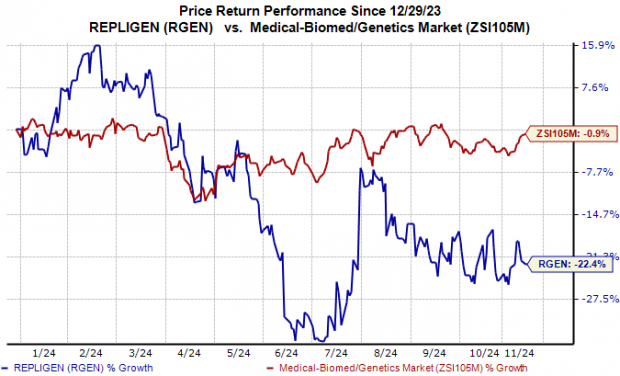

The company also adjusted its anticipated earnings per share for 2024 to be between $1.50 and $1.58, up from the earlier estimate of $1.42-$1.49. This positive earnings outlook may explain the nearly 8% increase seen in the stock price during pre-market trading today. Year to date, the stock has decreased by 22.4%, contrasting with a slight decline of 0.9% in the overall industry.

Repligen expects its adjusted gross margin to be between 49.5% and 50.5%, improved from the initial guidance of 49% to 50%. Adjusted operating income guidance was increased to the range of $80-$85 million, up from $76-$81 million previously.

Zacks Rank for Repligen

Currently, Repligen holds a Zacks Rank of #3 (Hold).

Repligen Corporation Stock Overview

View the Repligen Corporation price chart

Top Picks in Biotech Stocks

In the biotech sector, some highly rated stocks include Castle Biosciences (CSTL), Amicus Therapeutics (FOLD), and Biogen (BIIB). CSTL is currently a Zacks Rank #1 (Strong Buy), while both FOLD and BIIB hold a Zacks Rank #2 (Buy).

Over the past 60 days, the estimates for Castle Biosciences’ 2024 loss per share narrowed from 58 cents to 8 cents, with the 2025 estimates also improving from $2.13 to $1.88. Their stock has surged 54.3% this year.

CSTL has outperformed expectations, beating estimates in each of the last four quarters with an average surprise of 172.72%.

For Amicus Therapeutics, EPS estimates for 2024 have risen from 20 cents to 22 cents, with 2025 estimates increasing from 49 cents to 53 cents. Despite a decline of 24.7% year-to-date, FOLD has beaten estimates in three of the last four quarters with an average surprise of 27.09%.

Biogen’s 2024 EPS estimates increased from $16.12 to $16.38 along with 2025 estimates from $17.09 to $17.16. Despite a 33.1% year-to-date drop, the company has beaten estimates in three of the last four quarters with an average surprise of 9.99%.

Potential High-Growth Stocks to Watch

Zacks experts have identified five stocks that may potentially double in value in 2024, presenting an enticing opportunity for investors. Previous selections have shown impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%.

The majority of these stocks have not yet garnered widespread attention on Wall Street, making it a prime time to invest.

Discover these 5 potential home run stocks here >>

Biogen Inc. (BIIB) : Free Stock Analysis Report

Repligen Corporation (RGEN) : Free Stock Analysis Report

Amicus Therapeutics, Inc. (FOLD) : Free Stock Analysis Report

Castle Biosciences, Inc. (CSTL) : Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.