“`html

The Shifting Investment Landscape: Adjusting Your Strategy in Trump 2.0

We are now officially in the Trump 2.0 era, bringing changes that investors must take seriously.

This new administration may negatively impact the returns of those who simply invest in an index fund like the SPDR S&P 500 ETF Trust (SPY) and hope for the best.

This period signals a stock picker’s market, where careful choices about individual dividend-paying stocks will be crucial. SPY holders, tied to the S&P 500 index, face challenges. As investing options shift, SPY does not allow for agile moves in buying or selling, which can cause losses when poor-performing stocks offset gains from winners.

Already, we see evidence of these developments. Allow me to highlight five stocks to consider selling after Trump’s inauguration, including SPY. Additionally, I will discuss one unrelated stock that you might want to sell due to management’s recent, unfortunate decisions.

Food Stocks to Consider Selling in the Trump 2.0 Era

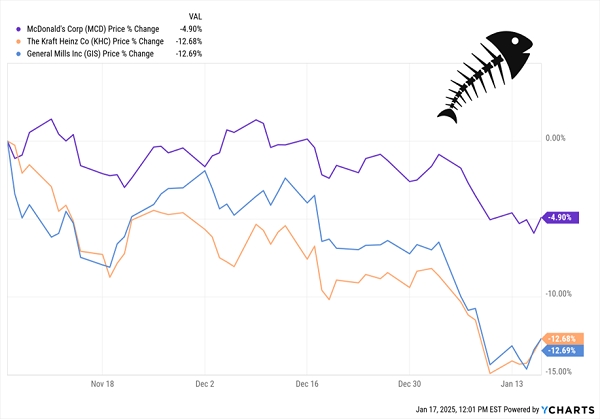

Starting with RFK Jr., President Trump’s nominee for the Health and Human Services department, his potential confirmation is a troubling sign for food companies like General Mills (GIS) and The Kraft-Heinz Co. (KHC). We’ve long criticized Kraft-Heinz for its outdated strategies. Fast-food giants such as McDonald’s (MCD) are also facing difficulties.

Given this backdrop, it’s unsurprising that shares of these three companies have declined since Election Day, even as the S&P 500 index has risen. Recovery does not seem imminent.

Food Giants Struggle Amid New Administration Influence

As advocates for dividend growth, we have steered clear of these three companies. For instance, General Mills experienced a slow dividend increase, only rising by one cent over the last year:

General Mills’ Dividend Growth Stumbles

McDonald’s has received attention for moving away from DEI programs. Although that may resonate with the new administration, the reality is that MCD distributes a staggering 73% of its free cash flow (FCF) as dividends, far exceeding my 50% safety threshold. This heavy payout limits future dividend increases.

Kraft-Heinz may have a tempting 5.6% dividend yield, but such a yield follows a significant decline in stock value over the last ten years. Remember, share prices and dividend yields move inversely.

Moreover, Kraft-Heinz previously cut its dividend in early 2019, which pushed the share price down further. This showcases the “reverse dividend magnet,” where reduced dividends also negatively impact stock prices:

KHC’s “Reverse Dividend Magnet” Sinks Its Stock

With revenue growth stagnating for almost a decade and dividends comprising 65% of the last year’s FCF, there’s little prospect for KHC to escalate its dividend or boost share prices.

It’s wise to reconsider holding SPY, as all three discussed stocks are included in “America’s ticker.” Looking beyond food and pharmaceuticals, investors should also be cautious of S&P 500 dividend payers with heavy exposures to China.

China Tariffs Will Impact These Two Toymakers

One thing is clear: higher tariffs are on the horizon, and companies relying heavily on Chinese production are at risk. I’m particularly concerned about toy manufacturers Mattel (MAT) and Hasbro (HAS).

These companies face risks not only from increased tariffs but also shifting demographics, as declining birth rates affect demand. According to the Centers for Disease Control and Prevention, the U.S. recorded fewer than 3.6 million births in 2023, the lowest since 1979.

Both companies deserve acknowledgment for reducing their production dependencies on China. In May of last year, Mattel announced it would close a plant there. Its CEO, Ynon Kreiz, noted in the first-quarter 2024 earnings call that around 50% of its products still originate from China, a figure he expects to decrease over time.

For Hasbro, about 40% of its products come from China, with plans to cut that to 20% over the next four years. However, altering supply chains is a complex and lengthy process.

Importantly, Hasbro derives a large part of its revenue—the majority of 67% in Q3 2024—from its consumer-products division, which includes traditional toys and games, even as online engagement rises.

Recent reports reveal Hasbro’s Q3 revenue dropped by 9%, excluding the sale of its eOne movie and TV business, and linked to a 10% fall in consumer-products sales.

Despite a current dividend yield of 5%, it has not increased since before the pandemic:

Hasbro’s Dividend Growth Stalls

As for Mattel, it has not paid a dividend since 2017 and is therefore not a suitable option for dividend-focused investors.

Overall, the landscape is challenging for both companies, with no signs indicating improvement. Potential future sanctions related to China may further depress their stock values, which are significantly lower than they were on Election Day. This poses concerns not only for MAT and HAS but also for SPY investors.

A Final Recommendation on Vail Resorts

The last stock to consider selling isn’t directly linked to Trump 2.0. However, Vail Resorts (MTN) has recently experienced a spike in dividend yield to 4.8%, which might catch your attention.

Vail Resorts (MTN) owns renowned locations like Whistler Blackcomb in British Columbia and Breckenridge, and while it may seem tempting, the future outlook also warrants caution.

“`

Vail Resorts Faces Challenges Amid Management Decisions and Cash Flow Concerns

Vail Resorts, known for its iconic Vail resort in Colorado as well as popular ski areas like Stowe in Vermont and ski spots in Europe, is currently in a precarious position. Investors who rely on dividends from Vail find themselves at the mercy of the weather, a concern that is particularly troubling in today’s market climate.

A pressing issue is Vail’s payout ratio. Over the past year, dividends have consumed 105% of free cash flow (FCF), a situation that clearly cannot continue.

However, the more pressing reason to reconsider investments in Vail is management’s recent refusal to grant ski patrollers a wage increase at the Park City, Utah resort. This decision led to long lift lines and restricted accessible terrain, resulting in negative feedback from the skiing community and damaging the company’s reputation on social media.

The demands made by the ski patrollers were reasonable, yet their unmet requests caused Vail’s share price to drop from December 7 to January 7, when a tentative agreement was finally reached:

Management Mistake Sends MTN Stock Tumbling

Despite the resolution of the strike, the leadership’s missteps have diminished confidence in their decision-making. Coupled with a payout ratio that is exceeding free cash flow, there are compelling reasons for investors to consider selling their shares.

A Focus on Dividend Growth

In the early days of this new administration, one principle remains clear: The growth of a stock’s dividend is the primary factor driving its share price.

This understanding gives rise to the “Trump 2.0” strategy: Seek out stocks with not just growing but also accelerating dividends. It’s crucial that these companies have the increasing sales, earnings, and cash flow necessary to sustain that growth.

Identifying stocks with share prices that lag behind their dividend growth can create an opportunity. As these stocks rebound, investors can benefit from the uptick in value.

While it’s easier said than done, successfully tracking the connection between dividends and share prices requires sophisticated charting tools and thorough analysis of earnings reports. Luckily, extensive research has already been conducted, resulting in a list of five prime “Dividend Magnet” stocks for 2025 that I recommend all investors consider.

These selected stocks are poised to keep their prices, along with their dividends, strong over the next four years. It’s essential not to miss out on these opportunities. Click here for a free Special Report that reveals the names and tickers of these five undervalued “Dividend Magnet” stocks.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.