Amazon Set to Overcome Nvidia: A Strong Market Position for 2025

In 2024, Nvidia briefly took the title of the world’s largest company by market capitalization, driven by a surge in demand for artificial intelligence (AI). Despite impressive profits, its high price-to-earnings ratio above 50 raises caution for investors looking toward 2025. Instead, Amazon (NASDAQ: AMZN) may present a better opportunity amidst its modest recent performance against the S&P 500.

Investing in AI Infrastructure

The backbone of Amazon’s profitability is Amazon Web Services (AWS), a leader in cloud computing. AWS is a major consumer of Nvidia chips, providing the servers for the increasingly popular AI applications. Recent quarterly results show AWS revenue growth accelerating—from 12% year-over-year in Q2 2023 to 19% in Q3 2024. Its projected annual revenue now exceeds $100 billion.

What stands out is AWS’s strong profit margins, reported at 35%, which translates to around $36 billion in operating income. As AI demand continues to rise in 2025, projections suggest that AWS could achieve revenue growth of up to 25%, pushing its total revenue to approximately $130 billion. Maintaining that 35% margin would yield about $45.5 billion in operating income.

A longer-term perspective shows ample growth potential for AWS. Management points out that a vast majority of IT spending remains on-premise, transitioning slowly toward cloud solutions. This ongoing shift indicates AWS has a significant opportunity to capture further market share, leading to sustained revenue increases.

Retail and Advertising Growth Prospects

Amazon’s impressive retail business also deserves attention. Revenue from its e-commerce, subscription services, and advertising in North America stands at $377 billion, with $140 billion more from international operations. However, international branches are not expected to deliver much profit in 2025 as Amazon invests in emerging markets like India, but North American profits should maintain an upward trajectory.

Notably, North American retail profit margins have recovered from close to 0% in 2023 to 6% over the last year. With advertising—a high-margin segment—growing at 19% annually, there’s plenty of room for further profit margin expansion. If North American revenue grows to over $400 billion, a 10% operating margin would imply over $40 billion in income, not accounting for the foreign segment’s potential growth.

Amazon’s Path to Dominance in 2025

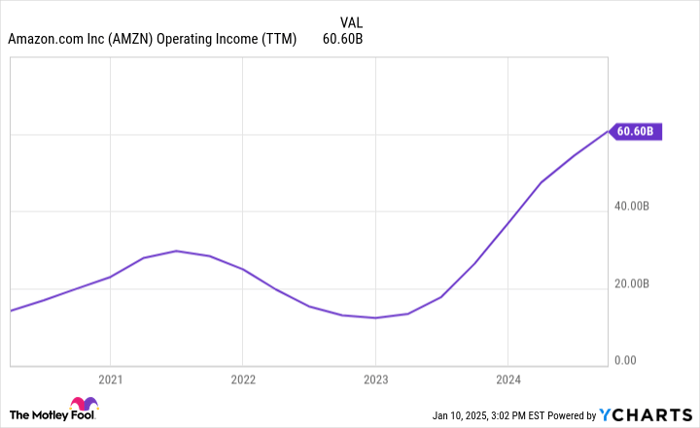

Expected financial performance for the year suggests Amazon could achieve around $100 billion in consolidated operating earnings, a significant increase from the $60 billion generated in the past 12 months. With AWS’ robust growth and possible margin expansion in retail, Amazon’s profits could rise rapidly, positioning it well for a favorable earning multiple.

If Amazon trades at about 40 times its 2025 operating income, its market cap could approach $4 trillion. This figure would surpass existing leaders like Nvidia, Apple, and Microsoft. Barring exceptional financial performances from these competitors, Amazon may reclaim its title as the largest market capitalization company.

Is Now the Time to Invest in Amazon?

Before investing $1,000 in Amazon, it’s essential to consider some insights:

The Motley Fool Stock Advisor team has discovered the 10 best stocks to buy currently, and Amazon isn’t one of them. These selected stocks have the potential for significant returns in the years ahead.

Historical context: Witness the success of Nvidia after its inclusion on their list on April 15, 2005. An initial investment of $1,000 then would be worth approximately $832,928 today!

Stock Advisor equips investors with strategies for building portfolios, regular analyst updates, and two new stock recommendations every month. The service has more than quadrupled the S&P 500’s returns since 2002.

*Stock Advisor returns as of January 13, 2025

Note: John Mackey, former CEO of Whole Foods Market (an Amazon subsidiary), is on The Motley Fool’s board. Brett Schafer holds positions in Amazon. The Motley Fool also has positions in and recommends Amazon, Apple, Microsoft, and Nvidia.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.