Rexford Industrial Realty, Inc. REXR has made a bold move in expanding its portfolio by acquiring two industrial properties in prime Southern California submarkets and disposing of one property for $11.3 million in December. The company’s 2023 investments have now reached $1.5 billion, solidifying its position in the market. Additionally, REXR is looking to continue its growth with around $75 million in new investments either under contract or with accepted offers.

Strategic Acquisitions in Prime Locations

REXR strategically acquired properties in the prime infill Southern California market using a mix of funds from forward equity settlements, cash on hand, and 1031 disposition proceeds. With these acquisitions, the company now holds a total of 373 properties, spanning 45.8 million square feet located throughout infill Southern California. These strategic moves are crucial for Rexford’s growth, especially given the supply constraints in the United States industrial property market.

Howard Schwimmer and Michael Frankel, the co-chief executive officers of Rexford, expressed their confidence in the company’s ability to leverage its value-add expertise, and proprietary market access within infill Southern California to drive substantial value creation.

Detailed Acquisitions and Redevelopment Plans

Rexford acquired 600-708 E. Vermont Avenue, Anaheim, in the OC — North submarket, for $57 million. Following a short-term leaseback, REXR plans to redevelop the 12.1-acre site into a 264,000-square-foot divisible class A building, which is estimated to generate a 6.7% unlevered stabilized cash yield on total investment.

In the LA — San Gabriel Valley submarket, Rexford acquired 11234 Rush Street, South El Monte, for $12.5 million. The company plans to redevelop the vacant 4.7-acre land site into a 102,000-square-foot class A industrial building, with an expected 6.4% unlevered stabilized cash yield on total investment.

These investments come at a time when the vacancy rates in these submarkets are remarkably low, with CBRE Group reporting 0.9% in the OC — North submarket and 1.5% in the LA — San Gabriel Valley submarket.

Strategic Disposition and Reinvestment

Rexford also disposed of 3720-3750 W. Warner Avenue, Santa Ana, in the OC — Airport submarket, for $11.3 million. The company achieved an unlevered IRR of 28% on the transaction and reinvested the proceeds from the sale into the acquisition of 600-708 E. Vermont Avenue.

Rexford is poised to capitalize on its healthy market fundamentals, low-leverage balance sheet, and selective approach to capital allocation.

Market Performance and Future Outlook

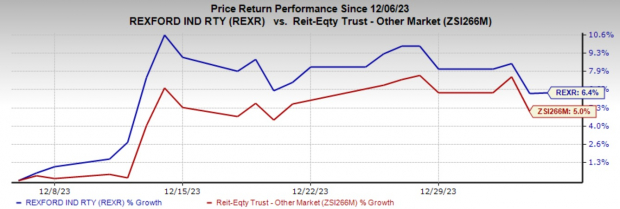

Shares of Zacks Rank #2 (Buy) REXR have risen 6.4% over the past month, outperforming its industry’s growth of 5%.

The future looks promising for Rexford, as the company strategically positions itself for growth and value creation in the industrial real estate market.

Other Stocks to Consider

Investors looking at the REIT sector may also consider other top-ranked stocks such as First Industrial Realty Trust, Inc. FR and Park Hotels & Resorts PK. PK sports a Zacks Rank #1 (Strong Buy), while FR carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for First Industrial Realty Trust’s 2023 FFO per share of $2.43 suggests a 6.6% increase year over year.

The consensus mark for Park Hotels & Resorts’ current-year FFO per share has moved marginally north over the past month to $2.03.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more. They’ve already closed 162 positions with double- and triple-digit gains in 2023 alone.

First Industrial Realty Trust, Inc. (FR) : Free Stock Analysis Report

Rexford Industrial Realty, Inc. (REXR) : Free Stock Analysis Report

Park Hotels & Resorts Inc. (PK) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

To read this article on Zacks.com click here

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.