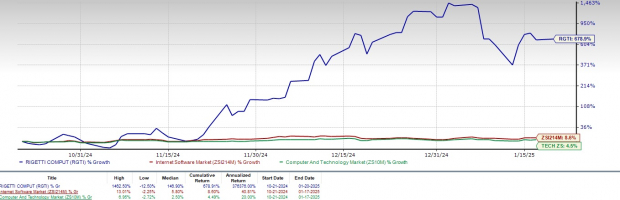

Rigetti Computing (RGTI) has seen an extraordinary increase in share value, rising 678.9% over the past three months. In contrast, the Zacks Internet – Software industry grew by only 8.6%, while the broader Zacks Computer & Technology sector achieved a 4.5% increase during the same period.

RGTI has outperformed a key competitor, D-WAVE QUANTUM (Q BTS), which recorded a 335.5% gain in the same timeframe.

This impressive growth can be linked to RGTI’s expanding client base and its rising importance in the quantum computing sector.

Image Source: Zacks Investment Research

RGTI’s 84-Qubit Ankaa-3 Marks a Quantum Leap

Rigetti’s progress in quantum computing technology has been instrumental in boosting its stock price.

In December 2024, RGTI introduced its 84-qubit Ankaa-3 quantum computer, which features a redesign that enhances performance and scalability. With a median 99% iSWAP gate fidelity and 99.5% fSim fidelity, it is compatible with advanced algorithms and is accessible via Rigetti QCS.

The system will expand to Amazon (AMZN) Braket and Microsoft (MSFT) Azure in early 2025, enabling users to harness these platforms for innovative quantum computing solutions.

RGTI Pioneers in Quantum Computing Innovations

RGTI’s growth in the quantum computing arena is noteworthy. In the third quarter of 2024, Rigetti successfully showcased 9-qubit chips with a median 2-qubit gate fidelity of 99.4% and announced ambitions to roll out a 36-qubit system by mid-2025. These advancements are crucial for RGTI’s trajectory.

The company’s multi-chip architecture for scaling up qubit systems significantly enhances Rigetti’s industry standing and capabilities.

The quantum computing market, projected to grow at a CAGR of 20.1% from 2024 to 2030 according to a Grand View Research report, bodes well for RGTI’s future growth.

Strong Partnerships Propel RGTI Forward

RGTI’s collaboration with firms like Riverlane, NVIDIA, and Quantum Machines has fueled its success, establishing the company as a vital participant in the evolving quantum computing landscape.

In December 2024, Rigetti announced its partnership with Quantum Machines to utilize artificial intelligence to automate the calibration of its 9-qubit Novera QPU, leveraging NVIDIA DGX Quantum technology. This collaboration boosts gate fidelities and represents a significant step forward in quantum computing operations.

Additionally, Rigetti’s work with Riverlane on quantum error correction technology has been crucial in enhancing the reliability of quantum systems, which is critical for scaling up its technology.

In October, the collaboration yielded successful real-time and low-latency quantum error correction on Rigetti’s 84-qubit Ankaa-2 system, improving decoding times and ensuring fault tolerance in quantum operations.

RGTI’s Earnings Outlook is Promising

The Zacks Consensus Estimate for RGTI’s 2025 revenue is projected at $15.32 million, reflecting a substantial year-over-year growth of 40.29%.

Additionally, the consensus estimate for loss per share in 2025 stands at 28 cents, with no changes noted in the past month, indicating a 17.65% year-over-year increase.

Rigetti Computing, Inc. Price and Consensus

Rigetti Computing, Inc. price-consensus-chart | Rigetti Computing, Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Challenges Face RGTI Amid Quantum Market Competition

While Rigetti continues to make strides in quantum computing, external factors have posed challenges for its growth.

Ongoing macroeconomic uncertainties and fierce competition within the quantum computing sector have hampered RGTI’s overall revenue growth.

Furthermore, recent comments from industry leaders, including Meta CEO Mark Zuckerberg and NVIDIA CEO Jensen Huang, have raised concerns about the immediate practical applications of quantum computing, suggesting that commercial viability may be years away.

These remarks have contributed to a broader market downturn affecting Rigetti and its competitors, resulting in a 12.54% drop in RGTI stock on January 17, 2025.

Analyzing RGTI: What Should Investors Consider?

Currently, RGTI stock is viewed as expensive, receiving a Value Score of F.

Its forward 12-month Price/Sales ratio stands at 113.48X, significantly above the sector average of 7.02X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Presently, Rigetti holds a Zacks Rank of #3 (Hold), suggesting that potential investors might benefit from waiting for a more favorable entry point before acquiring the stock. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks with High Growth Potential

These five stocks have been selected by a Zacks expert as likely to double in value by 2024. While not all selections may succeed, past recommendations have often yielded exceptional returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently overlooked by Wall Street, making them potentially lucrative investment opportunities.

Today, Explore These Five High-Growth Stocks >>

Looking for the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.