Ciena: Riding the Wave of AI in Optical Networking

Optical networking company Ciena (NYSE: CIEN) has gained significant attention in the stock market recently, posting a remarkable 35% increase in the last three months. However, the reasons behind this surge may not be as straightforward as it seems.

In the third quarter of fiscal 2024, Ciena’s revenue and earnings experienced a downturn. From July 27, the company reported a 12% drop in revenue year over year, totaling $942 million, with non-GAAP (adjusted) net income declining 41% to $0.35 per share. Despite these drops, investors appear optimistic about a potential rebound, fueled by a rise in telecommunications spending and the increasing use of artificial intelligence (AI).

Signs of Recovery for Ciena

Ciena has been significantly affected by the ongoing decline in the telecom equipment sector, which began in late 2023. Market research firm Dell’Oro Group noted a 17% decrease in global telecom spending in the first half of 2024. This decline has negatively impacted Ciena’s order book and contributed to an excess inventory that hinders its profit margins.

Dell’Oro anticipates telecom spending in 2024 may fall between 8% to 10%, a steeper drop than the previous year’s 4% decrease. However, Citigroup has identified a positive trend in the North American telecommunications sector, projecting a spending increase of 3% in 2025.

On a brighter note, Ciena is starting to see better business conditions. In fiscal Q3, the company recorded more incoming orders than outbound shipments, resulting in a book-to-bill ratio exceeding 1, signaling solid demand for its products.

Ciena’s inventory levels also improved, dropping to $937 million last quarter from $1.2 billion a year ago. This trend points to a more optimistic outlook for the next quarter, with revenue expected to reach $1.1 billion at the midpoint and an adjusted gross margin projected in the low to mid-40% range.

The forecast indicates a year-over-year revenue performance that would be a notable recovery from the previous quarter’s double-digit decline. The anticipated gross margin also suggests that Ciena’s profitability issues may stabilize.

AI Growth and Ciena’s Future

With the rapid integration of AI into various sectors, Ciena’s management and some analysts believe this trend will expand its market opportunities. Recent price target adjustments from major investment firms highlight this potential: Morgan Stanley raised its target to $63 from $60, while Jefferies set a more optimistic target of $80, up from $65.

Both firms see a significant increase in demand for faster connectivity between data centers driven by expanding AI workloads. Ciena is positioned to benefit from this growth, particularly in data center interconnect (DCI) technology, which is crucial for handling increased data traffic.

Ciena’s recent presentations indicated that global data center bandwidth is anticipated to quadruple between 2023 and 2027, which could lead to a faster demand for optical bandwidth than the historical growth rate of 25% to 30% per annum.

Management confirmed the positive outcomes of AI adoption, stating, “In Q3, we secured new wins with major cloud provider customers, driven mainly by preparations for anticipated AI and cloud traffic growth.”

Additionally, Dell’Oro estimates that investment in back-end networks connecting data centers could reach $80 billion annually within five years. This projection suggests strong potential for Ciena’s future growth.

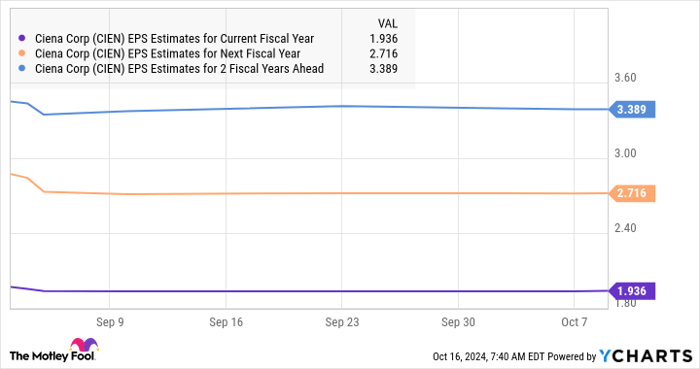

CIEN EPS Estimates for Current Fiscal Year data by YCharts

Ciena’s earnings were $2.72 per share in fiscal 2023, but they are expected to decline this year, as shown in the accompanying chart. However, significant growth is projected over the next few years, with predicted earnings of $3.39 per share in fiscal 2026. If Ciena maintains a price-to-earnings ratio of 25 during that period, its stock price could reach $85, representing a 25% increase from current values. A higher earnings multiple combined with improving performance could lead to even greater gains.

For investors seeking promising opportunities linked to AI, Ciena is currently priced at 2.5 times sales and 25 times forward earnings, making it an attractive option.

Take Advantage of This Investment Opportunity

Have you ever thought you missed the chance to invest in a potential market leader? Now might be your moment.

Our expert analysts occasionally identify stocks that are primed for substantial growth, referred to as “Double Down” recommendations. If you worry about missing out, this could be your optimal time to consider investing.

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

We are currently issuing “Double Down” alerts for three exceptional companies, so don’t miss this chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Jefferies Financial Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.