The Struggle Continues: Rivian and Lucid Face Tough Times Ahead

The electric vehicle (EV) market is becoming increasingly competitive. However, for Rivian Automotive Inc RIVN and Lucid Group Inc LCID, the struggle is real. Both companies have seen their stock values plummet nearly 50% this year.

As they prepare to announce their third-quarter earnings today, investors are anxious about the extent of their losses. Rivian is projected to report a loss of 92 cents per share, while Lucid is expected to announce a loss of 30 cents.

However, it’s not just about the numbers. Pre-earnings trends indicate serious challenges ahead for both companies.

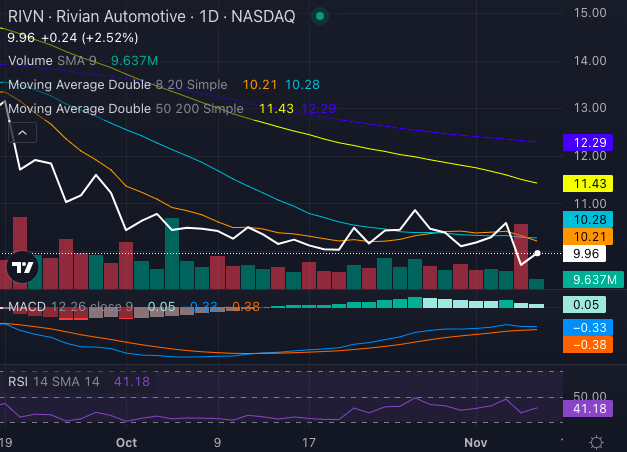

Rivian: Struggling Yet Hopeful Amid Bearish Trends

Rivian’s stock has dropped nearly 60% in 2023.

Chart created using Benzinga Pro

Currently trading at $9.96, Rivian’s stock is well below significant moving averages, including the five, 20, 50, and 200-day averages. All indicators point to a bearish outlook, with technical charts revealing ongoing selling pressure.

The stock’s Relative Strength Index (RSI) stands at 41.18, meaning it may be nearing oversold conditions and could see a small rebound. Nevertheless, with a MACD indicator reading of -0.33, there appears to be little momentum in the bullish direction.

The company is pinning its hopes on the launch of its more affordable R2 and R3 platforms in 2026 and 2027. The key question remains: Can Rivian endure the current challenges and rebound following earnings, or will doubts from investors persist?

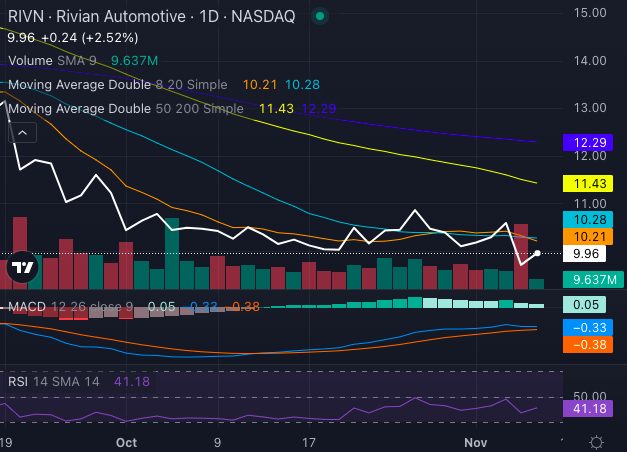

Lucid: Financial Liquidity Under Pressure

Lucid’s stock has also struggled, dropping 46% this year.

Chart created using Benzinga Pro

Trading at $2.22, Lucid is also significantly below its moving averages, highlighting ongoing selling pressure. Its RSI is worse off at 27.94, indicating that it is intensely oversold, though a short-term recovery could be possible.

Recently, Lucid announced a $1.75 billion public offering to stabilize its cash flow and fund future growth initiatives. Yet, as the company continues to report losses, investors are looking closely at whether Lucid’s new Gravity SUV and increased orders can turn the tide.

Overall, the outlook remains uncertain as both companies await their earnings reports.

Rivian vs. Lucid: The Race for Recovery Post-Earnings

Both Rivian and Lucid share a similar fate: promising products but struggling stocks facing significant losses and unfavorable market conditions. Expectations for their third-quarter performances are low, and the upcoming earnings reports may reveal whether they can provide any positive surprises or continue their downward trajectory.

For investors, market trends suggest a cautious approach is warranted, as volatility may spike following the earnings announcements. With both stocks showing oversold signals, a brief bounce could be possible, but a sustained recovery hinges on each company’s ability to deliver on their product promises.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs