Background on the Investment: Former NFL star Rob Gronkowski revealed in a recent interview that his best investment has been purchasing shares of Apple Inc. AAPL ten years ago.

During a conversation with Fortune, Gronkowski disclosed that his home builder urged him to invest in Apple back in 2014. “The guy actually who built my house in Foxborough, he told me, ‘Hey buy Apple stock. I’m telling you that’s where it’s at,” Gronkowski remembered.

Taking this advice to heart, Gronkowski instructed his financial advisor to invest $69,000 in Apple shares. This decision came just before Apple launched the iPhone 6, which turned out to be a significant success, along with the introduction of the first Apple Watch the following year. Since the iPhone 6’s debut on September 9, 2014, Apple’s stock has soared over 900%. As a result, Gronkowski’s initial $69,000 investment is now valued at approximately $740,000.

The Discovery of Gains: After nearly two-and-a-half years, Gronkowski discovered that his Apple shares had grown to around $250,000. He decided to sell a portion of the shares while retaining the rest. “So I sell off the portion of the $69,000 I bought in and I have, now to this date, I have over $600,000 in Apple stock all because of the investment I made in 2014, having no idea what I was doing, but just listening to the guy that built my house here in New England so I appreciate that,” he explained.

About Gronkowski: A four-time Super Bowl champion, Gronkowski played for both the New England Patriots and Tampa Bay Buccaneers over an 11-season NFL career, earning about $70 million.

Market Context: Apple currently experiences modest growth, with the smartphone sector expected to see a 6.2% rise in global shipments in 2024. However, projections suggest growth will wane to low single-digit percentages after 2025.

Despite facing challenges, including competition from Huawei’s advancements in domestic chip technology amidst U.S. sanctions, Apple remains a major player in the global smartphone market. Huawei’s increasing market share, particularly in China, may pose significant competition.

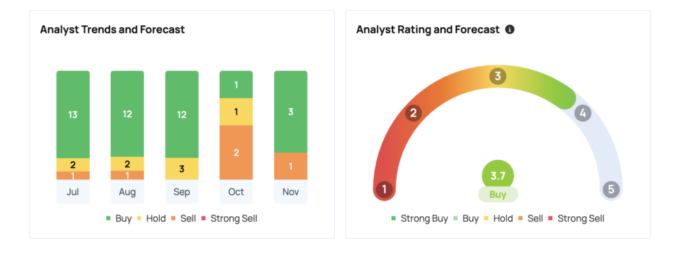

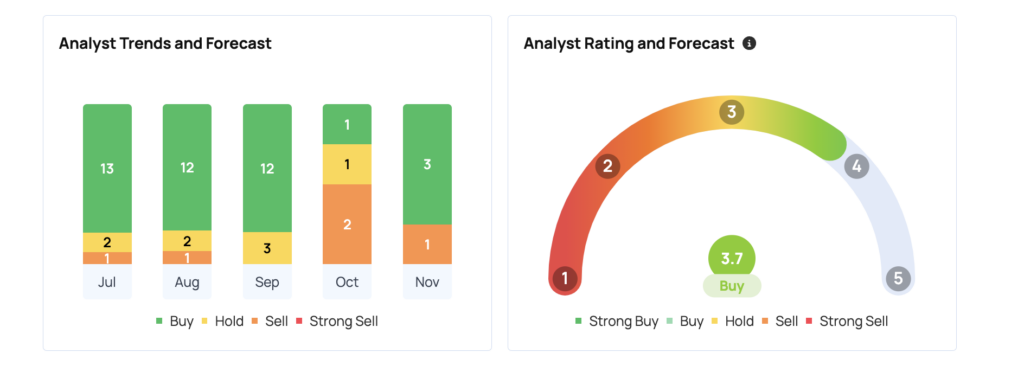

As per data from Benzinga Pro, analysts have set a consensus price target for Apple at $242.26, based on evaluations from 31 analysts. Recent ratings from Morgan Stanley, Maxim Group, and Barclays, issued on November 25 and November 1, indicate a slightly lower average price target of $224, suggesting a potential downside of 4.76%.

Current Stock Performance: On Wednesday, Apple stock closed stable at $234.93 per share. Please note that all financial markets, including banks and stock exchanges, will be closed on Thursday for Thanksgiving.

Next Steps for Readers: Stay informed on the latest market trends.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs