Rodman & Renshaw Launches Coverage of Adial Pharmaceuticals with High Growth Potential

Analysts Anticipate 577% Growth for Adial Pharmaceuticals

Fintel reported on November 14, 2024, that Rodman & Renshaw has initiated coverage of Adial Pharmaceuticals (NasdaqCM:ADIL) with a Buy recommendation. As of October 22, 2024, the average one-year price target for the company is $7.65 per share. These forecasts range from a low of $7.07 to a high of $8.40, indicating a remarkable potential increase of 576.99% from its latest closing price of $1.13 per share.

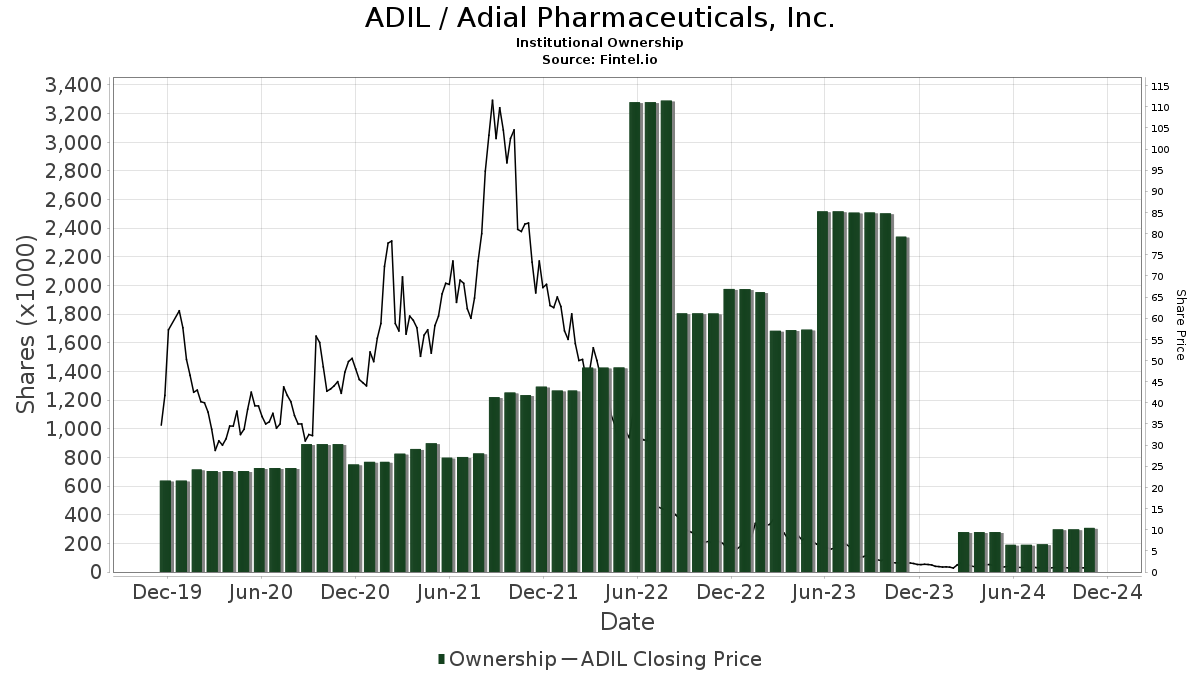

Institutional Investments Reveal Mixed Sentiment

The projected annual revenue for Adial Pharmaceuticals stands at $0MM, with a projected annual non-GAAP EPS of -0.50. Currently, 19 funds or institutions are reporting positions in Adial Pharmaceuticals, a decrease of 2 owners or 9.52% from the previous quarter. The average portfolio weight of all funds invested in ADIL has increased by 17.36% to 0.00%. However, total shares owned by institutions have declined by 14.08% in the last three months to 256,000 shares.

Insight into Individual Shareholder Activities

Manchester Capital Management holds 48,000 shares of Adial, which represents 0.75% ownership and has seen no change in the last quarter. Geode Capital Management owns 45,000 shares, also representing 0.71% ownership; the firm has increased its holdings by 43.09%, although its portfolio allocation in ADIL decreased by 26.22% this past quarter.

Citadel Advisors now holds 33,000 shares, indicating a 25.62% increase from the previous 25,000 shares, reflecting an 11.33% rise in its portfolio allocation towards ADIL. BlackRock owns 28,000 shares (0.43%), while Two Sigma Securities possesses 27,000 shares (0.42%).

Understanding Adial Pharmaceuticals

(Description provided by the company)

Adial Pharmaceuticals focuses on developing therapies for addiction. Its primary product, AD04, is a therapeutic agent targeting serotonin-3 receptors, currently undergoing a pivotal Phase 3 clinical trial for Alcohol Use Disorder (AUD). This trial, part of the ONWARD™ program, is intended for participants with specific genetic markers, identified through the company’s proprietary test. Previous Phase 2b trials of AD04 indicated significant reductions in drinking behavior, with no notable safety concerns raised.

Fintel serves as a comprehensive research platform for individual investors, traders, financial advisors, and small hedge funds. The platform offers extensive data covering fundamentals, analyst reports, ownership data, and more, all aimed at enhancing investment decision-making.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.