The Small Caps Show Their Spark

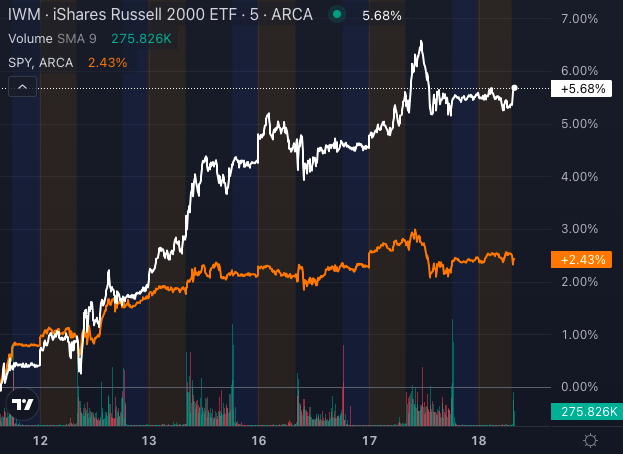

Small-cap stocks are ablaze as they anticipate the impending dance of the Federal Reserve with interest rates. The Russell 2000 Index, the fiery torchbearer of small-cap performance, torched ahead by more than 5% in the previous week, overshadowing the modest 2.5% gain of its larger brethren in the S&P 500 Index.

Chart created using Benzinga Pro

The iShares Russell 2000 ETF (IWM), the trusty tracker of the fiery Russell 2000 Index, has outshone the SPDR S&P 500 ETF SPY. Fueled by soaring stocks like IGM Biosciences Inc (IGMS), Intuitive Machines Inc (LUNR), and Applied Therapeutics Inc (APLT), which surged by 59.33%, 38.62%, and 44.90% in the last five days, respectively.

Riding The Wave Of Rate-Cut Anticipation

The allure of cheaper borrowing costs has investors believing in a Fed easing, particularly benefiting small caps entangled in debt and reliant on fluctuating rates. With their penchant for floating-rate debt, small-cap companies ride the wave of falling interest rates, reducing their borrowing burdens and potentially boosting their financial standing.

However, despite this bullish wave, concerns loom over lackluster earnings and a cloudy economic horizon in the U.S., casting shadows on the enthusiasm towards small caps. This juxtaposition begs the question of sustainability.

Indications of a Bright Path

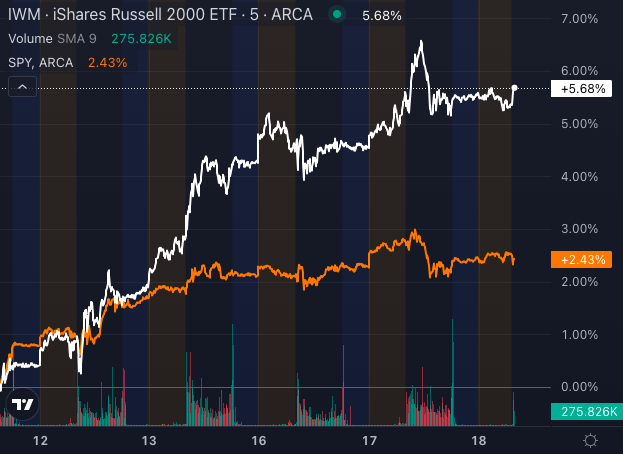

Chart created using Benzinga Pro

The IWM, the northern star of small-cap stocks, gleams with a strong bullish trend, its value at $219.23 towering above various simple moving averages. Captivatingly, the eight-day, 20-day, and 50-day SMAs signal positivity, reflecting the ETF’s robust upward drive. Yet, hints of slight selling pressure forewarn of short-term volatility.

If the Fed decides on a robust half-point cut, small caps could be star performers. Even a modest 25-basis-point cut might sustain the rally, offering a glimmer of hope. Investors eyeing the scene may want to consider the SPDR S&P 600 Small Cap ETF (SLY) for broader exposure to potential beneficiaries of reduced rates.

Don’t miss the opportunity to join the elite at the Benzinga SmallCAP Conference on Oct. 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile.

Seize the chance for CEO encounters, investor connections, and invaluable insights. Whether a trader, entrepreneur, or investor, this event promises unparalleled growth and networking prospects

Reserve your space now!

Market News and Data brought to you by Benzinga APIs