Salesforce’s Stock Soars: Is It Time to Buy?

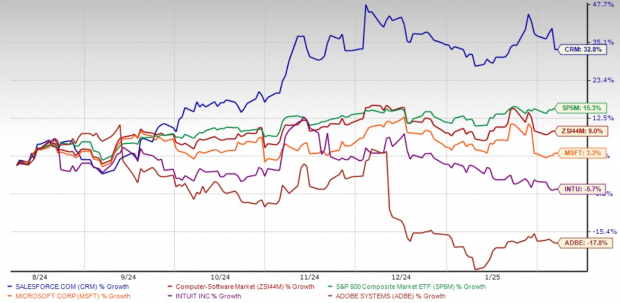

Salesforce, Inc. CRM has experienced an impressive 32.8% rise in its stock price over the past six months, standing out even amidst broad market fluctuations. In comparison, the Zacks Computer – Software industry has only increased by 9%, while the S&P 500 index rose by 15.3%. Not even major players such as Microsoft Corporation MSFT, Intuit Inc. INTU, and Adobe Inc. ADBE can match Salesforce’s recent performance, solidifying its status as a dominant force in enterprise software.

Can Salesforce Maintain Its Momentum?

Investors are keen to know whether Salesforce can keep up its impressive growth. The signs suggest that it can. Here’s a closer look at why CRM remains a strong investment even after its substantial increase.

Unmatched Market Leadership

Salesforce stands as the leader in the customer relationship management (“CRM”) sector, consistently outperforming competitors like Microsoft, Oracle, and SAP. Gartner’s annual rankings repeatedly confirm its top position, which can be attributed to its wide array of products, seamless integrations, and innovative enterprise solutions.

Strategic acquisitions have significantly bolstered Salesforce’s market position. Notably, the company spent $27.7 billion to acquire Slack in 2021, greatly enhancing its collaboration tools and solidifying its presence as an enterprise software giant. More recently, the $1.9 billion takeover of Own Company in 2024 strengthened its offerings in data protection and artificial intelligence (AI), aligning with the growing focus on security and automation in businesses today.

Salesforce’s AI initiatives, especially since launching Einstein GPT in March 2023, have further solidified its leadership role. This technology has broadened AI functionalities across its platform, improving automation, streamlining workflows, and enhancing customer interactions, giving it a noteworthy edge as AI adoption expands in various industries.

Rising IT Spending: A Positive Outlook

Salesforce is well-positioned to capitalize on the surge in global IT spending. Gartner forecasts that total IT expenditure will reach $5.61 trillion by 2025, marking a 9.8% annual increase. Spending specifically on enterprise software is expected to grow even more rapidly, by 14.2% year-over-year. As digital transformation continues to be essential for businesses, Salesforce is poised to capture a significant portion of these increasing budgets.

The company’s growth narrative is bolstered by strong financial projections. According to the Zacks Consensus Estimate, revenue is expected to grow by 9% and earnings per share (EPS) by 11.3% for fiscal 2026.

Salesforce Valuation: Justifying the Premium

Investors may express concern over Salesforce’s valuation, which currently sits at a forward price-to-earnings (P/E) ratio of 32.9, slightly above the industry average of 31.11. However, this premium is a reflection of the company’s unparalleled status in AI-driven CRM solutions and its potential for continued long-term growth.

Salesforce’s dominance in enterprise software helps ensure high customer retention and steady revenue growth. Unlike smaller companies that face pricing pressures, Salesforce benefits from an established network of enterprise clients that rely on its platform for critical operations. Moreover, its proactive expansion into AI-driven automation and cloud-based CRM solutions positions it well for ongoing success in a rapidly changing software landscape.

Final Thoughts: Invest in Salesforce

Salesforce’s 33% stock increase over the last six months is supported by solid fundamentals, not merely market trends. The company’s strength in CRM, ambitious AI developments, and increasing enterprise IT spending provide a sturdy foundation for future growth. Its capacity to maintain double-digit earnings growth while frequently surpassing analyst expectations boosts its attractiveness as an investment opportunity.

Even after its recent surge, Salesforce remains a worthy buy. With continued AI adoption, increasing IT budgets, and deeper business reliance on CRM solutions, investors have a valuable opportunity. For those looking for a high-quality growth stock with long-term potential, Salesforce presents an appealing choice.

Salesforce currently holds a Zacks Rank #2 (Buy). You can view the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Explore Nuclear Energy: A Bright Future

The demand for electricity is soaring as we strive to reduce reliance on fossil fuels. Nuclear energy presents an excellent alternative. Recently, leaders from the U.S. and 21 other nations pledged to triple the world’s nuclear energy capacity, signaling a significant transition. This shift could create substantial opportunities for investors in nuclear-related stocks.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into the key players and technologies involved in this transition, spotlighting three standout stocks with the most potential. Download your free copy today.

Interested in more insights from Zacks Investment Research? You can currently access 7 Best Stocks for the Next 30 Days for free.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.