Salesforce Shines in 2024: A Deep Dive into Performance and Future Prospects

Salesforce, Inc. CRM finished 2024 with an impressive 27% increase, standing out in a challenging market. This performance surpassed the Zacks Computer – Software industry’s growth of 14.7% and the S&P 500’s rise of 24.4%.

Salesforce Outperforms Industry Rivals

Salesforce has outperformed many of its competitors, including Microsoft Corporation MSFT, Intuit Inc. INTU, and Adobe Inc. ADBE. While MSFT and INTU recorded gains of 12.1% and 0.5%, respectively, ADBE saw a decline of 25.5% in 2024.

Image Source: Zacks Investment Research

Following this success, investors are curious to see if CRM can maintain its momentum in 2025.

Salesforce’s Industry Leadership

Salesforce continues to be a leader in customer relationship management. Competing against giants like Microsoft, Oracle, and SAP, Salesforce has remained at the top of the market, an acknowledgment by Gartner shows its strength. This leadership stems from a strong product lineup, an easy user experience, and an active partner network.

Strategic acquisitions have been key to this success. A prime example is the $27.7 billion acquisition of Slack in 2021, which enhanced Salesforce’s CRM capabilities. Furthermore, the recent acquisition of Own Company for $1.9 billion in 2024 boosted its position in data protection and management—areas of growing importance in the age of artificial intelligence (AI) and digital transformation.

Salesforce’s foray into generative AI has also transformed its growth path. The launch of Einstein GPT in March 2023 and subsequent expandability has enriched its product offering. These advancements allow enterprises to use AI for more efficient operations, helping Salesforce maintain its leading edge in technology.

A Look at Salesforce’s Valuation

Even after a strong rally in 2024, Salesforce remains attractively priced. Its forward 12-month price-to-earnings (P/E) ratio stands at 29.84, lower than the industry’s average of 32.02, indicating potential value for investors looking for long-term opportunities in a tech leader.

Image Source: Zacks Investment Research

Challenges Ahead for Salesforce

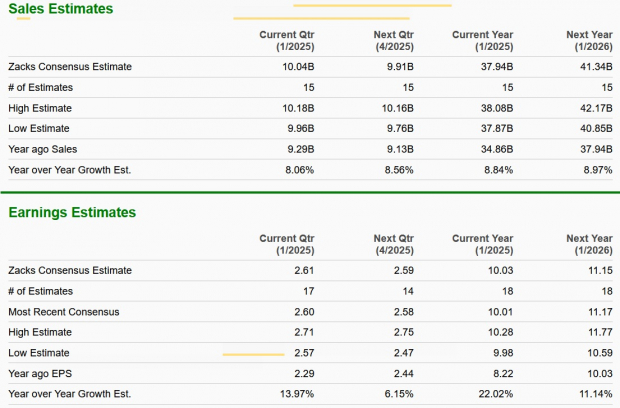

While Salesforce shows strong long-term potential, it faces notable short-term challenges. Revenue growth has slowed from its historical double-digit percentages to single-digit rates in recent quarters. This trend reflects cautious spending among enterprises due to economic uncertainties and geopolitical issues. Analysts expect this pattern to continue, projecting mid-to-high single-digit growth for fiscal years 2025 and 2026.

Image Source: Zacks Investment Research

This slowdown indicates a shift in how enterprises approach technology, with a preference for smaller projects rather than extensive digital transformations. Salesforce must adjust its strategies to adapt to this evolving market landscape.

Conclusion: A Hold Recommendation for CRM Stock

Salesforce’s strong performance in 2024, backed by its leading position in customer relationship management and advancements in generative AI, presents a solid long-term investment opportunity. Nonetheless, the hurdles of slowing revenue growth and external economic pressures suggest a need for caution.

For now, maintaining your position in Salesforce stock allows investors to participate in its innovative efforts and market leadership while sidestepping potential overvaluation risks in an unstable market. Adopting a patient approach will be vital as Salesforce addresses its immediate challenges and prepares for future growth. Currently, Salesforce holds a Zacks Rank #3 (Hold).

Discover 5 Stocks Poised for Growth

Every stock in this selection has been identified by a Zacks expert as a top contender to gain +100% or more in 2024. While not all selections guarantee success, prior recommendations have seen astonishing gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks may not yet be on Wall Street’s radar, creating an opportunity for early investment.

Today, Explore These 5 Potential Game-Changers >>

Interested in the latest recommendations from Zacks Investment Research? Download the “7 Best Stocks for the Next 30 Days” report for free today.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce Inc. (CRM): Free Stock Analysis Report

Adobe Inc. (ADBE): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

For more insights on this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.