Analysis of Q4 Earnings Performance

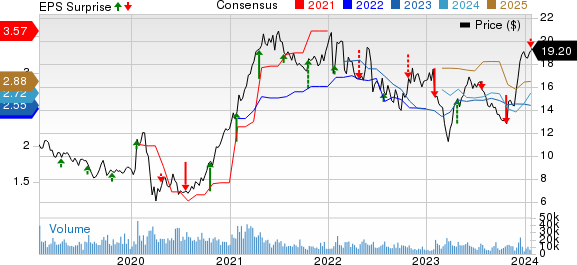

Sallie Mae’s (SLM) core earnings per share for the fourth quarter of 2023 fell short of the Zacks Consensus Estimate, coming in at 72 cents instead of the expected 87 cents. Despite this, the bottom line showed significant improvement from the prior-year quarter’s loss of 33 cents. This bolstered the company’s GAAP net income to $168 million, a stark contrast to the net loss of $77 million in the same period the year before.

The financial results were hampered by a surge in non-interest expenses. However, lower provisions for credit losses, a rise in the net interest income (NII), healthy loan originations, and increased non-interest income provided some positive momentum.

Notable Financial Indicators

The Net Interest Income (NII) for the fourth quarter witnessed a 1.2% increase year over year, reaching $385.9 million, surpassing the Zacks Consensus Estimate. Additionally, the net interest margin (NIM) remained steady at 5.37%.

Amidst this, non-interest income soared to $57.1 million, a significant turnaround from the non-interest loss of $40.6 million in the corresponding quarter of the previous year. However, the surge in non-interest expenses, which jumped 44.3% to $202.1 million, presented a notable challenge.

Positive Credit Quality Trends

The provisions for credit losses plunged to $16 million from $297 million in the previous year’s quarter, primarily attributable to negative provisions resulting from a significant private education loan sale. This led to a notable 20.4% decrease in net charge-offs for private education loans, marking a positive turn in the company’s credit quality.

Robust Balance Sheet Performance

Sallie Mae demonstrated bolstered financial resilience with a nearly 1% year-over-year increase in deposits, reaching $21.65 billion as of Dec 31, 2023. Private education loans held for investment also exhibited an upward trajectory, rising by 4% to $19.77 billion. The company further reported private education loan originations of $839 million in the fourth quarter, reflecting a 2% increase from the corresponding period in the previous year.

Future Outlook and Share Repurchase Programs

Sallie Mae announced a new share repurchase program, authorizing the buyback of shares worth $650 million. The program, effective Jan 26, 2024, and set to expire on Feb 6, 2026, reflects the company’s confidence in its long-term prospects.

The company has also provided a positive outlook for 2024, with expectations for core earnings per share (on a non-GAAP basis) in the range of $2.60 to $2.70. Additionally, total loan portfolio net charge-offs are projected to be in the range of $340 to $370 million, while private education loan originations are anticipated to grow by 7-8% year over year.

Position in Comparison to Peer Companies

It’s worth noting that Sallie Mae sits on a Zacks Rank #3 (Hold) despite the mixed fourth-quarter results. A comparison with other consumer loan providers such as Ally Financial and Navient Corporation provides a wider industry context to the company’s performance.

Conclusion

In conclusion, while Sallie Mae’s performance in the fourth quarter showcased significant improvements, particularly in NII and credit quality, the surge in expenses presents a considerable near-term challenge. The company’s announced share repurchase program and optimistic outlook for 2024, however, underscore its confidence in future growth potential, which may resonate positively with the investor community.