Uncertain Investment Prospect

As a regular user of Sea Limited’s (NYSE:SE) principal revenue source, the e-commerce platform Shopee, I’ve developed a liking for the app and hold an optimistic outlook regarding its potential. However, my stance on investing in the company’s shares is one of prudent reservation. Presently, the company is teetering on the edge of turning a profit. This precarious situation engenders substantial share price volatility and an increasing number of outstanding shares. Therefore, assessing the stock’s valuation, especially given the unavailability of a P/E ratio, presents a formidable challenge. My own valuation, under the assumption of a future net income margin of 5%, affirms that the current valuation does not present an attractive entry point.

A Brief Company Overview

The company, established in 2009 and headquartered in Singapore, operates primarily in Southeast Asia through its e-commerce platform Shopee and financial division. Its gaming sector caters to a global audience.

Our mission is to enhance the lives of consumers and small businesses using technology. We run three core businesses in digital entertainment, e-commerce, and digital payments and financial services, referred to as Garena, Shopee, and SeaMoney, respectively.

Sea Limited, company profile

Historical Financial Progress & Trends

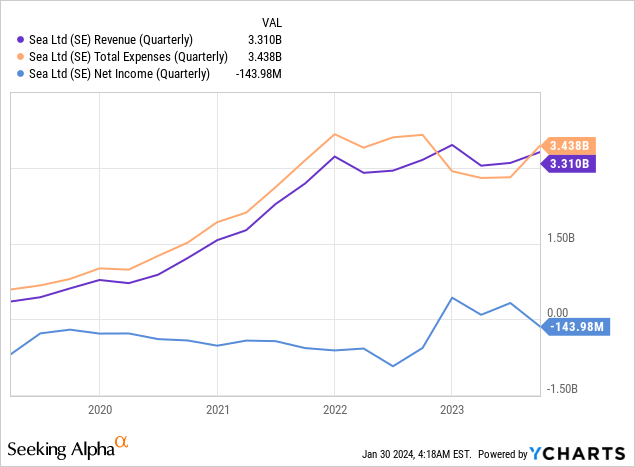

Firstly, an extended overview of the previous period’s revenue, expenses, and net income is provided.

Sea Limited: Navigating the Tides of Southeast Asian E-commerce

Insight into E-commerce Growth

Let’s journey back to a time when Southeast Asia was barren of e-commerce – a world without virtual storefronts and digital queues. A decade ago, online shopping was a foreign concept in this region, with no traction to speak of. Fast forward to today, and the landscape has shifted dramatically. While the West enjoys a robust online shopping culture, Southeast Asia has caught onto the e-commerce wave, albeit with a lower online shopping penetration than its Western counterparts.

Shopee’s Reign in the Southeast

Enter Shopee, a titan in the Southeast Asian e-commerce duopoly. As it vies for the top spot against Lazada, Shopee’s rise to dominance has reshaped the online retail experience for both locals and expatriates. Mind you, my admiration for Shopee isn’t influenced by stock analysis. Its seamless interface and user-friendly navigation have won me over, a sentiment shared by fellow Thai patrons who prefer it over its contender, Lazada.

Valuation & Current Landscape

Sea Limited is currently valued at an enterprise value of $21.8B, boasting a market cap of $23B. With more cash than debt, Sea Limited’s valuation is an intricate web. However, peering into future profitability using analysts’ forward PE figures in the next 12 months may yield little fruit, considering the nebulous nature of long-term profitability. Further muddling the waters are the non-GAAP numbers, whose allure may mask the stark reality.

The Perils and Potential of SE

An annual sales projection hovering around $13B in 2023 sets the stage for a prospective net income margin of 5%, translating to an estimated profit of $650M. But as 2027 beckons, with revenue projected at $17B and a fixed net profit margin, the potential of Sea Limited to scale in the e-commerce sphere calls for a discerning eye. Factors like annual increase percentage and other incumbent risks cast shadows over this valuation narrative.

Navigating Risks: The E-commerce Sea

The e-commerce realm seldom offers smooth sailing, especially with Sea Limited’s gaming division facing a puzzling prognosis. An upturn in sales remains elusive, engendering uncertainty rather than promise. In this tempestuous Southeast Asian e-commerce sea, the specter of competition looms large. As TikTok, with its colossal user base, starts encroaching into e-commerce, and with formidable players like Lazada (a part of Alibaba) buoyed by robust financial might, the e-commerce battlefield seems more treacherous than ever.

Trade Secrets & Stock Woes

A cursory inspection into the stock game reveals standard checks, indicative of potential stock dilution and its ripple effect on shareholders. Insider trades, meanwhile, offer a glimpse into the confidence – or lack thereof – in the company’s direction. A question mark hovers over the abrupt halt in stock-based compensation in 2022, while insider sales paint a cryptic picture.

The Final Voyage

While Sea Limited’s future holds promise, the current valuation lacks allure. The e-commerce landscape in Southeast Asia, with TikTok’s advent, sets a scene of both intrigue and peril. With a volatile gaming segment and Shopee navigating profitability challenges, the shares may not reward the risk taken. In the vast stock market ocean, alternative opportunities beckon, more attractive and less perilous than Sea Limited’s current voyage.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

yes, but slowing |

Increasing over longer periods |

|

Improving margins? |

the stock hasn’t reached sustainable profitability yet |

Possible competitive edge |

|

PEG ratio below one? |

no |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

no |

Returning capital to shareholders |

|

Shareholder negatives? |

yes |

Actions that disadvantage shareholders |

|

Stock in an uptrend? |

no |

Trading above its 200-day moving average? |