General Dynamics Sees Downgrade While Analysts Predict Modest Growth

Fintel Reports Insight on General Dynamics’ Status

On October 11, 2024, Seaport Global revised its outlook for General Dynamics (XTRA:GDX) from Buy to Neutral.

Analyst Predictions Point to Potential Increase

The average one-year price target for General Dynamics, as of September 25, 2024, stands at 297.33 €/share. This number varies, with projections ranging from a low of 263.29 € to a high of 326.75 €. The average suggests a 9.27% increase from the last reported closing price of 272.10 € / share.

Company’s Revenue and Earnings Forecast

For the upcoming fiscal year, General Dynamics is expecting an annual revenue of 45,363 million euros, reflecting a 0.93% increase. The projected annual non-GAAP earnings per share (EPS) is estimated at 15.23.

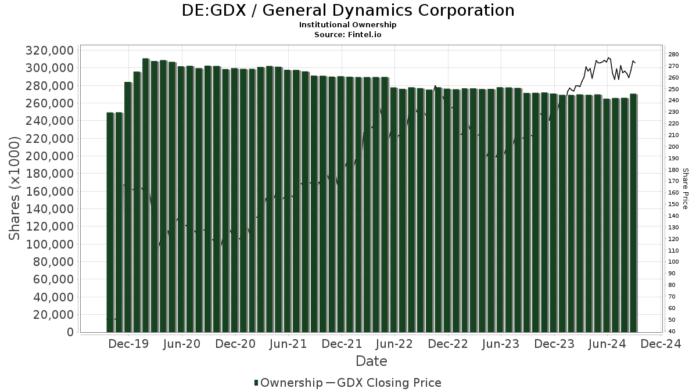

Fund Sentiment Toward General Dynamics

Currently, 2,676 funds or institutions have reported positions in General Dynamics, marking an increase of 32 owners or 1.21% over the last quarter. The average portfolio weight of all funds invested in GDX is 0.42%, up by 0.89%. Institutional ownership rose by 2.94% in the last three months, reaching 270,347K shares.

Longview Asset Management currently holds 28,098K shares, or 10.24% of the company, showing no change from previous filings. Nonetheless, the firm increased its allocation to GDX by 0.31% over the last quarter.

Newport Trust now owns 15,463K shares, constituting 5.64% of General Dynamics. This represents a decrease of 1.06% from its prior holding of 15,626K shares, with a notable reduction in portfolio allocation by 6.05% over the last quarter.

Wellington Management Group LLP has 14,096K shares, equating to 5.14% ownership, which is a decrease of 2.44% from the previous 14,440K shares. Allocations in GDX fell dramatically by 85.76% in the last quarter.

Bank of America increased its holdings to 7,853K shares, equal to 2.86% ownership, up from 7,350K shares, marking a 6.40% increase and a portfolio allocation rise of 3.47%.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 7,802K shares, about 2.84% ownership, which is an increase from the prior 7,751K shares, reflecting a 0.66% growth in allocation.

Fintel serves as a comprehensive investment research platform, providing essential data covering fundamentals, analyst reports, ownership insights, and more, aimed at individual investors, traders, and financial advisors.

Click to Learn More

This report originally appeared on Fintel.

The opinions expressed in this document are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.