“`html

Boost Your Income: Explore High-Yield Dividend Companies

Investors in U.S. equities have enjoyed impressive gains in recent years. From the end of 2022 to December 27, the S&P 500 index jumped 55.5%.

While stock prices have surged, new investors looking for passive income found that high stock prices often lead to lower dividend yields. Currently, the average yield of stocks in the S&P 500 stands at just 1.3%.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Despite the low yields of many S&P 500 stocks, several business development companies (BDCs) offer attractive options for income-focused investors. Companies like Ares Capital (NASDAQ: ARCC), PennantPark Floating Rate Capital (NYSE: PFLT), and Hercules Capital (NYSE: HTGC) provide an average yield of 9.9%. For an initial investment of around $5,040 in these stocks, investors could secure annual dividends of $500.

1. Ares Capital

Ares Capital is the largest publicly traded BDC. Its dividend has not increased consistently, but it has risen by 20% over the past five years. Currently, the stock offers an 8.7% yield, supported by a strong track record.

Over the past two decades, Ares Capital’s underwriting team has issued $156 billion in loans, showcasing extensive expertise. By the end of September, Ares held a loan portfolio worth $25.9 billion. Among its 535 companies, only a few are facing financial difficulties, with loans on nonaccrual status dropping to 1.3% of the total portfolio’s cost.

Moreover, approximately 69% of Ares Capital’s portfolio consists of loans with variable interest rates. The rapid interest rate hikes in 2022 caused some challenges in loan repayment, but the nonaccrual rate peaked at just 1.7% in early 2024, indicating a recovery.

With the Federal Reserve now cutting interest rates, the outlook for Ares Capital’s portfolio appears promising.

PennantPark Floating Rate Capital

PennantPark Floating Rate Capital represents another solid BDC option for dividend seekers. Its stock currently boasts a substantial yield of 11.3% with monthly dividend payments.

As its name suggests, most of PennantPark’s loans are now generating lower interest than a year ago. While this may not be ideal for lenders, PennantPark has managed to maintain or increase its dividends every year since it began issuing them in 2011.

This BDC focuses on small middle-market companies earning between $10 million and $50 million annually before various financial obligations. Although its portfolio is smaller than Ares Capital’s, PennantPark’s underwriting team excels at selecting borrowers who can reliably pay back their loans, with just 0.4% on nonaccrual status at the end of September.

Hercules Capital

Hercules Capital offers another appealing dividend option with a yield of 9.7% at recent prices.

While Ares and PennantPark focus on conventional businesses, Hercules Capital stands apart with a $3.6 billion portfolio that includes investments in innovative technology and life science sectors.

At the end of September, Hercules held equity positions in 76 companies and warrant positions in 98. Although some investments may not succeed, successful ones can significantly bolster overall returns. For instance, its investment in 23andMe has underperformed, while its stake in Palantir saw growth of over tenfold.

As a BDC, Hercules must distribute at least 90% of its earnings as dividends. To manage the unpredictability of its investment portfolio, the company offers a stable quarterly distribution alongside a variable supplemental distribution.

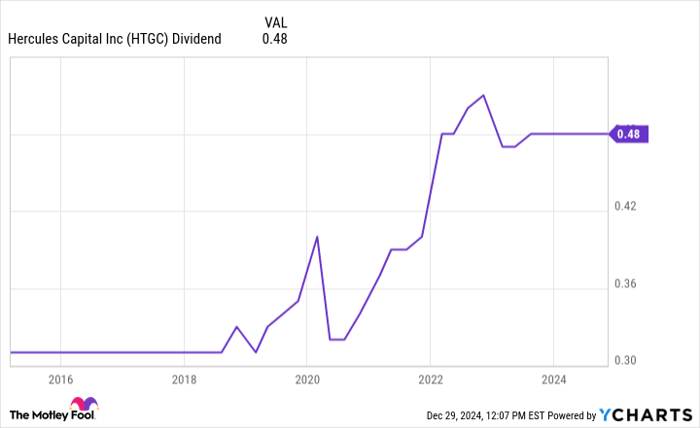

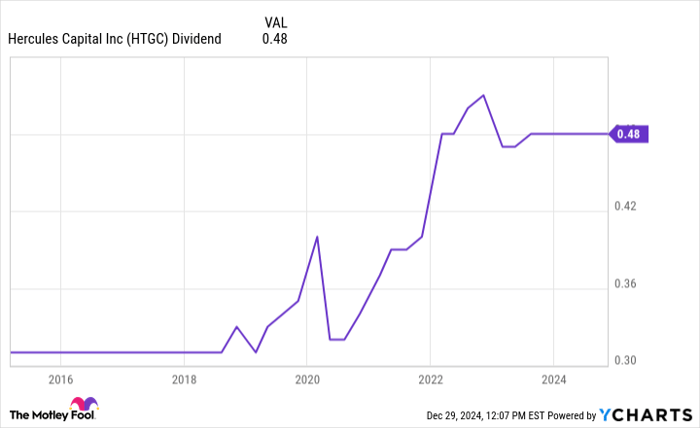

HTGC Dividend data by YCharts

Although Hercules Capital’s dividend may seem volatile, the quarterly payout has consistently increased from $0.20 to $0.40 per share since 2010. Investors might see further increases in the forthcoming quarters, especially after a 10% rise in total investment income year-over-year during the first nine months of 2024.

During the same period, Hercules’s debt portfolio expanded by 12%. This growth signals potential for increased profits that could be distributed to shareholders every three months, making shares an attractive addition to a diverse portfolio aimed at boosting passive income streams.

Should you invest $1,000 in Ares Capital right now?

Before deciding to invest in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital was not included. The selected stocks are anticipated to deliver exceptional returns in the coming years.

For instance, consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at that time, you’d have $839,670!*

Stock Advisor offers an accessible framework for investors, providing guidance on portfolio building, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has significantly outperformed the S&P 500 since 2002.*

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Cory Renauer has investments in Ares Capital. The Motley Fool has investments in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`