Investors Seek Shelter in Newmont Corporation Amid Political Turbulence

In an era of geopolitical instability, many investors look for stability in assets like Newmont Corporation NEM, aiming to protect their wealth.

Recently, AFP reported that German Chancellor Olaf Scholz faced a confidence vote, effectively ending his troubled administration. This moment of political unrest, alongside the French government’s collapse earlier this month, has intensified interest in safe-haven investments.

As the world’s leading gold producer, NEM stock is often seen as a proxy for gold itself. For years, investors have relied on gold as a key means of preserving wealth during uncertain times.

Inflation is also a critical factor influencing the prices of precious metals. Analysts expect the Federal Reserve to announce a 25-basis-point rate cut soon, sparking renewed inflation concerns. Such expectations usually bode well for the price of gold.

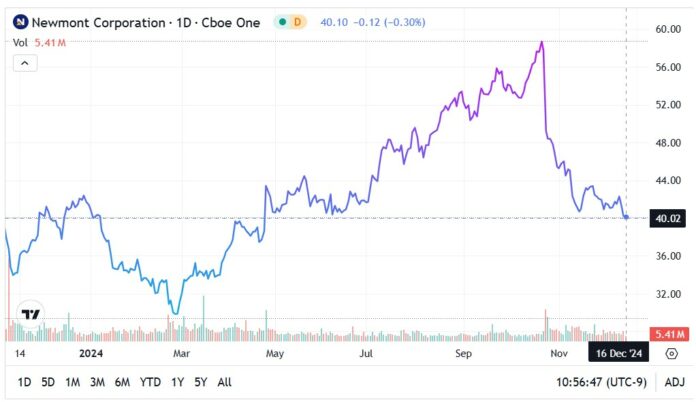

Currently, NEM stock is hovering near a key support level at $40 per share. Although the stock has faced volatility since late October, it has shown signs of stability in recent sessions, making it an appealing option for investors seeking potential rebounds.

Also Read: Fed Poised To Cut Interest Rates By 0.25% This Week: Here’s Why Your Focus Should Shift To Other Signals

Exploring a Bull Call Spread Strategy

Buying shares of Newmont Corporation is one straightforward way to invest. However, this method often lacks the leverage that some investors desire. Newmont’s current market capitalization is nearly $46 billion, which suggests that significant price movements may not be on the horizon.

As a result, many retail traders opt for call options instead. Data from the New York Stock Exchange shows that these traders often favor low-priced options, typically out-of-the-money options that have a slim chance of profitability.

A more strategic approach involves the bull call spread. In this strategy, a trader purchases a call option for a specific price, while also selling a call at a higher price with the same expiration date. This method distinguishes itself by balancing risk and reward.

While the structure caps maximum gains at the level of the sold call, it offers advantages. First, the money received from the sold call partially offsets the cost of the purchased call. Additionally, this strategy lowers the breakeven point, making profitability more attainable.

The bull call spread allows traders to pursue more promising transactions rather than relying on longshots from low-priced out-of-the-money options.

How to Structure an Ideal Spread for NEM Stock

Given Newmont’s popularity among investors, there are numerous bull call spreads to consider. It’s crucial, however, to aim for spreads that not only have a high chance of success but also offer reasonable payouts.

Traders can employ stochastic analysis to estimate the anticipated price movements of the stock. This analysis combines the current stock price with the implied volatility (IV) of the options chain, adjusted for time decay.

For instance, the options chain expiring on December 27 shows an average IV of 28.75%, while NEM’s share price is approximately $40.05. These factors suggest that the stock could rise to about $42.05 or drop to roughly $38.05 by the expiration date.

A potentially favorable strategy within this options chain is to consider a 39/41 bull call spread—purchasing the $39 call and selling the $41 call. As of now, the net investment required is $110, which also represents the maximum potential loss. If the trade succeeds, with NEM reaching $41 or higher, the possible reward is $90, translating to nearly an 82% payout.

Read Next:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.