# Sensata Technologies Reports Q1 2025 Earnings with Mixed Results

Sensata Technologies Holding plc (ST) announced first-quarter 2025 adjusted earnings per share (EPS) of 78 cents, down from 89 cents last year. Nevertheless, this figure exceeded the Zacks Consensus Estimate by 8.3%.

The company’s revenues for the quarter totaled $911.3 million, reflecting a 9.5% year-over-year decline. This drop was largely due to the divestiture of $200 million in annualized revenues linked to various low-margin products and the sale of the Insights business in September 2024. Despite this, revenues surpassed management’s expectations ($870-$890 million) and beat the consensus estimate by 3.6%, aided by strength in Sensing Solutions.

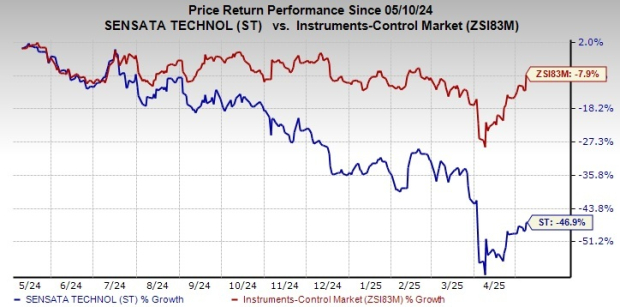

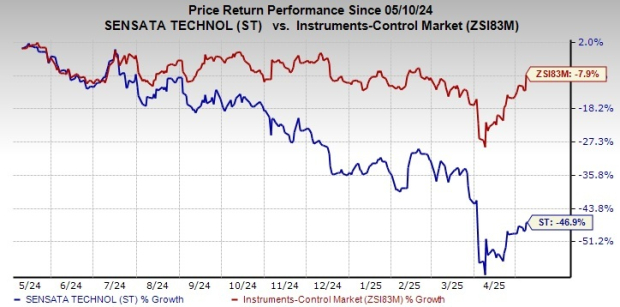

Shares of ST rose 4.6% in pre-market trading after the announcement. Over the past year, the stock has declined 46.9%, while the Instruments-Control industry has seen a decline of 7.9%.

Image Source: Zacks Investment Research

Segment Performance

Performance Sensing revenues, which make up 71.4% of total revenues, decreased 8.8% year over year to $650.4 million. This decline resulted from the divestiture of products and reduced light vehicle production volumes in key markets. Additionally, lower demand in heavy vehicles, construction, and agricultural segments also impacted performance.

In this segment, adjusted operating income was $142.9 million, down from $169 million in the same quarter last year.

Sensing Solutions revenues, comprising 28.6% of overall revenue, rose 1.2% year over year to $260.8 million, driven by stability in industrials and aerospace sectors, along with rising demand for A2L gas leak detection sensing products.

Adjusted operating income in this segment was $76.1 million, an increase from $72.3 million in the previous year.

Financial Overview for Q1

For the first quarter, adjusted operating income was $166.5 million, down from $188.8 million a year ago. The adjusted operating margin contracted by 40 basis points to 18.3%.

Adjusted EBITDA amounted to $200.2 million, compared to $223.2 million the previous year.

Total operating expenses decreased by 8.5% year over year to $789.1 million.

Cash Flow & Liquidity

During the quarter, Sensata generated $119.2 million in net cash from operating activities, an increase from $106.5 million a year prior. Free cash flow stood at $86.6 million, compared to $64.4 million last year.

As of March 31, 2025, Sensata reported $588.1 million in cash and cash equivalents, alongside $3,177.3 million of net long-term debt. These figures reflect slight changes from $593.7 million and $3,176.1 million, respectively, recorded on December 31, 2024.

In the reported quarter, the company returned $17.9 million to shareholders through dividends and bought back $100.5 million in shares.

Q2 Guidance

Looking ahead to the second quarter, Sensata projects revenues between $910-$940 million, suggesting a sequential increase of 0% to 3%. This forecast includes about $20 million anticipated from tariff recovery.

Adjusted operating income is expected to fall between $169-$177 million, representing a sequential rise of 1% to 6%.

For adjusted EPS, the estimate ranges from 80 to 86 cents, indicating a potential improvement of 3% to 10%. Adjusted net income is projected to be between $117-$125 million, a rise of 0% to 7%.

Current Zacks Rank

Sensata currently holds a Zacks Rank #4 (Sell).

Recent Performance of Other Tech Companies

Badger Meter, Inc. (BMI) reported earnings of $1.30 for Q1 2025, exceeding the Zacks Consensus Estimate by 20.4% and up from 99 cents in the prior quarter. Quarterly net sales reached $222.2 million, a 13% rise from $196.3 million last year.

In six months, BMI shares gained 1.1%.

Watts Water Technologies, Inc. (WTS) achieved adjusted EPS of $2.37, up from $2.33 in the same quarter last year. The bottom line surpassed the Zacks Consensus Estimate by 11.8%, although quarterly net sales dipped 2% year over year to $558 million.

Over the past six months, shares of Watts Water have risen 10.9%.

Itron Inc. (ITRI) posted non-GAAP EPS of $1.52, beating the consensus estimate by 16.9% and rising from $1.24 a year prior. Revenue crept up 1% year over year to $607 million, though it missed management’s guidance due to challenges in certain segments.

In the past six months, ITRI shares have decreased by 13.3%.

# Investment Insights: Stocks Poised for Significant Gains Ahead

This article discusses potential stock opportunities that may exceed previous high-performing stocks, such as Nano-X Imaging, which soared by +129.6% in just over nine months.

For those interested in identifying promising investments, various tools are available to analyze market trends and stock performance.

Investors may want to examine specific companies, such as:

- Badger Meter, Inc. (BMI): Free Stock Analysis Report

- Itron, Inc. (ITRI): Free Stock Analysis Report

- Sensata Technologies Holding N.V. (ST): Free Stock Analysis Report

- Watts Water Technologies, Inc. (WTS): Free Stock Analysis Report

For a comprehensive outlook, you can explore detailed analyses by reputable sources. Stay informed with industry updates and insights for informed investment decisions.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.