AT&T’s Strategic Growth Amid Changing Market Dynamics

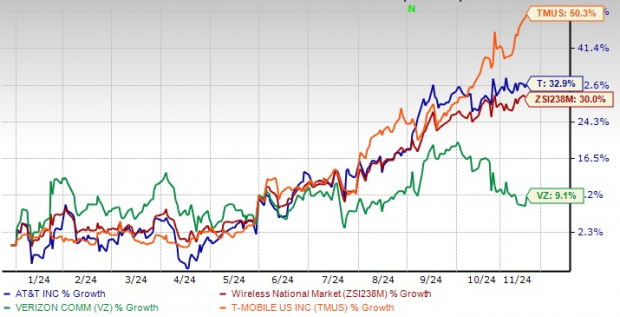

AT&T Inc. (T) has seen a healthy increase of 32.9% year-to-date, slightly outperforming the broader industry growth of 30%. While AT&T has outpaced competitors like Verizon Communications Inc. (VZ), it has not kept up with T-Mobile US, Inc. (TMUS).

Recently, AT&T released its third-quarter financial results, showcasing considerable growth in its wireless segment, alongside notable customer additions. However, this was somewhat tempered by a decline in demand for legacy voice and data services. The company’s solid subscriber growth stems from a resilient business model and strong cash flows, fueled by effective operational strategies. Looking ahead, AT&T plans to keep investing in key growth areas such as 5G technology and fiber internet, adapting its strategies to the changing market conditions for long-term sustainability.

Year-to-Date Price Performance of AT&T (T)

Image Source: Zacks Investment Research

Prioritizing Customer Connection

AT&T is dedicated to strengthening its network infrastructure, particularly through enhancements in its 5G and fiber networks. These improvements are crucial for ensuring extensive service coverage and capacity nationally. The company’s efforts to bridge the digital divide highlight its commitment to fostering inclusive connectivity and promoting socio-economic development as technology advances.

The focus on a customer-centric approach positions AT&T to leverage the deployment of mid-band spectrum and the expansion of its fiber network. This integrated fiber strategy aims to improve broadband access for both businesses and consumers, while ongoing 5G implementations are expected to enhance user experiences.

To facilitate seamless transitions between Wi-Fi, LTE, and 5G services, AT&T plans to roll out a national mobile 5G network. The 5G strategy includes utilizing millimeter wave spectrum in densely populated areas, while mid- and low-band spectrum will serve suburban and rural locales.

Additionally, AT&T’s acquisition of C-Band spectrum provides significant improvements in bandwidth and coverage quality across urban and rural settings. The company reported an addition of 226,000 fiber customers in the third quarter of 2024 and aims to exceed 30 million fiber service locations by the end of 2025.

Moving Towards Open RAN Systems

In efforts to boost operational efficiency and foster a diverse ecosystem of network infrastructure providers, AT&T plans to collaborate with Ericsson (ERIC) to establish a nationwide open radio access network (Open RAN). This architecture is expected to foster competition among vendors, reduce dependency on single suppliers, offer scalability, lower costs, and enhance network security by minimizing reliance on foreign vendors such as Huawei.

AT&T aims for Open RAN to handle 70% of its wireless network traffic on open-capable platforms by late 2026, with the full integration of Open RAN sites expected to begin in 2024. The shift will allow for quicker scaling and managing of various supplier hardware at cell sites. From 2025 onward, AT&T plans to expand this Open RAN setup across its entire wireless network in conjunction with multiple vendors, positioning itself prominently in the industry.

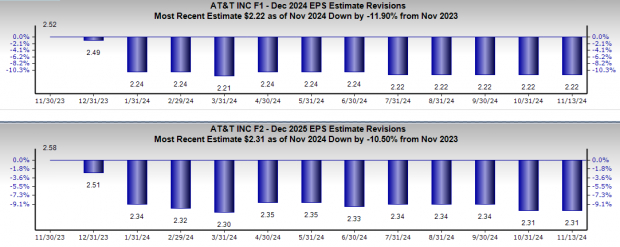

Earnings Outlook: A Cautious Perspective

Even amidst strong wireless performance, analysts have revised down AT&T’s earnings estimates for 2024 by 11.9%, now forecasting $2.22 per share, while the 2025 estimate has also decreased by 10.5% to $2.31. These downward revisions suggest a cautious outlook for the stock’s future.

Image Source: Zacks Investment Research

Challenges in Legacy Services Persist

AT&T’s wireline division is experiencing ongoing challenges, marked by a decline in legacy services. Increased competition from voice-over-Internet protocol (VoIP) providers and the aggressive pricing strategies of cable companies have led to significant losses in access lines. The dip in high-speed internet revenues is also linked to the decline of traditional Digital Subscriber Line services, alongside the impact of simplified pricing and bundled options.

To attract customers, AT&T has been offering discounts and incentives, which have intensified margin pressures and could hinder its growth potential. The company has set conservative projections for 2024, anticipating adjusted earnings between $2.15 and $2.25 per share, heavily impacted by significant infrastructure investment costs.

Image Source: Zacks Investment Research

Conclusion

AT&T’s ongoing investments in infrastructure and innovations in technology position it favorably to improve nationwide connectivity and reduce the digital divide. This strategic focus could lead to strong subscriber growth and higher revenue per user in the Mobility Services segment.

Nevertheless, challenges related to a saturated wireless market and competitive pricing pressures remain significant hurdles for the company. The recent reduction in earnings estimates further reflects market skepticism regarding AT&T’s potential for growth. Currently rated with a Zacks Rank #3 (Hold), investors are advised to approach with caution while considering their options.

Explore Investment Opportunities Amid Infrastructure Growth

Billions of dollars in federal funding are being allocated to upgrade and repair America’s infrastructure, including areas such as AI data centers and renewable energy initiatives.

Discover five surprising stocks that are positioned to thrive from this financial influx that is just beginning.

Download your free report on Profiting from the Trillion-Dollar Infrastructure Boom.

AT&T Inc. (T) : Free Stock Analysis Report

Ericsson (ERIC) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.