Rocket Lab: A Rising Contender in the Space Economy

Building rockets is hard. Launching them reliably into space is even harder. Currently, only one private company, SpaceX, has achieved this at scale with its reusable rockets. However, Rocket Lab (NASDAQ: RKLB) is quickly gaining ground. The company has established itself as the second private entity to consistently and reliably launch payloads into orbit, marking a significant milestone in the space industry.

Unlike SpaceX, Rocket Lab is publicly traded, making it accessible for anyone with a brokerage account. As the company prepares to report its third-quarter earnings on Nov. 12, investors are eager for updates on revenue growth, product advancements, and overall profitability. Should you consider buying the stock ahead of this earnings report?

Capitalizing on the Space Boom

Rocket Lab is making the most of the expanding space economy, projected to exceed $1 trillion in annual spending within the next decade. Launching rockets is a key part of capturing value in this sector. With its small Electron rocket, Rocket Lab has positioned itself alongside SpaceX as a reliable launch service for commercial clients.

The company earns revenue primarily from launch contracts, but it also secures additional contracts for constructing space systems, capsules, and satellites for clients that include the U.S. government and private firms like Synspective. Due to limited competition in the small rocket segment, Rocket Lab has built a significant backlog—over $1 billion as of last quarter—for its launch and systems services.

In the long term, Rocket Lab aims to develop a third business pillar: space data and software services. Inspired by SpaceX’s Starlink satellite internet service, Rocket Lab plans to offer high-margin software services through its infrastructure. This could present the company’s greatest profit potential, as it currently faces challenges in profitability.

Advancing with Neutron and Looking to Improve Margins

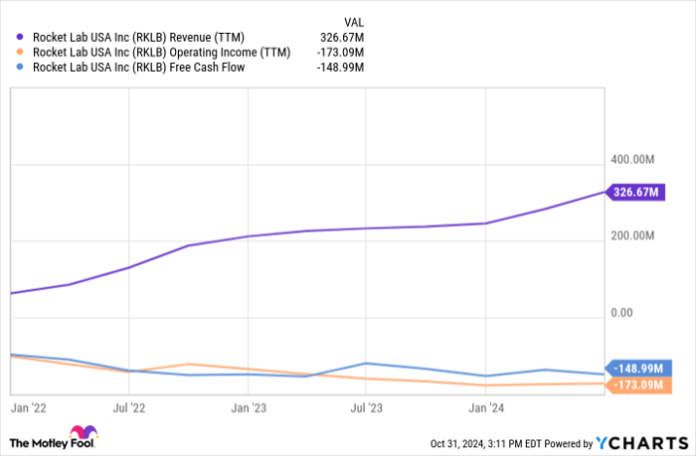

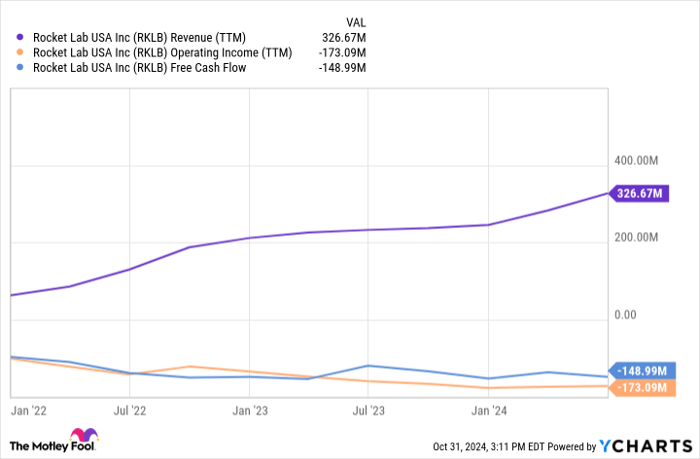

Rocket Lab has yet to record a profit or positive free cash flow, which may deter some investors. Over the past year, the company has burned through $149 million in free cash flow. With about $500 million in cash remaining, achieving profitability within the next three years is crucial, or the company may need to seek additional funding.

However, this does not mean its current Electron rocket launches are unprofitable. A large portion of Rocket Lab’s expenses stems from significant upfront investments required to manage its extensive customer backlog, along with the development of the larger Neutron rocket. The Neutron, anticipated to be significantly larger than the Electron, is expected to bring in much higher revenues per launch. In the last quarter alone, Rocket Lab invested about $40 million in research and development, representing 38% of its revenue. As the business scales, this R&D expense ratio should decrease.

RKLB Revenue (TTM) data by YCharts

Is Investing in Rocket Lab a Smart Move?

Before adding Rocket Lab to your investment portfolio, consider your risk tolerance. This stock carries both substantial risks and significant upside potential.

With a market capitalization of $5.3 billion, the stock trades at more than 10 times its trailing-12-month sales of $327 million, with no profits to speak of. Investors should be aware that Rocket Lab may remain unprofitable for the next three to five years, which might pressure the stock price.

On the upside, Rocket Lab boasts a growing backlog exceeding $1 billion and a clear development pipeline. The company plans to enhance its launch capabilities with the Neutron rocket, expand its space hardware sector, and eventually introduce data services. As the space economy approaches $1 trillion annually, Rocket Lab has the potential to grow its revenue substantially, helped by its vital position as one of the few companies capable of safely launching rockets into orbit.

If you’re comfortable taking on some risk, you might consider buying shares before the upcoming earnings report. If not, it may be wise to hold off on this investment.

Seize Your Opportunity with “Double Down” Stocks

Do you ever feel like you missed your chance to invest in top-performing stocks? Now could be your second chance.

Occasionally, our expert team issues a “Double Down” stock recommendation for companies poised for impressive growth. If you’re concerned you missed a prior opportunity, it’s time to buy before it’s too late. The numbers support this:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $22,292!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,169!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $407,758!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, which may not have another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Rocket Lab USA. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.