A Rollercoaster Year for the “Magnificent Seven”

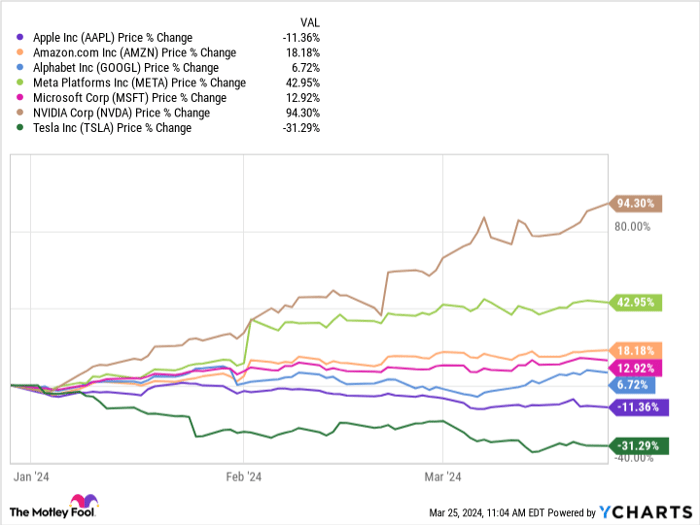

This year, the “Magnificent Seven,” a collection of tech titans, has experienced a myriad of outcomes. Among them, Apple (NASDAQ: AAPL) has found itself in a less-than-enviable position, closely trailing only Tesla in this unfortunate category.

Antitrust Allegations Resurface

Apple and its compatriots in the Magnificent Seven have long been under the regulatory microscope for alleged antitrust activities. The U.S. Department of Justice, supported by 16 states, recently launched a lawsuit accusing the tech giant of maintaining an illegal monopoly in the smartphone market.

Weathering the Legal Storm

Despite these challenges, it is premature to forecast the outcome of this legal battle. Apple’s robust financial standing and experience in legal skirmishes position it well to navigate this storm. The company’s substantial cash flow and history of legal entanglements signify a tenacity that may serve it well in this latest test.

A Cautionary Outlook

For potential investors, exercising prudence is advised. While selling off shares may not be warranted, a cautious approach towards increasing one’s stake is sensible amidst Apple’s current legal tribulations. Furthermore, the company’s position in the burgeoning artificial intelligence sector lags behind some rivals, contributing to a climate of uncertainty.

Challenges on the Horizon

Apple’s reliance on the iPhone, while historically lucrative, faces saturation, prompting the need for diversification. While its services segment shows promise, it remains a modest fraction of total revenue. With over 2 billion devices in circulation, the outcome of the legal fracas could dramatically alter Apple’s ability to capitalize on its ecosystem.

Deliberating Investment Decisions

Given the multitude of obstacles, Apple’s stock does not present a compelling case for purchase in the current scenario. The confluence of challenges – from regulatory hurdles to technological catch-up – do not paint a picture of an outright investment opportunity at present.