Palo Alto Networks (NASDAQ: PANW) reported its fiscal 2025 second-quarter results for the period ending January 31, 2025, on February 13. Initially, investors reacted negatively as the company’s earnings forecast did not meet expectations.

However, on February 14, shares of the cybersecurity firm dipped by less than 1%. It appears that investors were reassured by management’s broader perspective on the company’s performance and the effectiveness of its platformization strategy in securing larger contracts.

Where should you invest $1,000 today? Our analyst team has identified the 10 best stocks to consider right now. Learn More »

But is the company’s improving revenue pipeline enough to make Palo Alto stock a worthwhile investment, especially given its valuation concerns? Let’s explore.

Palo Alto Networks Faces High Valuation Challenges

The elevated valuation of Palo Alto Networks may have contributed to the immediate sell-off following its earnings report. Before the release, shares were trading at 114 times trailing earnings. When management projected fiscal third-quarter earnings between $0.76 to $0.77 per share—below the anticipated $0.80—investors reacted quickly.

Nonetheless, Palo Alto raised its full-year revenue and earnings forecast. The midpoint of its adjusted earnings outlook now stands at $3.21 per share, reflecting a 14% growth. Still, many believe this growth doesn’t fully justify the high earnings multiple.

Future increases in stock price could depend on Palo Alto delivering better-than-expected results. Additionally, success with its platformization strategy—combining various cybersecurity tools into one integrated solution—may provide long-term benefits.

In recent quarters, the company has exceeded Wall Street’s expectations and seems capable of enhancing earnings growth, supported by a stronger revenue pipeline.

Platformization: A Path to Sustainable Growth

Palo Alto Networks is dedicated to offering comprehensive protection through an integrated platform rather than through separate solutions. The company argues that by utilizing features like automation, AI, and analytics, it simplifies threat detection and management, which can cut costs and complexity for customers.

This platformization method has proven effective. During the recent earnings call, CEO Nikesh Arora highlighted:

We delivered approximately 75 new platformizations in Q2, up from around 45 last year. We now have a total of over 1,150 platformizations among our top 5,000 customers.

Palo Alto’s platform targets various sectors, including network security, cloud security, endpoint security, and security operations. Notably, many clients are adopting multiple platforms. As Arora explained:

Most of our platformizations begin with network security from clients who initially invest in one area. However, the number of customers utilizing two platforms has grown over 50% in Q2, and we’re seeing three-platform customers increase threefold year over year.

This shift explains why Palo Alto has gained strong momentum in lucrative segments like next-generation security services, resulting in a 50% year-over-year increase in $10 million deals. This surge contributed to a 21% rise in remaining performance obligations (RPO) to $13 billion.

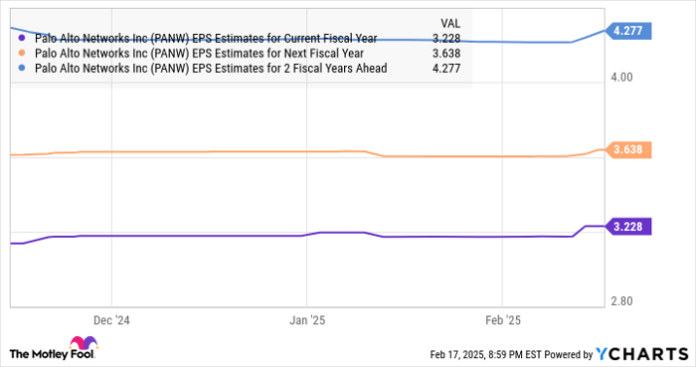

RPO indicates the total future contract value the company will fulfill, and the growth in this figure suggests a healthy business pipeline. This could result in accelerated earnings growth for Palo Alto, according to consensus estimates.

Data by YCharts.

Investors considering buying into this cybersecurity stock at a premium might find future rewards. However, they must prepare for potential volatility, as any signs of a slowdown could negatively affect Palo Alto’s stock price. It’s prudent for investors to evaluate their risk tolerance before investing.

A Chance to Seize a Potentially Profitable Opportunity

Have you ever thought you missed the opportunity to invest in top-performing stocks? If so, this could be your chance.

On rare occasions, our expert analysts issue a “Double Down” stock recommendation for companies that are poised for significant growth. If you’re concerned about missing out, consider investing now before the chance slips away. The past successes speak volumes:

- Nvidia: If you invested $1,000 when we issued a double down in 2009, you’d have $348,579!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,554!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $540,990!

Currently, we are issuing “Double Down” alerts for three standout companies, and there may not be another opportunity like this in the near future.

Learn more »

*Stock Advisor returns as of February 21, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool recommends Palo Alto Networks. The Motley Fool has a disclosure policy.

The opinions expressed here belong to the author and do not necessarily reflect those of Nasdaq, Inc.