Snowflake Soars: Strong Earnings Revive Stock After Tough Year

Snowflake (NYSE: SNOW) had a challenging start to 2024, with worries about its slow growth and high valuation weighing down its share price. However, recent quarterly results sparked a dramatic rebound for the technology company.

After announcing its fiscal 2025 third-quarter results for the period ending October 31 on November 20, Snowflake’s stock surged nearly 33%. Let’s explore the reasons behind this impressive performance and whether it’s a good time to consider investing in the stock as it gains momentum.

Snowflake Exceeds Expectations and Boosts Outlook

In fiscal Q3, Snowflake recorded revenue of $942 million, marking a 28% year-over-year increase, with product revenue rising 29% to $900 million. This performance surpassed analysts’ predictions of $897 million. The company’s non-GAAP earnings reached $0.20 per share. Although this was down from $0.25 per share in the previous year, it exceeded the consensus estimate of $0.15 per share.

Adding to the positive news, Snowflake raised its guidance significantly. The midpoint of its fiscal Q4 product revenue forecast is set at $908.5 million, outpacing the $884.5 million expectation from analysts. The company also increased its full-year product revenue guidance to $3.43 billion—a 29% rise compared to the previous year—up from an earlier forecast of 26% growth to $3.36 billion.

Moreover, Snowflake adjusted its operating margin expectation to 5%, up from 3%. The company’s impressive quarter is largely due to increased adoption of its data cloud platform, which has been enhanced by artificial intelligence (AI) integration. The customer base grew by 20% year over year, reaching over 10,600.

Customer spending also saw a boost, with the number of clients generating over $1 million in product revenue over the last year jumping by 25% to 542. This highlights Snowflake’s ability to generate more business from existing clients, allowing for the upward revision of its margin guidance.

Snowflake’s net revenue retention rate stood at 127% for the quarter. This figure, which measures the revenue generated by returning customers compared to the previous year, indicates that customers have either expanded their use of the platform or have opted for more products.

The combination of solid growth in customer acquisition and higher spending indicates that Snowflake’s revenue prospects are improving rapidly. As of the end of the last quarter, the company had $5.7 billion in remaining performance obligations (RPO), which reflects a significant 55% increase from the previous year. RPO refers to the total value of contracts that Snowflake still has to fulfill; thus, a faster growth rate in RPO compared to revenue suggests strong future revenue growth. Notably, Snowflake anticipates recognizing half of its RPO as revenue within the next year.

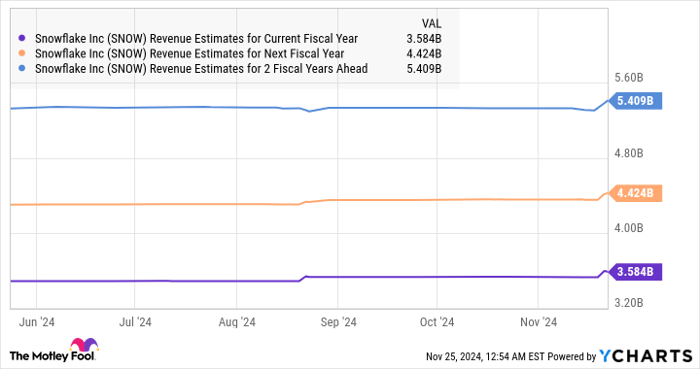

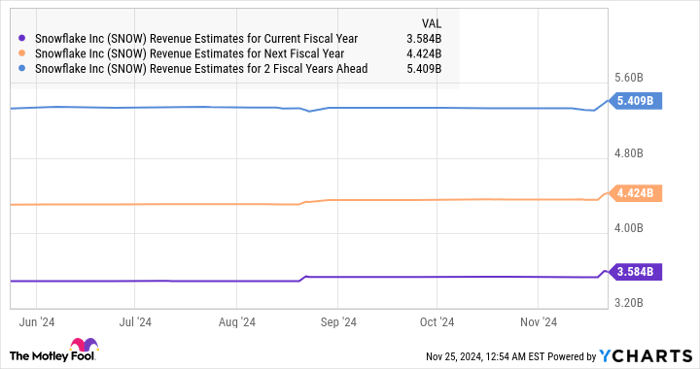

Considering the $3.2 billion in revenue generated over the previous four quarters, its robust RPO indicates promising revenue growth in the near future. Analysts have updated their growth projections for Snowflake accordingly.

SNOW Revenue Estimates for Current Fiscal Year data by YCharts

Meanwhile, Snowflake’s commitment to integrating AI-focused solutions into its data cloud platform is yielding positive outcomes. The company has made strides by providing AI products that enable customers to develop custom applications using their data. During its latest earnings conference call, management disclosed that its AI and machine learning (ML) solutions are currently deployed in over a thousand use cases.

Over 3,200 customers have begun using Snowflake’s AI offerings, a number that could continue to grow as the company seeks to incorporate more large language models (LLMs). This is exemplified by its partnership with AI-focused company Anthropic, which allows Snowflake customers to utilize Anthropic’s Claude 3.5 LLM for creating generative AI applications and workflows.

Is Now the Right Time to Buy Snowflake Stock?

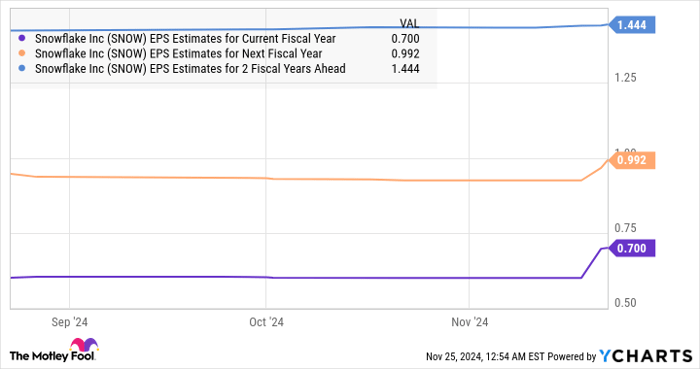

While Snowflake’s latest results and upward guidance are promising, a deeper examination of the stock’s valuation may raise some questions for investors. Currently, the stock is trading at a high price-to-sales ratio of 16, significantly eclipsing the U.S. technology sector’s average of 8. Notably, the company’s earnings decreased in the last quarter, and analysts expect earnings to drop to $0.70 per share in 2024, down from $0.98 per share the previous year.

However, this decline can largely be attributed to Snowflake’s investments in AI-related infrastructure, including graphics processing units (GPUs). The company’s revised operating margin forecast for this year suggests that profitability may improve in the coming period, leading analysts to predict a recovery in earnings starting next year.

SNOW EPS Estimates for Current Fiscal Year data by YCharts

Investors searching for growth stocks may find Snowflake appealing. Its substantial revenue pipeline and the potential for a rebound in earnings could justify its current valuation—especially in light of the recent results, which indicate a likely acceleration in business performance.

Seize the Opportunity

If you’re feeling like you’ve missed out on buying some of the top-performing stocks, now may be your chance.

Occasionally, our team of expert analysts identifies a “Double Down” stock—companies they believe are on the brink of significant growth. If you are concerned that it’s too late to invest, the time to act could be now. The results are compelling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $350,915!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,492!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $473,142!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Snowflake. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.