Brookfield Asset Management: A Closer Look at Investment Potential

Brookfield Asset Management (NYSE: BAM), a leading alternative asset management firm, became public in 1983. In December 2022, it rebranded to Brookfield Corp. (NYSE: BN), spinning off its core asset management operations as the new Brookfield Asset Management.

Brookfield Corp. now acts as the parent company of Brookfield Asset Management, which primarily focuses on earning management fees from its investment funds. This change positions Brookfield Asset Management as a dedicated asset manager.

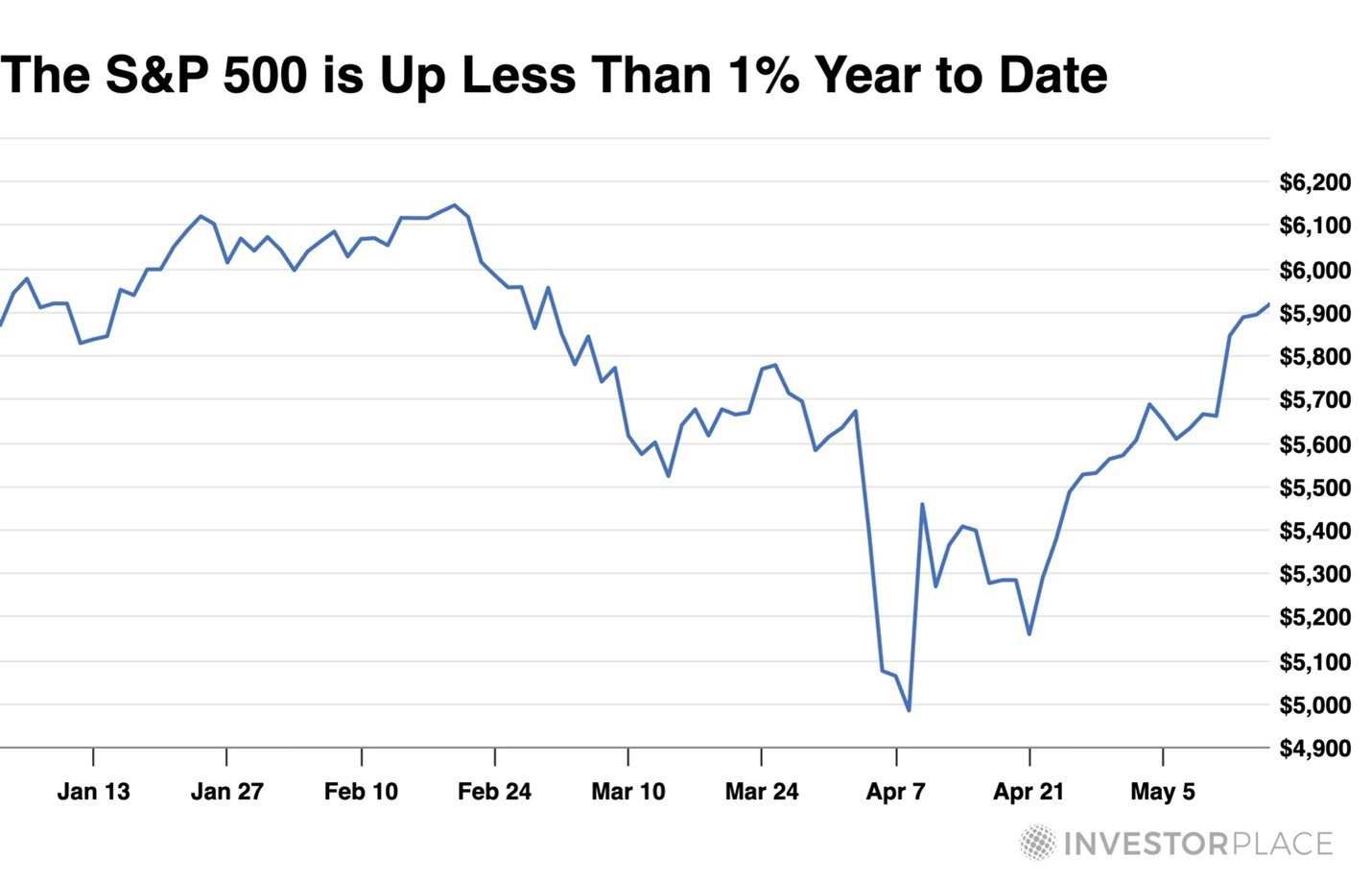

Brookfield Asset Management’s Stock Performance

Since its spinoff in 2022, Brookfield Asset Management’s stock has surged nearly 50%. Investors are considering whether it remains a safe haven in a volatile market.

Image source: Getty Images.

Evaluating Growth Metrics

Brookfield Asset Management provides exposure to “alternative” assets in real estate, infrastructure, private equity, and credit markets. The firm measures its growth using three critical metrics:

- Fee-Bearing Capital (FBC): The total managed capital from clients.

- Fee-Related Earnings (FRE): Total earnings from management and advisory fees.

- Distributable Earnings (DE): Cash flow available for dividends and interest payments.

All three metrics have shown healthy growth over the past three years.

|

Metric |

2022 |

2023 |

2024 |

|---|---|---|---|

|

FBC |

$418 billion |

$457 billion |

$539 billion |

|

FBC growth (YOY) |

15% |

9% |

18% |

|

FRE |

$2.11 billion |

$2.24 billion |

$2.46 billion |

|

FRE growth (YOY) |

15% |

6% |

10% |

|

DE |

$2.10 billion |

$2.24 billion |

$2.36 billion |

|

DE growth (YOY) |

11% |

7% |

5% |

Data source: Brookfield Asset Management. YOY = Year over year.

Brookfield’s impressive growth largely stems from institutional investors shifting from traditional investments to alternatives due to rising interest rates, inflation, and geopolitical uncertainties. Many of Brookfield’s funds commit investors for over ten years, providing insulation against short-term market fluctuations.

Positioning in Cloud and AI Markets

With significant exposure to infrastructure and renewable energy, Brookfield is positioned to benefit from the growth in cloud and artificial intelligence (AI) sectors. As cloud companies enhance their data centers for AI applications, this demand will generate substantial opportunities for Brookfield’s investments.

Earlier this year, Brookfield announced a €20 billion ($22.4 billion) investment over five years to enhance AI infrastructure in France, and it expanded its U.S. renewable energy business to cater to the increasing electricity demand from AI.

Dividend Coverage Analysis

In 2022, Brookfield Asset Management generated $1.28 in DE per share, increasing to $1.37 in 2023 and $1.45 in 2024. These earnings comfortably covered its annual per-share dividends of $0.56 in 2022 and $1.28 in 2023, though they did not completely cover the projected $1.52 dividend in 2024.

The higher dividend payment is manageable, especially as Brookfield raised its annual dividend rate to $1.75 in February, which surpasses the expected DE of $1.65 for 2025.

Is Now the Time to Invest?

Currently trading at $59 per share, Brookfield’s price reflects a valuation of 36 times this year’s DE per share. Its forward dividend yield of 3% may not attract income investors, especially with the 10-year Treasury yielding 4.5%. This high valuation may limit Brookfield’s upside potential in the near term.

Although Brookfield appears to be a solid long-term investment, significant price increases over the next few quarters may be unlikely. Investors could consider small investments now but may want to wait for more favorable valuations before acquiring additional shares.

Should You Invest $1,000 in Brookfield Asset Management?

Before purchasing shares of Brookfield Asset Management, consider this:

Analysts have recently highlighted what they believe are the ten most promising stocks for investors, and Brookfield Asset Management is not included on the list. Investors might want to evaluate these alternatives for potentially greater returns.

Leo Sun has no position in any stocks mentioned. Brookfield Corporation is recommended in various investment disclosures.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.