Alphabet (GOOG) (GOOGL) stands out from the tech pack with a modest YTD gain of just over 12% but lags behind the “Magnificent 7” group and the S&P 500 Index ($SPX). The recent court ruling on its online search market monopoly has stirred uncertainties, fueling discussions on breaking up the tech giant. But is now the time to be bold and consider investing in Alphabet for the fourth quarter?

The Current Outlook for GOOG Stock

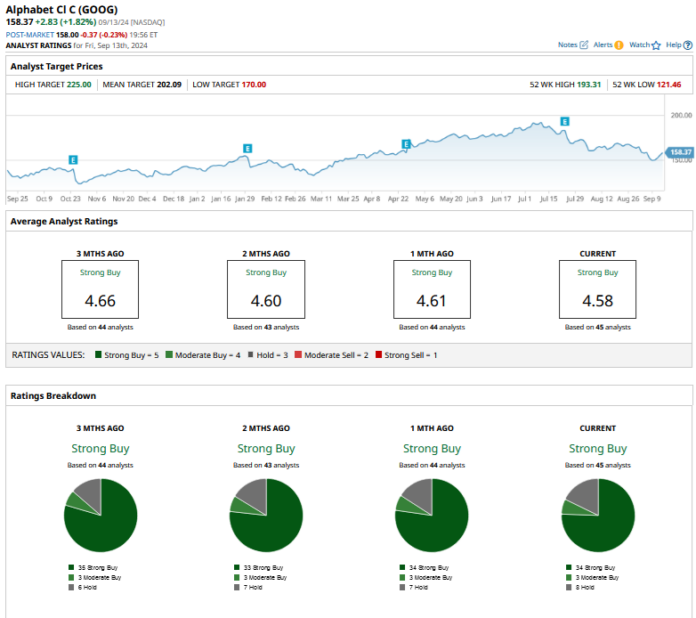

Despite maintaining a “Strong Buy” consensus rating from analysts, Alphabet faces mixed sentiments. While the mean target price of $202.09 represents a potential 27.1% increase from current levels, notable analysts like Rosenblatt, Bernstein, and Loop Capital have shifted from a “buy” to a “neutral” stance on GOOG. Evercore ISI also revised Alphabet’s target price down to $200 while upholding an “overweight” rating.

Risks on Alphabet’s Horizon

Alphabet’s underperformance is attributed to various challenges. Regulatory risks loom large, with Bernstein warning of potential litigations exceeding $100 billion due to overcharged ads. Market competition intensifies, with companies like Amazon, Uber, Disney, and Netflix vying for advertising dominance against Google. Additionally, the threat of regulatory intervention to dismantle Alphabet’s monopoly position persists.

Deciphering the Investment Potential

While Alphabet confronts significant risks, its forward P/E multiple of 20.4x, the lowest among the Magnificent 7, presents an attractive proposition. Notably, despite elevated tech valuations, GOOG trades at a discount compared to historical figures. The company boasts undervalued assets like YouTube, a leading streaming platform with immense monetization prospects, and the promising Waymo self-driving unit. The Cloud segment’s growing revenues and profits further underline Alphabet’s potential for expansion.

Despite regulatory headwinds, the inherent value in Alphabet’s underappreciated assets could catalyze long-term investor gains. While short-term fluctuations may persist due to regulatory noise, the underperformance of this tech giant could evolve into a strategic opportunity for savvy investors.

On the date of publication, Mohit Oberoi had a position in: GOOG , AMZN , DIS . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.