When contemplating an investment in a stock, investors often turn to analyst recommendations for guidance. These sell-side analysts can exert significant influence over a stock’s movement, trickling down through the media, but how much weight should investors put on these ratings?

Before delving into the reliability of brokerage recommendations and how to leverage them to your advantage, let’s first explore what the Wall Street pundits have to say about Alibaba (BABA).

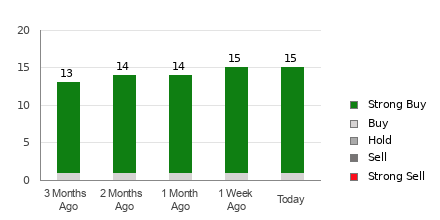

Alibaba presently holds an average brokerage recommendation (ABR) of 1.27, falling between Strong Buy and Buy on a scale of 1 to 5, with 1 representing Strong Buy and 5 reflecting Strong Sell. This ABR value is derived from the actual recommendations (Buy, Hold, Sell, etc.) of 15 brokerage firms. Notably, 86.7% of these recommendations are Strong Buy, signaling a bullish sentiment.

Brokerage Recommendation Trends for BABA

Check price target & stock forecast for Alibaba here>>>

While the ABR suggests a buy rating for Alibaba, making investment decisions solely based on this information may not be wise. Numerous studies have demonstrated the limited success of brokerage recommendations in identifying stocks with the most potential for price appreciation.

Wondering why? It’s due to the inherent bias of brokerage analysts towards the stocks they cover. Brokers often exhibit a strong positive bias, with five “Strong Buy” recommendations for every “Strong Sell” recommendation. This predisposition may not align with the interests of retail investors, failing to indicate the true trajectory of a stock’s price. It’s more prudent to use this information to validate your individual research or as a supplementary indicator alongside a proven method for predicting stock price movements.

Supported by a rigorously verified track record, our proprietary stock rating tool, Zacks Rank, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serving as a reliable gauge for a stock’s short-term price performance. Therefore, combining the ABR with Zacks Rank could significantly aid in making sound investment decisions.

Zacks Rank Should Not Be Confused With ABR

Despite being displayed on a 1-5 scale, Zacks Rank and ABR are fundamentally different measures.

ABR uses broker recommendations as its exclusive basis, typically presented in decimals (e.g., 1.28). In contrast, Zacks Rank is a quantitative model that harnesses the power of earnings estimate revisions, displayed as whole numbers from 1 to 5.

Brokerage analysts, owing to their allegiance to their employers, have historically been excessively optimistic with their ratings. Their recommendations often surpass the actual supportable research, leading to misguidance of investors. Conversely, Zacks Rank is driven by earnings estimate revisions, with empirical research demonstrating a strong correlation between short-term stock price movements and trends in earnings estimate revisions.

Furthermore, the different Zacks Rank grades are proportionally applied to all stocks for which brokerage analysts furnish current-year earnings estimates. This ensures a balanced representation across its five ranks.

Another critical divergence between ABR and Zacks Rank lies in their timeliness. ABR might not always be up-to-date, whereas Zacks Rank swiftly reflects the actions of brokerage analysts as they adjust their earnings estimates in response to evolving business trends, ensuring timely predictions of future stock prices.

Is BABA a Good Investment?

Assessing the earnings estimate revisions for Alibaba, the Zacks Consensus Estimate for the current year has held steady at $9.12 over the past month.

Analysts’ steadfast outlook on the company’s earnings prospects, evident from the unchanged consensus estimate, could indicate that the stock is poised to perform in line with the broader market in the near term.

Given the recent consensus estimate stability and three other correlated factors, Alibaba carries a Zacks Rank #3 (Hold). Discover today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Given Alibaba’s Buy-equivalent ABR, a cautious approach might be wise.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.