Alibaba Stock: Analyzing Recent Trends and Future Potential

Alibaba (BABA) has emerged as a frequent topic of discussion among investors on Zacks.com. Let’s dive into some key factors that could influence the stock’s performance soon.

Performance Snapshot

Over the past month, Alibaba’s shares have declined by -5.8%, contrasting with the Zacks S&P 500 composite’s increase of +1.7%. Meanwhile, the Zacks Internet – Commerce industry, which includes Alibaba, has remained unchanged during this timeframe. Investors are left pondering: What is the stock’s likely trajectory moving forward?

The Importance of Earnings Estimates

Media reports and rumors can lead to swift price changes, but we at Zacks prioritize earnings estimate revisions as a more reliable indicator of a company’s future stock performance. A company’s fair stock value largely depends on its potential future earnings.

Our approach focuses on how sell-side analysts are adjusting their earnings forecasts based on recent business trends. Generally, when earnings predictions increase, so does the stock’s fair value. This typically prompts investors to buy, thereby driving the stock price up. Studies have consistently shown a solid connection between trends in earnings estimate changes and short-term stock price movements.

Current Earnings Projections

For the upcoming quarter, Alibaba is anticipated to report earnings of $2.09 per share, which represents a -2.3% decrease from the same quarter last year. Over the last month, the Zacks Consensus Estimate has dropped by -6.5%.

Looking ahead to the current fiscal year, the consensus earnings estimate stands at $8.94, reflecting a +3.7% increase from the previous year. This estimate has seen a modest rise of +1.9% in the past month.

For the next fiscal year, a consensus estimate of $9.63 suggests a +7.7% increase compared to this year. Notably, this estimate has climbed +4.1% over the last month.

Our proprietary rating tool, the Zacks Rank, effectively reflects the stock’s near-term price performance by assessing these earnings estimate changes. The current consensus estimate adjustments, alongside additional relevant factors, have assigned Alibaba a Zacks Rank of #2 (Buy).

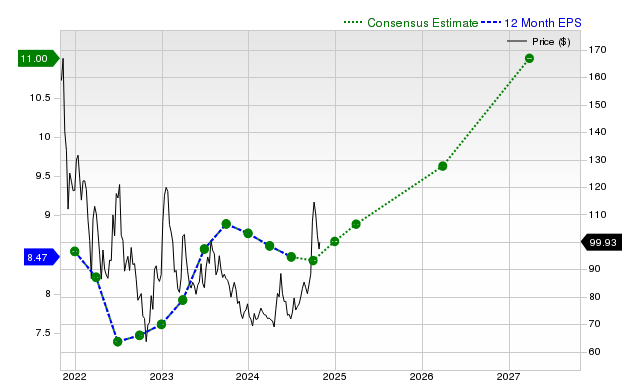

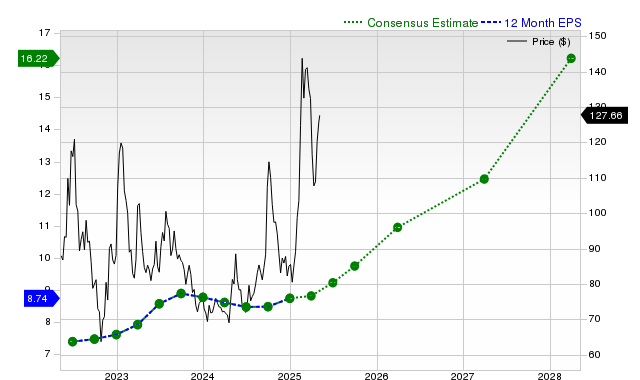

12-Month Earnings Per Share (EPS) Insight

Projected Revenue Growth

While earnings growth is crucial for assessing a company’s financial health, revenue growth is equally important. Sustained earnings increases typically accompany revenue growth, making it essential to evaluate a company’s revenue forecasts.

For Alibaba, the consensus sales estimate is $33.25 billion for the current quarter, representing a year-over-year growth of +7.9%. Predictions for the current and next fiscal years are $140.46 billion and $150.94 billion, indicating growth rates of +7.6% and +7.5%, respectively.

Recent Performance and Surprises

Alibaba posted revenue of $33.47 billion in the last quarter, which is a +3.7% increase from the prior year. The earnings per share (EPS) for this period was $2.26, down from $2.40 a year earlier.

Although the company’s revenue fell short of the Zacks Consensus Estimate of $34.95 billion by -4.23%, it did exceed the EPS estimate by +2.73%.

Over the past four quarters, Alibaba exceeded consensus EPS estimates three times but only matched revenue estimates once.

Valuation Considerations

A stock’s valuation plays a critical role in making informed investment decisions. It’s important to assess whether the current stock price aligns with the underlying business’s intrinsic value and growth prospects.

Considering current valuation multiples—such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF)—in relation to historical values can indicate whether a stock is fairly valued. Additionally, comparing these metrics to those of peers will provide context for the stock’s pricing.

Alibaba has received an A grade in the Zacks Value Style Score, suggesting it is trading at a discount compared to its competitors. For more on the valuation metrics that contribute to this grade, click here.

The Bottom Line

The information outlined here, alongside other resources on Zacks.com, could be instrumental in evaluating whether to heed the market chatter regarding Alibaba. The current Zacks Rank of #2 indicates a potential for the stock to outperform the market in the near future.

Expert Picks for Future Gains

Amid thousands of options, five Zacks experts have each identified a stock they believe could surge by +100% or more in the coming months. Among these, Director of Research Sheraz Mian has selected one stock projected to have substantial upside.

This particular company focuses on millennial and Gen Z markets, boasting nearly $1 billion in revenue last quarter. A recent price dip suggests an optimal entry point. While not all of our selections have succeeded, this stock may surpass previous Zacks picks, such as Nano-X Imaging, which skyrocketed by +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

For the latest recommendations from Zacks Investment Research, download the free report titled “5 Stocks Set to Double.”

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.