Amazon’s 2024 Q4 Earnings Preview: What Investors Need to Know

Amazon AMZN is scheduled to announce its fourth-quarter 2024 results on February 6, after market close. As a leader in e-commerce, understanding the company’s fundamentals ahead of its earnings report is essential.

Explore the Zacks Earnings Calendar to stay informed on important market news.

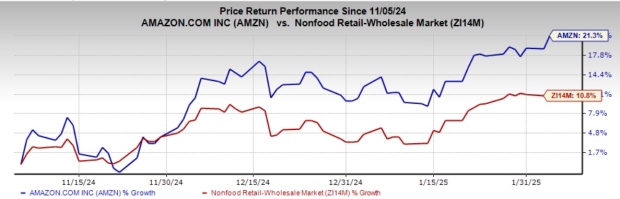

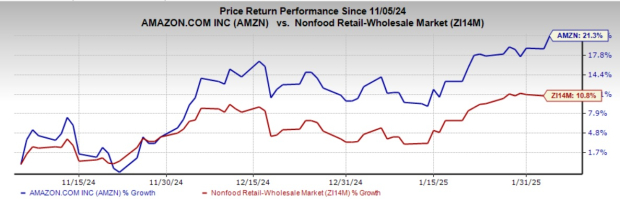

In the past three months, Amazon’s stock has increased by 21%, substantially exceeding the industry’s average growth rate of 10.8%. This trend of outperformance is likely to continue, especially since there are indications that the company may beat earnings estimates. Recently, Amazon experienced positive revisions in earnings projections, which often signals an earnings surprise.

Image Source: Zacks Investment Research

Investors may want to consider this favorable scenario by looking into ETFs with significant investments in Amazon. Notable options include the ProShares Online Retail ETF ONLN, Fidelity MSCI Consumer Discretionary Index ETF FDIS, Vanguard Consumer Discretionary ETF VCR, Consumer Discretionary Select Sector SPDR Fund XLY, and the VanEck Vectors Retail ETF RTH.

Understanding the Earnings Prediction

Currently, Amazon enjoys an Earnings ESP of +4.78% and holds a Zacks Rank of #2 (Buy). Based on surprise prediction methodology, having a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), 2 (Buy), or 3 (Hold) boosts the likelihood of an earnings beat. Use our Earnings ESP Filter to find the best stocks to buy or sell before earnings are reported.

In the last 30 days, analysts slightly increased the fourth-quarter earnings estimates, suggesting favorable trends leading up to the earnings release. The Zacks Consensus Estimate forecasts impressive year-over-year earnings growth of 50.5%, alongside a strong revenue growth projection of 10.2% for the upcoming quarter.

Amazon also has a strong track record of earnings surprises, averaging 25.85% over the past four quarters.

Amazon.com, Inc. Price, Consensus, and EPS Surprise

Amazon.com, Inc. price-consensus-eps-surprise-chart | Amazon.com, Inc. Quote

According to Wall Street analysts, Amazon has an average recommendation of 1.10 on a scale from 1 (Strong Buy) to 5 (Strong Sell), based on insights from 50 brokerage firms. Out of these, 46 firms rate it as Strong Buy and three as Buy, meaning 92% of recommendations are positive. The average price target set by 49 analysts for Amazon stands at $256.84, with estimates ranging from a low of $212.00 to a high of $306.00.

The stock boasts a solid Growth Score of A and is part of a highly regarded Zacks industry, ranking in the top 28% — clear signs it is positioned for growth.

Strong Growth Prospects

Thanks to its dominance in e-commerce and an expanding presence in cloud computing, advertising, and other fields, Amazon has reached new all-time highs. Its AI sector, which has seen rapid growth, is outpacing its cloud business during similar developmental stages. For the fourth quarter of 2024, Amazon anticipates revenue between $181.5 billion and $188.5 billion.

Following trends in the tech industry, Amazon has been increasing investments in data centers, chip development, and the energy needed for AI operations.

Notable ETFs Focused on Amazon

ProShares Online Retail ETF (ONLN)

The ProShares Online Retail ETF gives exposure to companies that predominantly sell online or through non-store channels, emphasizing those that are transforming retail. It tracks the ProShares Online Retail Index and comprises 20 stocks, with Amazon making up 23.9% of the portfolio.

Currently, ProShares Online Retail ETF has total assets of $78.5 million and an average daily trading volume of about 18,000 shares. The fund charges 58 basis points in annual fees.

Fidelity MSCI Consumer Discretionary Index ETF (FDIS)

This ETF follows the MSCI USA IMI Consumer Discretionary Index and contains 268 stocks, with Amazon holding the top position at 22.5% of the fund.

Fidelity MSCI Consumer Discretionary Index ETF has total assets of $2.1 billion and trades at an average daily volume of approximately 90,000 shares. It charges 8 bps in annual fees and currently holds a Zacks ETF Rank of #3 (Hold) with medium risk.

Vanguard Consumer Discretionary ETF (VCR)

The Vanguard Consumer Discretionary ETF tracks the MSCI US Investable Market Consumer Discretionary 25/50 Index and contains 298 stocks, with Amazon occupying the top position at 22.5%.

This ETF charges 9 bps in annual fees and trades at a moderate volume of nearly 55,000 shares daily, having amassed $6.9 billion in assets. It currently has a Zacks ETF Rank of #3 with medium risk.

Consumer Discretionary Select Sector SPDR Fund (XLY)

This fund offers a broad exposure to the consumer discretionary sector, tracking the Consumer Discretionary Select Sector Index. It is the largest ETF in this space, with approximately $24.6 billion in assets and an average daily trading volume around 3 million shares. Amazon is the top holding at 21.9%.

It charges 8 bps in annual fees and holds a Zacks ETF Rank of #2 (Buy) with medium risk.

VanEck Vectors Retail ETF (RTH)

The VanEck Vectors Retail ETF focuses on the 26 largest retail firms and tracks the MVIS US Listed Retail 25 Index. Amazon is the leading company, comprising 20.3% of the ETF’s assets.

This fund has total assets of $237.3 million and charges 35 bps in annual fees, trading at a lower volume of 6,000 shares daily on average. It carries a Zacks ETF Rank of #3 with medium risk.

Stay Updated with Key ETF News

Sign up for Zacks’ free Fund Newsletter to receive weekly insights on top news, analysis, and high-performing ETFs.

For more recommendations from Zacks Investment Research, you can download a report on the 7 Best Stocks for the Next 30 Days.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

VanEck Retail ETF (RTH): ETF Research Reports

Consumer Discretionary Select Sector SPDR ETF (XLY): ETF Research Reports

Vanguard Consumer Discretionary ETF (VCR): ETF Research Reports

Fidelity MSCI Consumer Discretionary Index ETF (FDIS): ETF Research Reports

ProShares Online Retail ETF (ONLN): ETF Research Reports

To read more articles at Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.