Ford Motor Company Faces Challenges Amid Soaring Stock Risks

Shares of Ford Motor Company (NYSE: F) are trading close to their 52-week low. The major American automaker recently concluded its 2024 fiscal year with significant losses in its electric vehicle segment, undermining profits generated from its traditional combustion models. Additionally, ongoing trade tensions with Mexico and Canada threaten to introduce tariffs on essential imported goods and materials in the U.S.

Currently, the stock presents a hefty 6.3% dividend yield and is priced at a fraction of the valuation of the S&P 500 index. Stocks can drop in value when a company faces uncertainty, and Ford’s situation might illustrate this phenomenon. However, the low stock price may be deserved, as flawed companies can attract investors only to underperform.

Why is Ford’s Stock Declining?

The automotive sector is highly competitive, making life tough for companies like Ford. Operating factories is costly, and the abundance of domestic and foreign rivals adds pressure. Ford faces additional challenges causing its stock to decline.

First, the company is struggling to harmonize its profitable traditional combustion engine business with the shift toward electric vehicles. In 2024, Ford reported losses of about $5 billion in its consumer electric vehicle division (Model e), counterbalanced by approximately $14.2 billion in profits from the consumer internal combustion segment (Ford Blue) and sales to government and commercial clients (Ford Pro).

Second, ongoing trade disputes between the U.S. government and Canada and Mexico could lead to tariffs on imported materials, such as the steel used in vehicle production. During the company’s fourth-quarter earnings call, management indicated that prolonged tariffs could seriously damage their business by compressing profits and dampening new vehicle demand due to rising prices.

In addition, the current economic landscape is troubling. The average interest rate for new vehicle loans has reached almost 7.5%, close to a decade high. Meanwhile, U.S. credit card debt is at unprecedented levels and the personal savings rate has dropped to its lowest since 2016. Since vehicles are significant purchases, consumers may delay buying them when finances are tight.

Given the looming tariffs and economic pressures, Ford presents a higher-risk investment at this time. However, it remains financially stable. By the year’s end, Ford reported $28 billion in cash and $47 billion in overall liquidity. While it faces headwinds, Ford is not on the brink of collapse. The company is also adjusting its electric vehicle strategy, opting to concentrate on hybrid models to achieve a more profitable balance.

The effectiveness of this strategy remains uncertain. Different manufacturers have adopted varying approaches; for instance, Toyota Motor has focused on hybrid vehicles, while General Motors is pushing forward with fully electric models. Though electric vehicles have not yet transformed the automotive landscape dramatically, that could change if innovation reduces prices and extends battery ranges in the upcoming decade.

Is It Time to Buy Ford Stock?

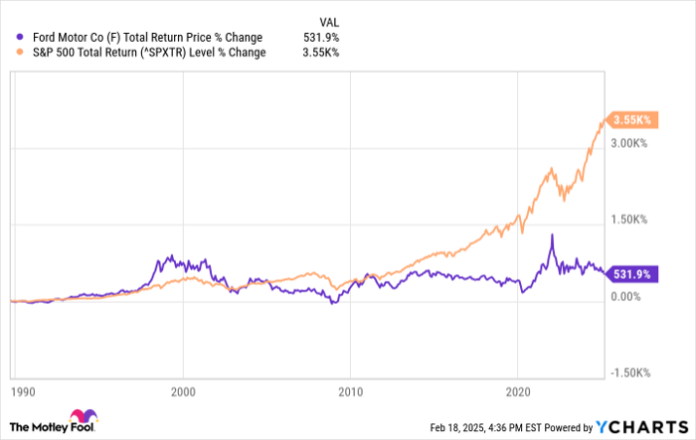

Ford is a cyclical business, sensitive to economic conditions and consumer spending habits. Long-term investors often find opportunities in cyclical companies when they are facing challenges, lower earnings, and bearish sentiment. Unfortunately, Ford’s stock has consistently underperformed against the S&P 500 through various economic cycles.

F Total Return Price data by YCharts

This underperformance largely explains why Ford trades at a significantly lower valuation compared to the broader market. A low valuation does not guarantee that a stock is a good buy.

Ford’s struggles highlight the challenges in the automotive industry: costly factories, intense competition, and a lack of strong competitive advantages. Even if trade tariffs do not materialize, Ford’s electric vehicle losses will continue to weigh heavily on its business in the near term.

While the dividend may seem appealing, it offers limited assurance (especially if it gets cut during a recession). Investing in Ford stock now involves higher risks than exploring more stable opportunities elsewhere. Therefore, Ford Motor Company does not appear to be a buy right now.

Should You Invest $1,000 in Ford Motor Company Today?

Before purchasing shares in Ford Motor Company, consider the following:

The Motley Fool Stock Advisor analyst team has recently highlighted what they consider the 10 best stocks for investors to buy now, and Ford Motor Company was not among them. These selected stocks have great potential for substantial returns in the years ahead.

For context, consider that when Nvidia was recommended on April 15, 2005, a $1,000 investment at that time would be worth $823,858!

Stock Advisor offers investors a straightforward path to success with insights on portfolio management, regular analyst updates, and two new stock suggestions each month. The Stock Advisor service has more than quadrupled returns compared to the S&P 500 since 2002.

Learn more »

*Stock Advisor returns as of February 21, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.