When it comes to investing, the opinions of Wall Street analysts often reign supreme. But do these recommendations truly hold the key to unlocking the potential of a stock, or are they merely a smoke screen?

Let’s delve into what the big guns on Wall Street have to say about Meta Platforms (META) before we uncover the real value behind brokerage recommendations and how you can leverage them to your advantage.

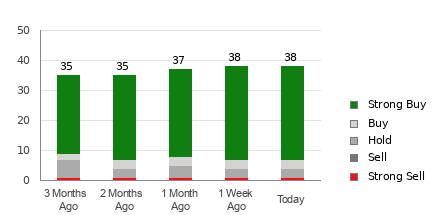

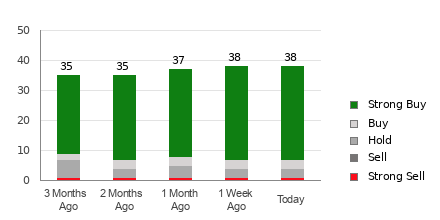

Meta Platforms currently boasts an average brokerage recommendation (ABR) of 1.29, falling between Strong Buy and Buy on a scale of 1 to 5. This figure is an aggregate of recommendations from 45 brokerage firms, with an overwhelming 86.7% rating the stock as a Strong Buy and 2.2% as a Buy.

Diving Deeper into META’s Brokerage Recommendations

Check price target & stock forecast for Meta Platforms here>>>

While the ABR paints a rosy picture for Meta Platforms, solely relying on this information may not be wise. Studies show that brokerage recommendations often lack the ability to steer investors towards stocks with the highest potential for growth.

So why is that? The innate bias of brokerage firms towards stocks they cover inevitably skews their analysts’ ratings. Our research uncovers a stark truth – for every “Strong Sell” recommendation, these firms are dishing out five “Strong Buy” recommendations.

These conflicting interests mean that brokerage recommendations may not always align with the true trajectory of a stock’s future value. It’s crucial to leverage this information to validate your own analysis or turn to a reliable tool that can accurately predict stock price movements.

Enter the Zacks Rank – our ace in the hole. This meticulously audited stock rating tool classifies stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering a dependable gauge of a stock’s short-term performance. Combining the ABR with the Zacks Rank could be a game-changer in your investment strategy.

Understanding the Zacks Rank Vs. ABR

While both the ABR and Zacks Rank use a 1-5 scale, they serve different purposes.

The ABR hinges solely on broker recommendations, usually depicted in decimal form. In contrast, the Zacks Rank is built on earnings estimate revisions, displayed in whole numbers 1 to 5.

Broker analysts have long been overly optimistic in their recommendations, swayed by their firms’ vested interests. Conversely, the Zacks Rank thrives on earnings estimate revisions, a metric strongly linked to short-term stock price movements.

This tool evenly assigns its five ranks across all stocks with current-year earnings estimates, ensuring fairness. Plus, thanks to the swift reflection of earnings estimate revisions in the Zacks Rank, it remains a timely predictor of stock price fluctuations.

Should You Back META in the Investment Race?

As per the latest data, the Zacks Consensus Estimate for Meta Platforms for the current year has risen by 12.5% to $19.94 in the past month.

The unanimous uptick in analysts’ sentiment towards the company’s earnings outlook, as evidenced by a surge in EPS estimates, could set the stage for a bullish run in the near future.

Paired with a Zacks Rank #1 (Strong Buy) due to recent changes in estimates, Meta Platforms seems poised for success. Curious to find out about other Zacks Rank #1 (Strong Buy) opportunities? Check this out >>>>

Therefore, the ABR’s Buy-equivalent rating for Meta Platforms could be a beacon for investors seeking guidance.

Unveiling the #1 Semiconductor Stock by Zacks

One-fifth the size of NVIDIA, which witnessed an 800% surge post-recommendation. While NVIDIA stands tall, this newcomer holds immense potential for growth.

With robust earnings and an expanding clientele, it’s primed to cater to the soaring demands for AI, Machine Learning, and IoT. The global semiconductor market is forecasted to skyrocket from $452 billion in 2021 to $803 billion by 2028.

Peek at This Stock for Free Now >>

Want the hottest recommendations from Zacks Investment Research? Get your hands on the 7 Best Stocks for the Next 30 Days today. Click here for this complimentary report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Read this article on Zacks.com here.

Zacks Investment Research

The opinions shared here are solely those of the author and not a reflection of Nasdaq, Inc.