Nvidia‘s (NASDAQ: NVDA) has seen remarkable stock market success over the past two years. After gaining over 238% in 2023, the stock is up approximately 164% this year so far. These impressive back-to-back gains have established Nvidia as one of the largest companies in the world.

The pressing question now is whether the stock can achieve a third consecutive year of substantial gains in 2025. Interestingly, Nvidia’s stock has historically produced returns of 30% or more for three consecutive years on four separate occasions, with gains of 50% or more achieved during two instances. Although it has yet to record four straight years of 30%+ returns, Nvidia previously experienced an impressive period where its stock rose by over 25% for five consecutive years from 2013 to 2017.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider buying now. See the 10 stocks »

Let’s explore why Nvidia may post another outstanding performance in 2025.

Surging Demand for AI Chips

Investing in Nvidia is heavily influenced by the growing expenses tied to artificial intelligence (AI) infrastructure. The graphics processing units (GPUs) that Nvidia designs serve as the core for building this infrastructure due to their ability to conduct multiple calculations simultaneously, making them perfect for training large language models (LLMs) and conducting AI inference.

As AI technology evolves, these models require significantly more computing power, thus increasing the demand for GPUs. A clear example is seen in the training of both Amazon‘s Llama 4 LLM and xAI’s Grok 3 model, which utilized ten times the number of GPUs compared to their earlier versions.

This growing need for GPUs is coming from large tech companies with massive data centers, like Microsoft, Alphabet, Amazon, and Meta Platforms, as well as well-funded AI startups such as OpenAI and xAI backed by Elon Musk. Currently, these firms are all vying to create the top AI models, resulting in what Nvidia describes as “insane” demand for its latest generation of Blackwell GPUs.

The trend of growth shows no signs of slowing down. Major customers of Nvidia, including Meta Platforms and Alphabet, have expressed intentions to significantly increase investments in data centers to support their AI projects. They recognize the risk of underinvesting at a time they feel presents a once-in-a-generation opportunity. In addition, Oracle has projected robust growth in AI infrastructure within the next five to ten years.

Image source: Getty Images.

Strong Competitive Advantage

While Nvidia isn’t the only supplier of GPUs, it has established a significant competitive edge largely due to its CUDA software platform. Originally, GPUs were developed primarily for improving graphics rendering in video games. However, Nvidia expanded their applications by creating a free program that allows developers to utilize their GPUs for various tasks.

This initiative allowed CUDA to evolve into the standard for GPU programming, thus forming the strong competitive barrier it holds today. The use of Nvidia’s GPUs in cryptocurrency mining also played a pivotal role, showcasing their capacity for high-performance computing, which laid the foundation for the company’s current success in AI.

In addition to the initial development of CUDA, Nvidia has continued to innovate. The company has rolled out domain-specific microservices and libraries on top of CUDA, known as CUDA X, to optimize capabilities for AI. Moreover, Nvidia has accelerated its GPU development cycle to once a year to maintain its technology leadership.

The main challenge Nvidia faces stems from the emergence of custom AI chips, like those designed by Broadcom. These chips can be tailored for specific tasks, making them more efficient. However, designing and producing custom chips takes time and incurs higher costs. In an industry racing toward AI advancements, Nvidia’s offerings remain more accessible and affordable, bolstered by its range of AI-specific services and libraries through CUDA X.

As a result, despite the potential competition from custom AI chips, Nvidia seems well-positioned to retain its dominant status in the AI market for the foreseeable future.

Attractive Valuation for Future Growth

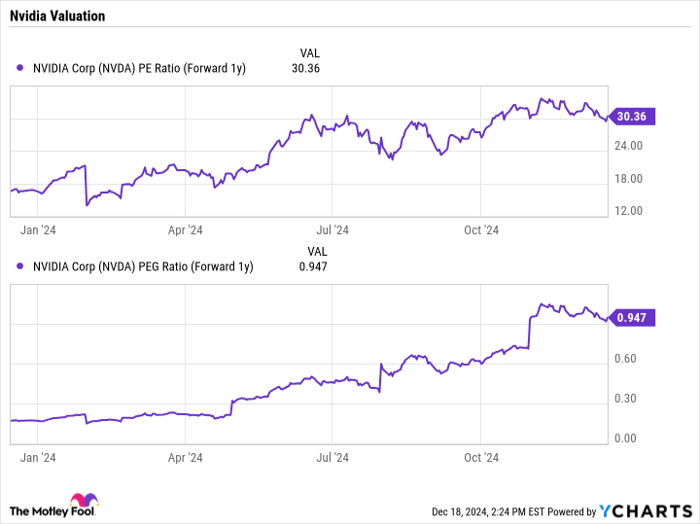

Another factor suggesting Nvidia’s potential for strong performance in 2025 is its valuation. Despite the significant gains in the last two years, the stock trades at a forward price-to-earnings (P/E) ratio of approximately 30 based on analyst estimates for 2025, along with a price/earnings-to-growth (PEG) ratio around 0.95. A PEG ratio below 1 is generally regarded as undervalued, whereas growth stocks often exceed a PEG of 1.

Data by YCharts.

For a company that just experienced 94% revenue growth year over year last quarter and is forecasted to achieve 50% revenue growth in 2025, this valuation looks quite appealing. With AI appearing to be in its early stages and Nvidia maintaining its competitive advantage, the stock appears to be a good buy as we head into 2025.

Seize This Opportunity

Have you ever felt you missed out on investing in top-performing stocks? If so, now might be your moment.

Our team of analysts occasionally offers a “Double Down” stock recommendation for companies poised for significant growth. If you’re worried you’ve missed your chance to invest, now could be the perfect time to act before it’s too late. The numbers speak volumes:

- Nvidia: Investing $1,000 when we doubled down in 2009 would have turned into $349,279!*

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $48,196!*

- Netflix: A $1,000 investment when we doubled down in 2004 would have grown to $490,243!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and such an opportunity may not present itself again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.