Walmart and Target Set to Reveal Key Q3 Earnings This Week

The earnings reports from retail heavyweights Walmart WMT and Target TGT will be a focal point of this week’s financial news.

Both companies are expected to show solid growth as they prepare to release their third-quarter earnings on Tuesday, November 19, and Wednesday, November 20, respectively.

Walmart’s Sales Forecast

According to Zacks estimates, Walmart’s Q3 sales are anticipated to increase by 4%, reaching $167.49 billion. For earnings per share (EPS), Walmart’s Q4 is projected to rise 4% as well, hitting $0.53 compared to $0.51 last year.

In its last quarter report, Walmart exceeded expectations by 3% in August, posting EPS of $0.67 against estimates of $0.65. Over the last nine quarters, Walmart has consistently met or surpassed the Zacks EPS consensus, averaging a 6.89% earnings surprise in the past four quarters.

Image Source: Zacks Investment Research

Target’s Sales and Earnings Outlook

Target is also making strides in reducing inventory losses, with its Q3 sales projected to climb 2% to $25.94 billion. EPS for Q3 is expected to rise 9% to $2.29, compared to $2.10 from the same period last year.

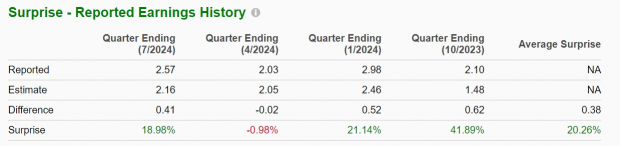

In its previous report, Target outperformed EPS estimates by nearly 19% in August, reporting earnings of $2.57 per share versus the expected $2.16. The company has exceeded the Zacks EPS consensus in three of the last four quarters, boasting an impressive average earnings surprise of 20.26%.

Image Source: Zacks Investment Research

Stock Performance Overview

Price Performance

Due to its affordable pricing, Walmart has attracted more customers during recent years of rising inflation, significantly growing its online sales. Consequently, Walmart’s financial performance has improved, with its stock up approximately 60% year-to-date, while the benchmark S&P 500 is up by 23% and Target’s stock is up by 10%.

Image Source: Zacks Investment Research

Valuation Insights

While Walmart’s stock has outperformed in price, Target stands out due to its valuation metrics. Currently, Target’s stock is trading at 15.9X forward earnings, offering a discount compared to the S&P 500’s 24.8X and Walmart’s 34.4X.

Additionally, Target’s valuation sits below its peak of 30.4X forward earnings over the last ten years and is slightly below its median of 16.2X. Conversely, Walmart is trading close to its historic high of 34.7X, exceeding its long-term median of 22X. Furthermore, both companies maintain a sales multiple under 2X, which is considered optimal.

Image Source: Zacks Investment Research

Dividend Comparison

When it comes to dividends, Target leads with an impressive 2.95% annual yield, outpacing Walmart’s 0.99% and the S&P 500 average of 1.22%.

Image Source: Zacks Investment Research

Conclusion

As they approach their Q3 earnings announcements, Target’s stock holds a Zacks Rank of #2 (Buy), while Walmart has a Zacks Rank of #3 (Hold). Notably, Target’s more favorable P/E valuation is supported by significant earnings estimate revisions for the current fiscal year.

Walmart’s EPS estimates have not changed over the past three months, yet both companies anticipate steady growth in their profits moving forward.

Only $1 to Access All of Zacks’ Picks

We’re serious.

Years ago, we surprised our members by offering 30-day access to all our recommendations for just $1. There’s no obligation to spend another penny.

Thousands seized this opportunity while others hesitated, thinking there must be a catch. There’s not. We want you to familiarize yourself with our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 228 positions with double- and triple-digit gains in 2023 alone.

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.