The Resilience of Simon Property Stock

The formidable Simon Property Group SPG, with its premium retail assets spread across the United States and beyond, is a beacon of hope in a sea of economic uncertainties. With a strategic focus on omnichannel retailing and innovative mixed-use developments, the company has charted a course for long-term success.

Embracing an omnichannel strategy and fostering partnerships with top retailers have proven to be lucrative moves for Simon Property. By seamlessly integrating its online retail platform with brick-and-mortar stores, the company has positioned itself for sustained growth in the ever-evolving retail landscape.

Strategic Acquisitions and Redevelopment Initiatives

Simon Property’s proactive approach to acquisitions and transformative redevelopment projects underscores its commitment to staying ahead of the curve. The company’s recent investments in property expansions and renovations, such as the Busan Premium Outlets in South Korea, demonstrate its unwavering dedication to unlocking new avenues for growth.

Financial Fortitude and Dividend Payouts

One of Simon Property’s key strengths lies in its solid financial foundation. With $11.2 billion in liquidity as of June 30, 2024, and impressive credit ratings from top agencies, the company is well-equipped to weather any storm. Moreover, its commitment to enhancing shareholder value through consistent dividend hikes reflects its confidence in long-term sustainability.

The Challenges Ahead

While Simon Property navigates the changing retail landscape with finesse, challenges loom on the horizon. The increasing shift towards e-commerce and lingering macroeconomic uncertainties pose hurdles for the company. Additionally, concerns over high-interest rates could impact its borrowing costs and real estate development endeavors.

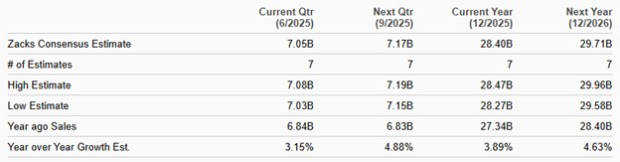

Despite these challenges, Simon Property remains a resilient player in the retail REIT sector. Its strategic initiatives, robust financial position, and commitment to shareholder value make it a compelling choice for investors seeking long-term growth opportunities.

Looking Beyond the Numbers

As investors mull over whether to retain Simon Property stock in their portfolios, the decision ultimately boils down to a balancing act of risk and reward. While the company’s track record of growth and dividend payouts is commendable, the evolving retail landscape demands a cautious approach.

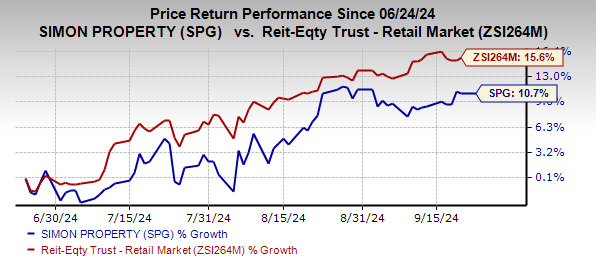

With Simon Property’s stock charting a volatile course in recent months, investors must weigh the company’s strengths against the prevailing market conditions. As history has shown, prudent investment decisions are often the result of a comprehensive analysis of both quantitative data and qualitative factors.