Surge in Options Trading Signals Interest in GameStop, Amkor, and CrowdStrike

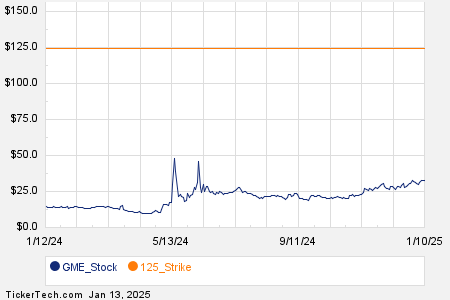

Options trading activity among Russell 3000 index members has marked significant movements today, particularly for GameStop Corp (Symbol: GME). A total of 151,847 contracts have been traded, translating to around 15.2 million underlying shares, since each contract represents 100 shares. This trading volume corresponds to 135.2% of GME’s average daily volume of 11.2 million shares observed over the past month. Notably, the $125 strike call option, which expires on January 17, 2025, has seen high interest with 19,554 contracts traded, equating to approximately 2.0 million underlying shares. Below is a chart displaying GME’s trading history for the last twelve months, highlighting the $125 strike in orange:

Similarly, Amkor Technology Inc. (Symbol: AMKR) recorded an options trading volume of 15,239 contracts today. This figure represents roughly 1.5 million underlying shares, accounting for about 124.5% of AMKR’s average daily trading volume of 1.2 million shares over the past month. The $21 strike put option expiring on February 21, 2025, was particularly active, with 15,012 contracts traded—translating to approximately 1.5 million shares. Below is a chart showing AMKR’s trading history over the past twelve months, with the $21 strike indicated in orange:

Meanwhile, CrowdStrike Holdings Inc (Symbol: CRWD) reported a trading volume of 29,923 options contracts today. This volume corresponds to around 3.0 million underlying shares, or about 96.6% of CRWD’s average daily trading volume of 3.1 million shares during the past month. The $500 strike call option expiring on March 21, 2025, attracted attention with 2,731 contracts traded, representing approximately 273,100 underlying shares. A chart illustrating CRWD’s trading history over the past twelve months is shown below, highlighting the $500 strike in orange:

For more information on available expirations for options on GME, AMKR, or CRWD, please visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- Top Stocks Held By Paul Singer

- ANSS Options Chain

- VIMC Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.