High Options Trading Activity for Texas Instruments, Mohawk Industries, and Boston Scientific

Today, significant trading volumes were observed in options for three prominent S&P 500 companies, highlighting investor interest and market activity.

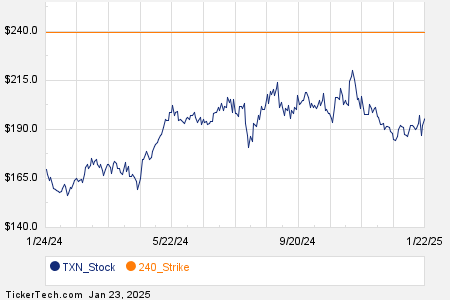

Texas Instruments Inc. (TXN) Options Performance

Texas Instruments Inc. (Symbol: TXN) reported a notable options trading volume today, with 27,276 contracts traded, equivalent to approximately 2.7 million underlying shares. This represents about 51.3% of TXN’s average daily trading volume of 5.3 million shares over the last month. The $240 strike call option set to expire on March 21, 2025, was particularly active, with 2,635 contracts traded, amounting to around 263,500 underlying shares. The following chart illustrates the trading history of TXN over the past twelve months, with the $240 strike highlighted in orange:

Mohawk Industries, Inc. (MHK) Trading Volume Insights

Mohawk Industries, Inc. (Symbol: MHK) experienced an options trading volume of 2,945 contracts, which translates to approximately 294,500 underlying shares. This is about 47.6% of MHK’s average daily trading volume of 618,510 shares for the past month. The $130 strike call option, also expiring on March 21, 2025, saw particularly high engagement, with 2,305 contracts trading today, representing nearly 230,500 underlying shares. Below is a chart reflecting MHK’s trading history for the last twelve months, highlighting the $130 strike:

Boston Scientific Corp. (BSX) Stock Options Activity

Boston Scientific Corp. (Symbol: BSX) recorded an impressive 25,916 contracts traded, equivalent to approximately 2.6 million underlying shares. This figure represents around 47.4% of BSX’s average daily trading volume of 5.5 million shares over the last month. The $105 strike call option, due to expire on March 21, 2025, was the most active, with 12,025 contracts traded today, representing about 1.2 million underlying shares. Below is a chart detailing BSX’s trading history over the past twelve months, with the $105 strike indicated:

Explore More Options Opportunities

For additional details on available expirations for TXN, MHK, or BSX options, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- Cheap Industrials Stocks

- YVV Videos

- Institutional Holders of BBRC

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.