High Options Trading Activity in U.S. Steel, EQT, and Regal Rexnord

Investors Make Moves with Heavy Trading Volumes in Key Companies

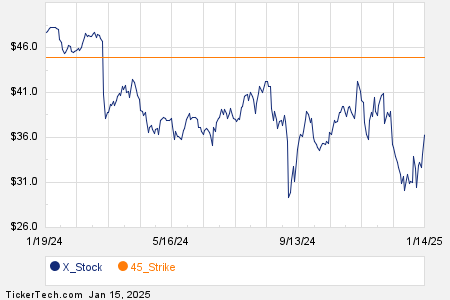

Among the components of the Russell 3000 index, significant options trading activity was reported today. United States Steel Corp. (Symbol: X) saw a total of 56,960 contracts traded, amounting to around 5.7 million underlying shares. This reflects approximately 60% of X’s average daily trading volume of 9.5 million shares over the past month. Notably, the $45 strike call option expiring on March 21, 2025, recorded particularly high volume, with 12,879 contracts traded today, representing around 1.3 million underlying shares of X. Below is a chart showing X’s trading history over the last twelve months, highlighting the $45 strike in orange:

In a similar vein, EQT Corp (Symbol: EQT) experienced options trading volume of 41,438 contracts, translating to about 4.1 million underlying shares. This accounts for approximately 58.4% of EQT’s average daily trading volume of 7.1 million shares over the past month. A particular focus was seen in the $50 strike call option set to expire on March 21, 2025, where 6,369 contracts were traded today, representing roughly 636,900 underlying shares of EQT. The following chart illustrates EQT’s trading history over the past twelve months, with the $50 strike highlighted in orange:

Regal Rexnord Corp (Symbol: RRX) tops off today’s attention with options trading of 2,754 contracts, equating to approximately 275,400 underlying shares. This tallies to 57.7% of RRX’s average daily trading volume of 477,200 shares over the past month. Specifically, the $160 strike call option expiring on January 17, 2025, is notable, with 1,500 contracts traded thus far, representing about 150,000 underlying shares of RRX. Below is a chart reflecting RRX’s trading history over the last twelve months, showcasing the $160 strike in orange:

For further details regarding available expirations for X options, EQT options, or RRX options, check out StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

The Ten Worst ETF Performers

QGEN Videos

CNNE YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.