“`html

Skye Bioscience Grants Stock Options to New Employee

Skye Bioscience has granted stock options to a new employee as part of its equity incentive plan.

Overview of the Stock Option Grant

Skye Bioscience, Inc. announced the granting of a non-qualified stock option award for 19,000 shares of its common stock. This award is part of the company’s 2024 Inducement Equity Incentive Plan and complies with Nasdaq Listing Rule 5635(c)(4). The stock options come with an exercise price of $1.73 per share and will vest over four years. Skye focuses on developing therapeutics for metabolic health, including a Phase 2 clinical trial for nimacimab, an antibody designed to treat obesity. The company aims to create innovative therapies targeting G-protein coupled receptors.

Potential Advantages

- The stock option award reflects Skye’s commitment to attracting and retaining talent within a competitive market.

- This inducement grant highlights the company’s strategy to assemble a strong team focused on next-generation therapeutic solutions for metabolic health.

- Alignment with Nasdaq Listing Rules reinforces corporate governance and regulatory compliance.

- Skye’s ongoing research efforts, exemplified by the Phase 2 clinical trial for nimacimab, showcase its innovative approach in a key therapeutic area.

Potential Concerns

- The grant of stock options might suggest a dependency on new personnel for future growth, raising concerns about the stability of the current workforce.

- The announcement of a Phase 2 clinical trial lacks details regarding existing financial or operational challenges, which could lead to investor skepticism about transparency.

- A focus on forward-looking statements introduces potential risks and uncertainties that could impact stock performance and investor confidence.

Frequently Asked Questions

What stock option award did Skye Bioscience grant recently?

On April 23, 2025, Skye Bioscience granted a stock option award allowing the purchase of 19,000 shares to a new non-executive employee.

What is the exercise price of the new stock options?

The stock options have an exercise price of $1.73 per share, which matches the closing price on April 23, 2025.

What is the purpose of the 2024 Inducement Equity Incentive Plan?

This plan provides equity awards to new employees as an inducement for joining Skye and ensures compliance with Nasdaq regulations.

How will the stock options vest for the new employee?

The options will vest over four years, with 25% vesting after one year and the remaining options vesting monthly thereafter.

What therapeutic areas does Skye Bioscience focus on?

Skye Bioscience is dedicated to metabolic health, developing therapies that target G-protein coupled receptors to enhance clinical differentiation.

Disclaimer: This summary is based on a press release disseminated by GlobeNewswire. The model used for this summary may contain inaccuracies. Refer to the full release here.

$SKYE Insider Trading Activity

In the past six months, $SKYE insiders have conducted eight trades in the open market, all sales. Notably, no shares were purchased during this period.

Here is a breakdown of recent trading activity:

- PAUL A. GRAYSON: 0 purchases, 2 sales totaling 86,551 shares for approximately $432,061.

- PUNIT DHILLON (CEO): 0 purchases, 2 sales totaling 82,910 shares for about $413,924.

- KAITLYN ARSENAULT (CFO): 0 purchases, 2 sales totaling 43,396 shares for roughly $216,652.

- TUAN TU DIEP (CDO): 0 purchases, 2 sales totaling 19,574 shares for around $97,721.

For tracking insider transactions, consult Quiver Quantitative’s insider trading dashboard.

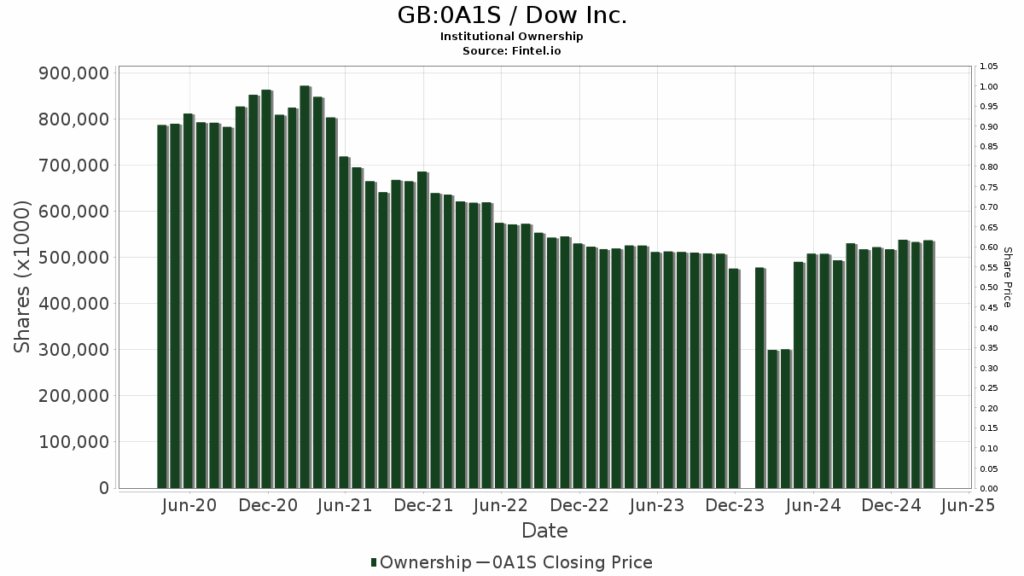

$SKYE Hedge Fund Activity

In the latest quarter, 41 institutional investors increased their positions in $SKYE stock, while 24 decreased their holdings.

Some of the largest movements include:

- BRAIDWELL LP added 825,732 shares, totaling an estimated $2,336,821 in Q4 2024.

- SCHONFELD STRATEGIC ADVISORS LLC added 463,644 shares, with a total of approximately $1,312,112 in Q4 2024.

- POINT72 ASSET MANAGEMENT, L.P. removed 416,424 shares, amounting to about $1,178,479 in Q4 2024.

- AWM INVESTMENT COMPANY, INC. removed 400,000 shares, estimated at $1,132,000 in Q4 2024.

- MILLENNIUM MANAGEMENT LLC removed 394,386 shares, roughly valued at $1,116,112 in Q4 2024.

- VELAN CAPITAL INVESTMENT MANAGEMENT LP removed 211,071 shares, totaling about $597,330 in Q4 2024.

- ENSIGN PEAK ADVISORS, INC. decreased their holdings by 132,713 shares, a loss of approximately $375,577 in Q4 2024.

To follow hedge fund activities, you can explore Quiver Quantitative’s institutional holdings dashboard.

Complete Release

SAN DIEGO, April 25, 2025 (GLOBE NEWSWIRE) — Skye Bioscience, Inc. (Nasdaq: SKYE), a clinical-stage biopharmaceutical company focused on discovering new therapeutic pathways for metabolic health, announced that on April 23, 2025, the Board of Directors granted a non-qualified stock option award allowing for the purchase of 19,000 shares of common stock to one new non-executive employee under the 2024 Inducement Equity Incentive Plan. This grant serves as a material inducement for the employee’s employment with Skye, per Nasdaq Listing Rule 5635(c)(4).

“`

Skye Bioscience Grants Stock Options with Strategic Vesting Schedule

Skye Bioscience has announced the grant of stock options that feature an exercise price of $1.73 per share. This price aligns with the closing value of Skye’s common stock on The Nasdaq Global Select Market as of April 23, 2025. The stock options will vest over four years, with 25% vested on the one-year anniversary of their commencement date. The remainder will vest in equal monthly installments over the next 36 months, contingent upon the employee’s continued employment with Skye on the vesting dates. These stock options adhere to the terms provided in the 2024 Inducement Plan and the associated stock option agreement covering the grant.

About Skye Bioscience

Skye Bioscience focuses on advancing therapeutic pathways for metabolic health. The company develops next-generation molecules aimed at modulating G-protein coupled receptors. This approach leverages biologic targets with significant human proof of mechanism to create therapeutics that boast clinical and commercial differentiation. Currently, Skye is conducting a Phase 2 clinical trial (

ClinicalTrials.gov: NCT06577090

) targeting obesity with nimacimab, an antibody designed to inhibit CB1. This trial also evaluates the effects of combining nimacimab with a GLP-1R agonist (Wegovy®).

For more insights, visit:

www.skyebioscience.com

.

Connect with us on:

X

and

LinkedIn

.

CONTACTS

Investor Relations

[email protected]

(858) 410-0266

LifeSci Advisors, Mike Moyer

[email protected]

(617) 308-4306

Media Inquiries

LifeSci Communications, Michael Fitzhugh

[email protected]

(628) 234-3889

FORWARD-LOOKING STATEMENTS

This announcement contains forward-looking statements as defined by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Identifiable terms include “anticipated,” “plans,” “goal,” “focus,” “aims,” “intends,” and similar phrases. These statements are based on management’s current expectations and assumptions, which are subject to various risks and uncertainties. Actual results may vary materially due to these risks, including capital resource fluctuations and uncertainties surrounding future testing outcomes. A comprehensive discussion of risks is available in Skye’s periodic filings with the Securities and Exchange Commission, especially in the “Risk Factors” section of the most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. Skye disclaims any obligation to update these forward-looking statements unless required by law.