Deckers Brands: HOKA Leads the Charge as Stock Soars

Despite the popularity of UGG boots this season, it’s the HOKA brand that has propelled Deckers Brands (NYSE: DECK) to a remarkable 75% increase in stock value over the past year. Over the last decade, the company has enjoyed over a 1,000% growth, driven primarily by the success of its leading brands.

HOKA Outpaces Rivals in Running Shoes

In what is regarded as one of the most successful acquisitions in the footwear industry, Deckers purchased HOKA in 2012 for just $1.1 million. This past quarter, HOKA’s revenue soared by 35% year-over-year, reaching $570.9 million, and the brand’s annual revenue exceeded $2 billion.

Its popular Clifton and Bondi shoe models continue to thrive, while new releases like the Skyflow and Mach X2 have received strong customer feedback. Notably, international sales growth surpassed that of the U.S., with Deckers expanding its presence in key global cities such as Tokyo, Paris, London, and Shanghai.

While UGG has a long-standing reputation, it too is experiencing growth, thanks to the introduction of new seasonal colors and styles. In the second quarter of fiscal 2025 (ending Sept. 30), UGG sales increased 13% to $689.9 million, largely driven by international sales and smart inventory management.

Overall, Deckers reported a 20% revenue increase to $1.31 billion, and earnings per share (EPS) grew by 39% to $1.59, exceeding analysts’ expectations for EPS of $1.24 on revenue of $1.20 billion.

On the domestic front, sales climbed 14% to $853.9 million, while international sales jumped 33% to $457.4 million.

Both direct-to-consumer and wholesale revenues rose by close to 20%. Retailers are eager to restock HOKA and UGG products earlier than previous years due to rising demand, especially with the busy holiday season approaching.

Deckers also saw gross margin improve by 250 basis points to 55.9%, attributed to a higher proportion of HOKA sales, which are typically more profitable, combined with the performance of higher-margin UGG products.

The company’s financial position is strong, with $1.23 billion in cash and no debt. Inventory grew at a slower rate than sales, up only 7% to $777.9 million, indicating a well-managed business strategy.

Looking forward, Deckers anticipates a full-year sales increase of 12% to $4.8 billion, up from a previous estimate of 10% growth to $4.7 billion. It expects the gross margin to range between 55% and 55.5%, with a projected EPS of $5.15 to $5.25, up from $4.96 to $5.11 after accounting for a recent 6-for-1 stock split.

Image source: Getty Images.

Assessing Deckers Stock: Is It Still a Good Investment?

HOKA remains the main growth engine for Deckers, with plans for expanding into new areas beyond running, including trail and lifestyle segments. Management aims to refresh the popular Bondi and Clifton shoe lines in the new year. While HOKA has grown into a $2 billion brand, Deckers still has room to increase brand awareness both at home and abroad.

UGG’s brand strength endures as well, with its classic boots consistently performing well and keeping up with market trends through color updates and new designs.

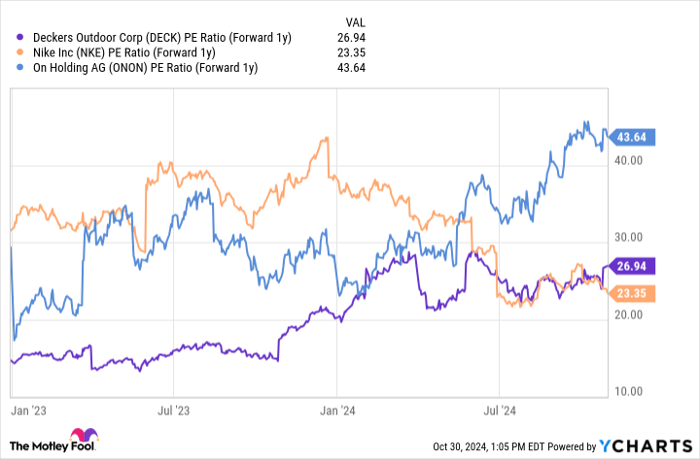

In terms of valuation, Deckers stock currently trades at a forward price-to-earnings (P/E) ratio of 27, which is slightly above struggling Nike and significantly below On Holding, a competitor in the running shoe market.

Data by YCharts.

While Deckers may not be the cheapest option on the table, its stock remains compelling due to the resilience of its core brands. Plus, the robust cash position provides flexibility for growth initiatives or stock buybacks. Ideally, a purchase at a lower price would be preferable; however, it has the potential to be a long-term success.

Is Now the Right Time to Invest in Deckers Outdoor?

Before investing in Deckers Outdoor, keep this in mind:

The Motley Fool Stock Advisor analyst team has highlighted what they see as the 10 best stocks to buy now, and Deckers Outdoor isn’t included on the list. Those selected stocks are expected to yield significant returns in the coming years.

Take, for example, Nvidia: when it made the list on April 15, 2005, an investment of $1,000 then would be worth $829,746 today!*

Stock Advisor provides investors with a straightforward strategy for success, including portfolio building guidance, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool also recommends On Holding. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.