SkyWest Soars: A Look at Its Record-Breaking Performance in 2024

SkyWest’s Impressive Year-to-Date Performance

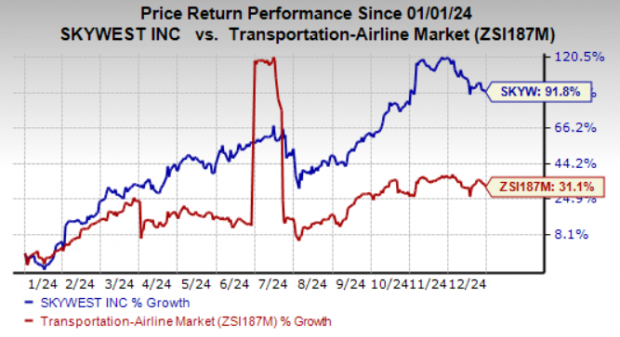

SkyWest (SKYW) shares have seen remarkable success in 2024. Based in St. George, UT, this regional airline’s stock price has risen by 91.8% year-over-year, far exceeding the 31.1% growth seen in the airline industry.

Image Source: Zacks Investment Research

Factors Behind SkyWest’s Growth

With such impressive performance, it’s essential to explore what’s fueling this growth for SkyWest, which currently holds a Zacks Rank #1 (Strong Buy). A surge in air travel, particularly for leisure, has led to increased passenger numbers. The company’s ongoing fleet modernization also makes SKYW stock enticing to investors. During the first nine months of 2024, SkyWest reported an 18.7% increase in revenue compared to last year. This growth is largely attributed to a 19.1% rise in flying agreements, which now account for 96.8% of the company’s total revenue.

The company benefits from challenges faced by major airlines, particularly Boeing (BA), as delays in their production have hindered the expansion plans of larger carriers. As big airlines manage their staffing levels, fewer pilots are migrating from regional carriers to mainline airlines. Some pilots are even considering returning to regional options like SkyWest to ensure job security. This dynamic is expected to boost both fleet utilization and revenue for SkyWest.

SkyWest Airlines maintains a fleet of about 500 aircraft, servicing over 240 destinations throughout North America. Notably, it transported more than 38 million passengers in 2023. Moreover, the company has agreements in place to incorporate 278 E175 aircraft into its fleet by the end of 2026. In February 2024, SkyWest also acquired a 25% stake in regional carrier Contour Airlines.

Looking ahead, strong air travel demand is likely to support SKYW stock’s continued performance into the new year.

Positive Estimate Revisions Forecast Bright Future

Reflecting the positive developments, the Zacks Consensus Estimate for SkyWest for the fourth quarter of 2024, full-year 2024, and full-year 2025 has been revised upwards by 3%, 3%, and 5.3% respectively over the past 60 days.

Image Source: Zacks Investment Research

Consider Another Strong Airline Stock

Another solid pick from the airline sector is American Airlines (AAL), which also holds a Zacks Rank #1. The company forecasts an earnings growth rate of 16% for this year and has a solid earnings surprise history, exceeding the Zacks Consensus Estimate in three out of the last four quarters, with an average beat of 124.4%. Over the past year, AAL shares have increased by 29.8%.

Expert Picks for Potential Growth

From a pool of stocks, five Zacks experts have highlighted their top picks expected to soar +100% in the near future. Among them, the Director of Research, Sheraz Mian, identifies one stock that stands out for its strong upside potential.

This company focuses on millennial and Gen Z markets, having generated nearly $1 billion in revenue last quarter. After a recent dip, it appears to be a prime opportunity for investors. While not every selection may succeed, this stock has the potential to outperform past Zacks picks, such as Nano-X Imaging, which surged 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

The Boeing Company (BA): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.