Skyworks Solutions Anticipates Decline in Q2 Fiscal 2025 Earnings

Skyworks Solutions (SWKS) is set to announce its second-quarter fiscal 2025 results on Wednesday.

For this quarter, the company forecasts non-GAAP diluted earnings of $1.20 per share. This figure matches the Zacks Consensus Estimate, which has not changed over the past 30 days. However, it reflects a 22.58% decrease from the same quarter last year.

Skyworks projects its revenues will fall between $935 million and $965 million for the second quarter.

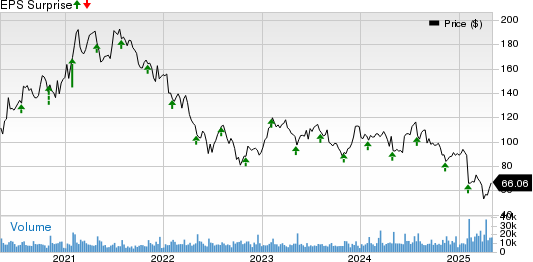

Current Stock Price and EPS Surprise Trends

Skyworks Solutions, Inc. price-earnings surprise

The Zacks Consensus Estimate for fiscal Q2 revenues stands at $951.26 million, indicating a projected 9.06% decline year-over-year. Over the past four quarters, Skyworks has consistently outperformed the Zacks Consensus Estimate, achieving an average earnings surprise of 1.46%.

Key Influencers of Q2 Performance

Skyworks’ upcoming fiscal Q2 results may be positively influenced by its diverse portfolio and growth in the edge IoT and automotive markets. The company anticipates that the introduction of new 5G content in devices like the Google Pixel 8a, Samsung Galaxy M, and Oppo Reno12 will have positively impacted revenues, particularly in higher-tier smartphones.

The firm expects moderate sequential growth and a return to year-over-year growth in broader markets. A strong demand for edge IoT products, including Wi-Fi 6e and Wi-Fi 7 systems, is likely promoting a multiyear upgrade cycle due to enhanced data transfer speeds and reduced latency.

In addition, the rise of generative AI and enhanced 5G technologies are expected to keep driving demand for high-performance RF solutions. Skyworks is strategically positioned to capitalize on the increased need for fast RF connectivity in AI applications, next-gen smartphones, and autonomous vehicles.

Despite facing some inventory challenges, Skyworks sees promising long-term growth opportunities in its automotive sector. The shift towards software-defined vehicles and the growing focus on connected cars are expected to sustain a high level of radio complexity, likely increasing demand for the company’s advanced RF solutions.

Conversely, the company’s mobile revenue is anticipated to decline in fiscal Q2 by a mid-to-high teens percentage sequentially, influenced by typical seasonal trends. Ongoing weakness in industrial and infrastructure sectors, attributed to sluggish demand, may hinder overall revenue growth in this upcoming quarter.

Earnings Model Insights for SWKS Stock

According to the Zacks model, a favorable Earnings ESP combined with a Zacks Rank of 1 (Strong Buy), 2 (Buy), or 3 (Hold) enhances the likelihood of an earnings surprise. Currently, however, this is not the case for Skyworks.

The company holds an Earnings ESP of -0.83% and a Zacks Rank of 4 (Sell) at this time.

Stocks to Watch

Investors may find interest in other companies exhibiting strong earnings potential:

Affirm (AFRM) has an Earnings ESP of +63.27% and a Zacks Rank of 1, and is scheduled to report its third-quarter fiscal 2025 results on May 8. Year-to-date, Affirm shares have decreased by 14.1%.

StoneCo (STNE) reports with an Earnings ESP of +6.25% and a Zacks Rank of 1, and its shares have surged by 72.8% this year. The company also reports its first-quarter 2025 results on May 8.

Baidu (BIDU) holds an Earnings ESP of +8.67% and a Zacks Rank of 2, with shares gaining 6.7% year-to-date. Baidu is expected to announce its first-quarter 2025 results on May 21.