Uncovering dormant market behemoths poised for resurgence is akin to stumbling upon a hidden gem in a sea of rocks. The financial and tech sectors harbor a trove of undervalued companies waiting to reclaim their former glory. Here are three such enterprises, each with a compelling narrative suggesting an imminent market uptick. Quietly but steadfastly, these businesses are laying the groundwork for substantial growth and profitability.

Revitalizing Force: SoFi

Source: Poetra.RH / Shutterstock.com

SoFi (NASDAQ:SOFI) has achieved a significant feat in diversifying its revenue streams. Notably, 40% of its adjusted net revenue in the fourth quarter stemmed from financial services and digital platforms.

Furthermore, this diversification move not only mitigates risks but also enhances stability by eradicating the company’s dependence on a single income source. It signifies SoFi’s foray into various financial services beyond its traditional lending domain, positioning it for sustained value appreciation across diverse market segments.

The Financial Services division exhibited exceptional growth in Q4, with net sales soaring by 115% year over year (YOY). Simultaneously, the Tech Platform division outstripped, registering a YOY revenue surge of 13%. These segments serve as linchpins in SoFi’s overall revenue diversification strategy and profitability. This underscores the efficacy of its multifaceted business approach.

Furthermore, SoFi exudes confidence in maintaining its growth trajectory, issuing an optimistic outlook and foreseeing robust future expansion. The company projects a compound annual top-line growth of 20% to 25% from 2023 to 2026, primarily fueled by expanding core entities and potential new business ventures. Finally, SoFi envisions bolstering its EPS and sustaining strong margins through 2026.

Lift-off Potential: PagerDuty

Source: La1n/Shutterstock

PagerDuty (NYSE:PD) has exhibited robust customer growth and retention figures, a testament to its innate ability to attract and retain clientele over time. As of January 31, 2024, the company boasted over 15,000 paying customers, showcasing consistent customer base stability year over year. Moreover, PagerDuty’s total user count, encompassing both paid and free users, surged past 28,000, indicating substantial growth.

Furthermore, as of January 31, 2024, PagerDuty reported a dollar-based net retention rate of 107%, showcasing its adeptness in client retention and upselling. This figure underscores its proficiency in catering to enterprise needs, charting remarkable inroads into the corporate sphere. Notably, the company witnessed a notable upswing in its high-value clientele base, with the number of new customers spending over $100,000 annually doubling by Q4 2024, a clear indicator of robust growth in this pivotal segment.

Lastly, by January 31, 2024, PagerDuty had secured 58 clients generating annual revenue exceeding $1 million, marking a 16% year-over-year increase. Collectively, these metrics underscore PagerDuty’s capacity to attract high-value corporate clients and augment its market presence.

Ascendancy Awaits: DecisionPoint (DPSI)

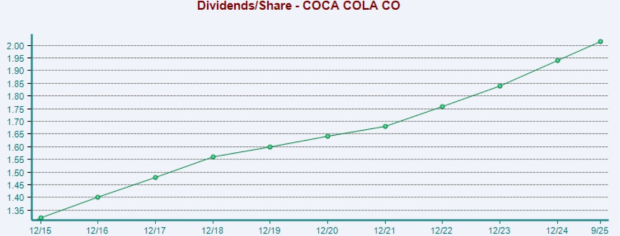

The Evolution of DecisionPoint’s Revenue Strategy

A Shift Towards Profitability

DecisionPoint (NYSEAMERICAN:DPSI) has witnessed a meteoric rise in revenue growth, indicating a soaring demand for its innovative mobility-first business services and solutions.

This surge in revenue coincides with a strategic pivot towards a more substantial mix of software and services, resulting in record gross margins nearing 28% in the latest quarter. The uptick in margins serves as a testament to DecisionPoint’s effective approach in enhancing profitability and extracting value from its offerings.

Maximizing Profitability Through Strategic Focus

DecisionPoint’s laser focus on high-margin service offerings has been pivotal in driving its expansion and profitability. By meticulously fine-tuning its revenue composition to incorporate a higher proportion of profit-yielding services, the company achieved record quarterly gross margins of 27.6%. This strategic maneuver underscores DecisionPoint’s adeptness in optimizing its product portfolio to maximize revenue.

Embracing Recurring Income Streams for Long-Term Viability

Furthermore, the emphasis on cultivating recurring income streams stands as a cornerstone of DecisionPoint’s sustainability in long-term growth. With a targeted objective of elevating the revenue contribution from services and software to 50%, the company aims to establish dependable and consistent revenue streams. This gradual shift away from reliance on one-off product sales is not just fortuitous but a well-devised game plan. It propels overall profitability higher and enhances the predictability of revenue streams.

As of this writing, Yiannis Zourmpanos held a long position in SOFI. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.