“`html

Snap Inc. Achieves Impressive Growth in Fourth Quarter Earnings

Snap (SNAP) reported fourth-quarter 2024 earnings of 16 cents per share, beating the Zacks Consensus Estimate by 14.29% and doubling the earnings from a year ago. In response, SNAP stock saw a surge of more than 5% in pre-market trading.

Revenue rose 14.4% year over year to $1.55 billion, surpassing the Zacks Consensus Estimate by 0.55%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Revenue Performance by Region

Regional revenue breakdown shows that North America, accounting for 62.2% of total revenues, saw a 7.7% year-over-year increase to $968.9 million. In Europe, which comprises 18.4% of the total, revenues jumped 20.5% to $287.03 million. The Rest of the World (ROW) achieved $301.3 million in revenue, marking a 34.8% year-over-year increase.

Average Revenue Per User (ARPU) Grows

The average revenue per user (ARPU) rose 4.6% year over year to $3.44. Highlights include an 8.6% increase in North America, a 16.1% rise in Europe, and a 15.5% growth in ROW, signaling broad engagement across markets.

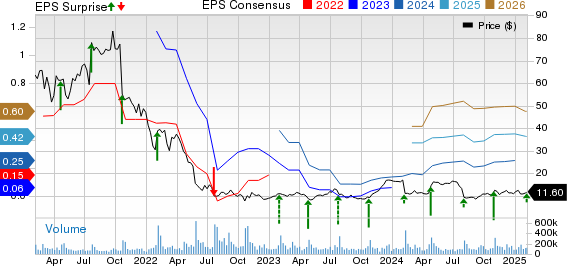

Snap Inc. Price, Consensus and EPS Surprise

Snap Inc. price-consensus-eps-surprise-chart | Snap Inc. Quote

User Engagement Drives Q4 Success

In Q4, Snap introduced new Bitmoji stickers and enhanced location-sharing features in the Family Center to better connect families. These updates coincided with a 9.4% year-over-year growth in global daily active users (DAUs), reaching 453 million; an increase of 10 million DAUs quarter-over-quarter.

DAUs in North America remained stable at 100 million, while Europe saw a 3.1% increase to 99 million. The ROW’s DAU reached 254 million, reflecting a notable 16.5% rise year over year.

Over one billion Snaps were shared publicly each month during the quarter, bolstered by a 40% increase in creators posting content on the platform.

Augmented Reality Initiatives Propel User Growth

Snap’s augmented reality (AR) offerings have gained traction, with over 400 million users engaging with new Gen AI Lenses more than four billion times in Q4. Noteworthy was the launch of the Pre-Generated AI Lens, which optimizes GPU use.

Snap partnered with Uber Eats and Match Group (MTCH), introducing the branded Dreams AI Lens, enhancing user interactions compared to traditional Lenses.

Lens Studio has been downloaded over a million times, contributing to a 49% year-over-year increase in Snaps with Lenses shared on Snapchat, and a 40% rise in Snaps shared between friends.

Snap introduced a new Monetization Program for creators, allowing them to earn from Spotlight videos, part of a broader effort that generated over 200 million Spotlight videos this year.

Snapchat+ gained 14 million subscribers in the quarter, with added features like Footsteps, enabling users to track locations on the Snap Map.

Snap’s New Augmented Reality Operating System

Snap unveiled a revamped Snap OS, presenting new Lenses that utilize the Spectacles camera and SnapML technology. These innovations enable users to learn activities like piano playing and soccer practice through interactive experiences.

Developers have embraced Snap OS, creating interactive Lenses for mastering skills from calligraphy to pool shots.

Snap also introduced developer tools, including an Image Spatialization API, and launched Spectacles in six new countries: Austria, France, Germany, Italy, Netherlands, and Spain, plus educational discounts for students.

Advertising Revenue Growth

Snap’s advertising revenue reached $1.41 billion, a 10% year-over-year increase, primarily fueled by a 14% rise in direct-response (DR) advertising. In contrast, brand-oriented advertising saw a 1% decline, largely from a few major clients in North America.

Improvements in Snap’s Lead Generation product drove a sixfold increase in leads generated for advertisers, with a 40% drop in cost-per-lead on average during Q4.

To remain competitive against larger rivals like Meta Platforms (META) and Pinterest (PINS), Snap tested new ad placements, including Sponsored Snaps and Promoted Places. Early results for Sponsored Snaps yielded over 50 million impressions in the U.S. among users aged 18 and older, suggesting effective engagement strategies.

Promoted Places aim to leverage Snap Map, encouraging users to visit highlighted locations, further driving engagement with content.

“`

Snap Inc. Reports Strong Growth in Fourth Quarter Earnings

Key Highlights from Snap’s Performance

Snap Inc. has seen impressive growth as its advertising platforms, Sponsored Snaps and Promoted Places, increased the number of unique Snapchatters reached by advertisers. In the fourth quarter, there was a remarkable 30% rise in reach on average across the United States.

Operating Financials Breakdown

The adjusted cost of revenues rose by 8.7% year over year, reaching $668.9 million. During this quarter, Snap’s adjusted operating expenses totaled $612.4 million, reflecting a 4.4% increase from last year. Meanwhile, sales and marketing expenses decreased by 3.9% to $185.1 million. In contrast, general and administrative expenses surged by 17.4%, amounting to $197.6 million. Additionally, research and development expenditures increased by 1.7%, totaling $229.7 million.

Snap reported an adjusted EBITDA of $276 million, which is a significant jump of 73.4% compared to the same quarter last year, indicating strong revenue growth and better control over operating expenses.

Balance Sheet and Cash Position

As of December 31, 2024, Snap held cash, cash equivalents, and marketable securities worth $3.37 billion, an increase from $3.2 billion on September 30, 2024. Operating cash flow improved to $231 million, compared to $165 million for the previous year. Free cash flow also rose to $182 million, up from $111 million year over year.

Future Outlook and Expectations

Looking ahead to the first quarter of 2025, Snap forecasts total revenues between $1.325 billion and $1.36 billion. It expects adjusted EBITDA to fall between $40 million and $75 million, while daily active users (DAU) are projected to reach 459 million.

Currently, Snap holds a Zacks Rank of #3 (Hold), and investors can check out the full list of Zacks #1 Rank (Strong Buy) stocks.

Five Stocks with Strong Growth Potential

Zacks experts have identified five stocks as top choices that could potentially double in value in 2024. Past selections have seen impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%. Most of these stocks are not yet on Wall Street’s radar, presenting an excellent opportunity for early investment.

Explore these five potential winners for your investment portfolio. Want to stay updated with the latest from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days for free today.

Match Group Inc. (MTCH) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.