Snowflake’s Earnings Preview: What to Expect in Q3 Fiscal 2025

Snowflake SNOW is preparing to announce its third-quarter fiscal 2025 results on Nov. 20.

The Zacks Consensus Estimate projects revenues to reach $898.77 million, reflecting a significant increase of 22.42% compared to the same quarter last year.

Recent estimates for earnings have remained steady over the past month, expected at 15 cents per share, which represents a 40% decline from the previous year’s earnings per share.

Notably, SNOW has surpassed the Zacks Consensus Estimate in three of the last four quarters, with an average surprise of 43.73%.

Snowflake Inc. Price and EPS Surprise

Snowflake Inc. price-eps-surprise | Snowflake Inc. Quote

Stay informed with the Zacks Earnings Calendar for important market updates.

Let’s explore the key factors influencing SNOW leading up to this earnings report.

Challenges Impacting SNOW’s Q3 Performance

Facing tough macroeconomic challenges, SNOW has encountered issues like ongoing inflation, which has affected customer spending.

Additionally, rising GPU-related expenses due to substantial investments in AI initiatives could pressure profit margins. Competition from companies such as Databricks has intensified pricing challenges.

On the upside, SNOW’s revenue growth may benefit from an enhanced product portfolio, which includes features like Marketplace Listing Auto-Fulfillment & Monetization, account replication & failover, Query Acceleration Service, geospatial analytics, Snowpark, and Snowpipe Streaming.

As of the end of the second quarter of fiscal 2025, SNOW reported over 400 accounts using Iceberg and more than 2,500 accounts utilizing Snowflake AI weekly, indicating strong momentum that is likely to continue into the upcoming quarter.

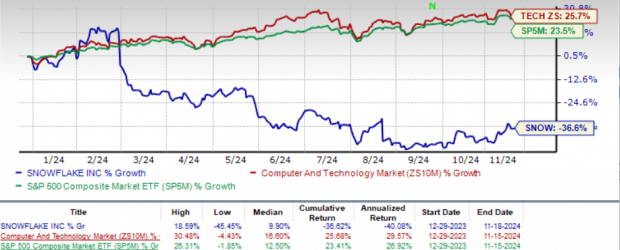

Stock Performance: SNOW Trails Behind Industry

Snowflake shares have decreased by 36.6%, lagging behind the Zacks Computer & Technology sector’s return of 25.7% and the S&P 500’s 23.5% return.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

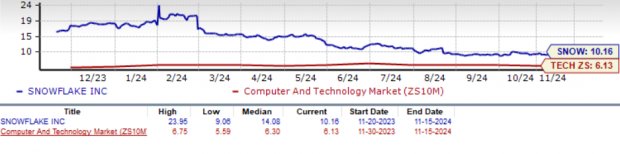

Currently, SNOW stock appears overvalued, receiving a Value Score of F, indicating a stretched valuation.

Trading at a forward price-to-sales (P/S) ratio of 10.16X, it stands above the Zacks Computer & Technology sector average of 6.13X.

P/S Ratio (F12M)

Image Source: Zacks Investment Research

Expanding Portfolio: A Bright Spot for SNOW’s Long-Term Outlook

Snowflake benefits from a robust product lineup, having introduced innovative features like Marketplace Listing Auto-Fulfillment & Monetization, account replication & failover, Query Acceleration Service, geospatial analytics, and Snowpipe Streaming.

With advancements such as Iceberg and Hybrid tables as well as Cortex LLM (Large Language Model)-powered functionalities, SNOW enhances its offerings. These developments are expected to improve long-term prospects by driving demand and setting the company apart from its competitors.

In the previous fiscal second quarter, Snowflake launched nine new product announcements and made over 15 capabilities widely available.

The Polaris Catalog, a vendor-neutral open catalog for Apache Iceberg, is setting new standards for data lakehouses and related architectures, allowing enterprise users enhanced control and security over their data.

Polaris facilitates interoperability with top cloud services such as Amazon’s AMZN, Google Cloud, Microsoft MSFT Azure, and Salesforce, among others.

Additionally, Snowflake is hosting META’s Llama 3.1 collection of multilingual open-source LLMs, providing enterprises with powerful tools to create AI applications efficiently.

Strong Partnerships Boost SNOW’s Growth Potential

Collaboration with major companies like Amazon, Microsoft, META, NVIDIA NVDA, and others strengthen SNOW’s market position.

A recent partnership with NVIDIA allows customers to leverage NVIDIA AI to build bespoke data applications within the Snowflake platform.

Snowflake’s integration of NVIDIA AI Enterprise software into Cortex AI facilitates businesses in connecting custom models to diverse datasets, offering precise outcomes.

Moreover, Snowflake and Microsoft are expanding their partnership to promote interoperability between Snowflake and Microsoft Fabric OneLake, supported by open standards for analytical storage such as Apache Iceberg and Apache Parquet.

Snowflake recently launched Data Clean Rooms for customers in AWS East, AWS West, and Azure West, utilizing technology acquired from Samooha.

The company’s growing client roster includes industry leaders like Disney, Capital One, and Pfizer, showcasing its diverse sector appeal.

Disney employs SNOW’s offerings for optimization within its parks, while Penske Logistics uses Cortex AI for efficient transportation solutions.

Should You Invest in SNOW Shares?

Investors may find SNOW a risky choice in the short term due to modest growth prospects and a high valuation.

Anticipated pressures on margins due to rising costs, a tough economic landscape, and stiff competition could further challenge the company.

Currently, Snowflake holds a Zacks Rank #4 (Sell), indicating that investors might consider avoiding the stock for now.

You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Years ago, we surprised our members by offering a 30-day access to all our picks for just $1, with no further obligation.

Thousands have embraced this opportunity, while others remain cautious. However, our goal is to help you explore services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which profited from 228 positions with gains in double and triple digits in 2023 alone.

See Stocks Now >>

Interested in the latest recommendations from Zacks Investment Research? Today, you can get 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.