SoundHound AI to Release Q1 2025 Financial Results on May 8

SoundHound AI (SOUN) is set to report its first-quarter 2025 results on May 8, following the market close. In the previous quarter, SoundHound experienced a loss of 69 cents per share. This loss was considerably larger than the 6-cent loss reported during the same period last year and fell 527.3% short of the Zacks Consensus Estimate. Despite the loss, revenues surged 101.5% year-over-year to $34.5 million, exceeding the consensus estimate by 3.1%. This significant increase in revenue resulted from new customer acquisitions, broader partnership networks, and advancements in generative AI. The company’s growth was particularly driven by rising adoption in quick-service restaurants, in-car voice commerce, and strategic acquisitions.

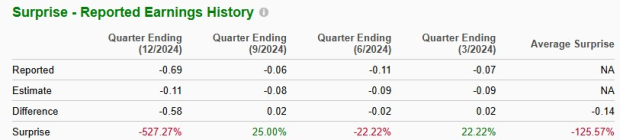

SoundHound, which develops AI tools for voice command interpretation, surpassed earnings expectations in two of the last four quarters, missing in the other two. The average negative surprise over this period stands at 125.6%. Historical figures can be reviewed in the accompanying chart below.

Image Source: Zacks Investment Research

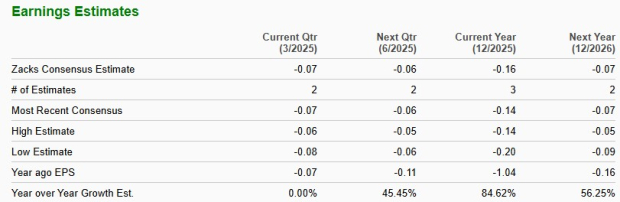

Current Estimates for SOUN Stock

The Zacks Consensus Estimate for the first quarter projects a loss of 7 cents per share, unchanged over the last 60 days. This equals the loss per share reported in the prior year. The consensus revenue estimate is $30.2 million, suggesting a year-over-year increase of 160.6%. For 2025, SOUN is forecasted to witness a 95.7% improvement compared to 2024.

In terms of bottom-line performance, SOUN is expected to see an 84.6% increase from the previous year.

Image Source: Zacks Investment Research

Analyzing SoundHound’s Earnings Potential

Our model does not predict an earnings beat for SoundHound this quarter. A stock must have both a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) for an earnings beat to be likely. Currently, SoundHound does not meet these criteria.

Earnings ESP: SoundHound has an earnings ESP of 0.00%. You can use our Earnings ESP Filter to find stocks that may outperform expectations.

Zacks Rank: The company holds a Zacks Rank of #3.

Drivers Behind SoundHound’s Q1 Performance

SoundHound’s extensive serviceable markets across core and emerging sectors, along with its diversified customer base and high-profile partnerships, are likely contributors to its revenue growth in the first quarter.

The company benefits from the growing adoption of its voice AI platform across various industries, including restaurants, automotive, healthcare, and energy. SoundHound serves over 10,000 locations in the restaurant sector, with recent deployments at Burger King UK and successes with major quick-service restaurant (QSR) brands. This industry’s movement toward automation is expected to generate significant recurring revenue, positioning it as a vital growth factor for Q1 2025.

Additionally, SoundHound has expanded its reach into healthcare, energy, retail, and government sectors. Notable partnerships with Duke Health, Wellstar Health, and a major U.S. utility highlight the scalability of its solutions. These contracts provide large-scale deployments with multi-year visibility, contributing to the company’s backlog and mitigating customer dependency. Initial contributions from these sectors, particularly a seven-figure energy contract, are expected in the first quarter.

The company’s alliances with industry leaders such as NVIDIA (NVDA), Perplexity, Lucid Group, Inc. (LCID), and LG are anticipated to bolster growth. SoundHound’s partnership with NVIDIA, involving the integration of AI Enterprise tools, enhances its voice AI capabilities, facilitating faster processing and real-time data generation. This integration is currently implemented in automotive applications, improving user experience through quicker response times. Looking ahead, SoundHound aims to expand NVIDIA’s AI software applications in various modules to further enhance automotive voice technology.

First-quarter results should also reflect early contributions from enterprise and government contracts. The company’s cumulative bookings backlog exceeded $1.2 billion last quarter, a 75% increase year over year, adding revenue visibility and reinforcing a SaaS-like revenue model.

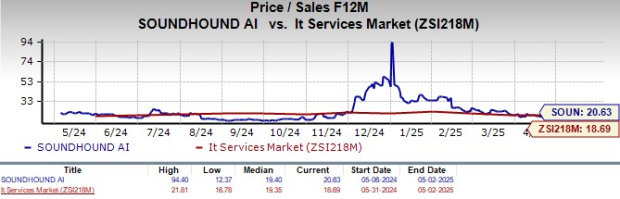

SOUN Stock Performance Compared to Sector

SOUN shares have appreciated 23.6% in the past month, outpacing the broader Zacks Computer & Technology sector, which has risen 16.9%, and the Zacks Computers – IT Services industry, which increased by 15.3%.

1-Month Performance of SOUN Stock

Image Source: Zacks Investment Research

Valuation Analysis of SOUN Stock

Currently, SOUN shares appear overvalued with a Value Score of F. The stock’s forward 12-month price-to-sales (P/S) ratio is 20.63, surpassing the industry average of 18.69.

Image Source: Zacks Investment Research

Conclusion: Should You Hold SOUN Stock?

Despite recent developments, ongoing analysis will determine the best course of action regarding SOUN stock in light of its market performance and financial projections.

# SoundHound AI Shows Promising Growth Amid Earnings Volatility

Despite market volatility and a challenging earnings history, SoundHound AI is demonstrating promising growth, warranting a hold recommendation. The company achieved over 100% revenue growth last quarter, with strong forecasts for both revenue and earnings in 2025. This growth highlights the increasing adoption of its voice AI platform across rapidly expanding sectors such as quick-service restaurants, automotive, healthcare, and energy.

Strategic Partnerships and Future Outlook

SoundHound AI’s partnerships with industry leaders, including NVIDIA and Lucid, underscore its technological prowess. Moreover, the company’s backlog now exceeds $1.2 billion, which suggests multi-year visibility and ongoing revenue opportunities.

Analyst Position and Stock Valuation

Analysts remain optimistic about SoundHound AI (SOUN), with three out of six recommending it as a “Strong Buy.” The stock’s average price target is set at $13.92, indicating a potential 48.2% upside from its most recent closing price.

While traditional metrics may classify the stock as overvalued, its recent 23.6% outperformance relative to both sector and industry benchmarks indicates that some near-term optimism has already been accounted for in its pricing.

This article originally published on Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.